Bank Branch

The Financial Brand website summary of mobile banking report shows a disappointing rate of mobile payment and payment adoption among consumers. Consumer enrollment in mobile banking services is growing as more individuals rely on their mobile phones for access to financial services. While growing, the total enrollment and usage percentages for most organizations still falls short…

Read MoreThe Expedited Funds Availability Act (EFAA) and the Check Clearing for the 21st Century Act (Check 21 Act), announced in 2014, will have amendments effective July 1, 2018. We learn this via the Federal Reserve Board (FRB) publishing in the Federal Register final amendments to Regulation CC (Availability of Funds and Collection of Checks). These amendments contain…

Read MoreA new year means new opportunities, and Aite Group’s Top 10 Trends Report tells us to be ready for changes in 2018! It looks to be an amazing year of challenges for retail banking payments as well as wholesale banking. Note: Both sites also feature a link to their Top 10 Trends in Financial Services, 2018 summary…

Read MoreAn interesting new white paper from Digital Check explores the expected demise of paper checks – – and how, as if by magic, the “expected” suddenly did not occur. We all know the drill: 50 billion checks written in the 90s; 20 billion checks written in 2013 – – – do the math, and at…

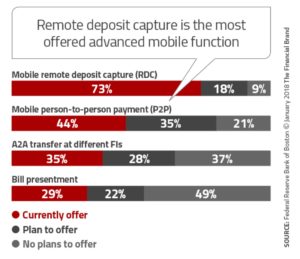

Read MoreOne reason check volume has stabilized is due to the marriage of the “tech evolution in check capture” and old-school paper…made possible by remote capture apps that are offered by nearly every major bank. The 2016 Mobile Deposit Benchmark Report, released Sept. 14 and put together by Futurion, a fintech and digital commerce research firm, makes a strong…

Read MoreFraud prevention solutions have evolved significantly in the past 3-5 years in terms of improved analytics, business intelligence, risk scoring, image analysis, platform deployment, and decision support. However, the deployment cycles of these solutions can be complex and challenging. When you weigh IT overhead, project costs, systems integration, security, infrastructure — just to name a…

Read MoreThe FDIC’s quarterly Banking profile contained good news for their client banks. FDIC-insured commercial banks and savings institutions are reporting third-quarter 2017 earnings of $47.9 billion — that’s 5.2% year over year. Community banks make up 92% of all FDIC-insured institutions; they reported net income of $6 billion, up 9.4% from last year. Also, Net Interest…

Read MoreFintechs and banks have been at odds with one another over customer information since the first moment that someone somewhere decided “fintech” was an actual word. American Banker reports that the icy relationship may be thawing. Fintechs have been arguing that they need to access bank customer account data to provide a variety of services,…

Read MoreThe Money20/20 conference this year in Las Vegas gathered an astounding array of speakers for what is called “The World’s Largest Payments & Financial Services Innovation Event.” Artificial intelligence, online commerce, robotics, even materials handling – – the spectrum of topics covered was enormous. In case you missed the conference (or if you attended but,…

Read MoreThe PYMNTS-Ingo Money Disbursement Satisfaction Index™ is an impressive research document summarizing payments. If you’re a banker, product manager, solution provider, or anyone interested in payments, the 2,243 data points might interest you! There is certainly an anti-check tone to the initial sections, but overall the data is very interesting. Check out pages 8-21 for a…

Read More