Automated Endorsement Analysis

Modern bank consumers are more and more comfortable interacting with their accounts online, often from a portable device. It’s never been easier to make deposits — using an app on an always-handy phone — and see the “funds available” right in an account, reassuring the user that the money is indeed deposited and… available. MyBankTracker…

Read MoreForbes magazine reports on a recent AI Today podcast wherein Casey Royer of USAA, a large US bank serving the military community, shared information on how the bank is adopting AI, how they’re using AI to broaden USAA banking offerings, make their operations more effective and efficient, and offer greater value to their growing customer…

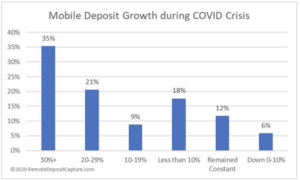

Read MoreRemoteDepositCapture.com had a hunch that the Covid-19 pandemic would lead to an increase in RDC deposits (Mobile Deposit, Desktop, ATM, etc.). So, in late February, they started polling the industry, asking the following question: For Financial Institutions: What has been the rate of growth or decline in your mobile deposit volume over the past year?…

Read MoreOrboGraph will soon be launching a website refresh with the official market announcements around OrbNet AI and OrboAnywhere 4.0. Check recognition is a process which is not perfect, but the gap of unread items is closing. As technology approaches reading all legible items, it is important to look closely at “defect” items which did not…

Read MoreA new podcast at PYMNTS.com features a conversation with Michael Reed, division president of payments at Deluxe. The podcast covers a wide range of timely payments topics, including: Checks still widely used with Reed reporting $7 trillion total transactional amounts with $2 trillion from lockbox. How work-from-home mandates have forced businesses to rethink how they…

Read MoreTechnavio, a leading global technology research and advisory company, has released a report indicating that the industry is poised to grow by USD 15.14 billion during 2019-2023, progressing at a CAGR of over 48% during the forecast period. Entitled Global Artificial Intelligence-as-a-Service (AIaaS) Market 2020-2024, a free sample of the report can be obtained via…

Read MoreCongress passed a $2 trillion stimulus bill — the largest in United States history — that promises to revive a coronavirus-stricken economy. These are payments that will be sent directly to Americans, with many adults getting $1,200. For every qualifying child age 16 or under, the payment adds an additional $500. The plan is for…

Read MoreOrboGraph’s dynamic webinar entitled Change is Inevitable – How Will You Respond? — co-hosted with NICE Actimize — provided fresh insight into the nature of fraud. The webinar provides information and scenarios to show how fraudsters are becoming more sophisticated in their methods of committing fraud and how incorporating new technologies like Artificial Intelligence and…

Read MoreAccelerated funds availability allows depositors to instantly access the money they deposit via check. That way, there’s no waiting period for the check to clear and no penalty if the check writer’s account has insufficient funds. An article at BAI Banking Strategies by Victoria Dougherty, director of Payment Management Solutions, Fiserv, opens by wondering why…

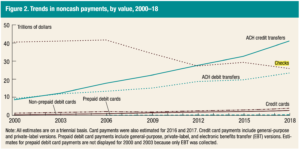

Read MoreThe Federal Reserve released the 2019 Federal Reserve Payments Study Executive Report on December 19, 2019. Based on 2018 compared to 2015, aggregate payment growth in “core noncash payments,” including debit card, credit card, ACH, and checks, were up as a whole by 6.7% representing an incremental 30.6 billion transactions valued at $97B! Comparing actual…

Read More