Bank Branch

Payments 3.0 columnist George Warfel signs off of his last column for the site by noting what he considers deep trends to watch in banking and payments. One particular point he makes is something we’ve seen borne out again and again as cleverly-named payments technology brands appear and then either disappear or team with more established…

Read MoreIf you already know the difference between “indorsement” and “endorsement,” you’re the kind of professional who will benefit from the newly-released RemoteDepositCapture.com’s Guide to Restrictive Indorsements, available to purchase at their website. The report is authored by John Leekley, founder and CEO of RemoteDepositCapture.com, who is widely regarded as the leading authority on all things…

Read MoreAdmit it – you thought everyone knows the basics of check writing, and figured that the younger generation is not using checks. So who cares? Well, you might think this is the case, but there are fresh ideas in this article at the street.com including safeguards against check fraud, which, according to the ABA Deposit Fraud Study, saw…

Read MoreThe National Check Fraud Center has a no-nonsense, word-dense list of 20 UCC Provisions Every Banker Should Know. Go “check” out that link – – looks pretty daunting, doesn’t it? Author Mary Beth Guard manages to keep it light, though, even in some of the longer explanations: Section 4-209: Are you familiar with the encoding warranty? A…

Read MoreIn the spirit of Independence Day, let’s take a look at an article from PaymentsSource.com that explores various attempts to become “independent from checks, cash, and cards.” Their list includes venerable “we’re going all-digital” efforts like Venmo, Green Dot, and even PayPal – – all have sought to declare independence from plastic cards and checks,…

Read MoreAccording to Thomas Skala, chief executive officer and president of telecommunications and payments company Genie Gateway, a mitigated risk of chargebacks makes checks the best path for high-risk sellers. High-risk sellers can include, for example, product repair companies if a customer is unhappy with a repair result; or the travel industry, in which buyers can chargeback travel…

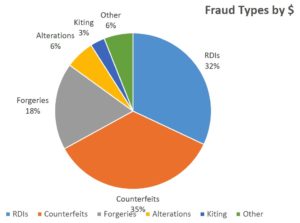

Read MoreContinuing our look at some of the highlights from our 2018 Healthcare and Check Payment Technology Conference in Nashville, TN, this time with information from a presentation entitled “Check Fraud and Payment Risk Industry Update and Technology Advancements,” presented by Joe Gregory, our own VP of Marketing; Yaron Katzir, who is Orbograph’s Director of Product Management for…

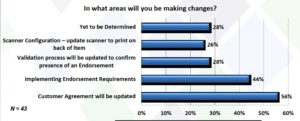

Read MoreWe’re continuing our look at some of the highlights from our 2018 Healthcare and Check Payment Technology Conference in Nashville, TN, via a presentation by Paul A. Carrubba, Partner at Adams and Reese LLP, and John Leekley, Founder & CEO, RemoteDepositCapture.com, entitled “Best Practices for July 2018 Reg CC Changes.” After Paul Carrubba’s overview of Reg CC Amendments that…

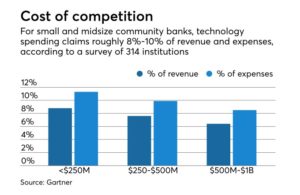

Read MoreSmall banks are at a crossroads: adopt new technologies or face the possibility of shutting the doors. According to Americanbanker.com: For community banks in highly competitive markets, service with a personal touch can be a differentiator to win and keep customers. But when legacy technology hampers the customer experience, all the cups of coffee in…

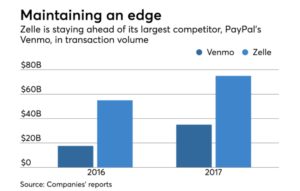

Read MoreAccording to American Banker, the bank-led person-to-person payment network Zelle is making progress, but having growing pains. Banks and consumers have learned a handful of truths — good and bad — about the network as it copes with a number of challenges including fraud threats, growing demand, as well as technical and enrollment issues. Here is…

Read More