Billers

We have receive a tremendous amount of positive feedback from our recent #OrboZone launch, with a countless number of clients, partners, and industry experts raving about their “experience.” But what is #OrboZone? It’s dynamic content that combines high-impact videos, visual galleries, energizing music, and entertaining activities for your WFH environment.

Read MoreAs we noted in our Check & Fraud recap earlier this week, the ORBOIMPACT VIRTUAL CONFERENCE, our two-day online event — which covered Healthcare Payments on Thursday, October 29, and Banking & Payments on Friday, October 30 — was a huge success! Industry speakers coupled with OrboGraph experts focused on AI innovation and payment strategy helped drive strong attendance, while innovative polling encouraged attendee participation and interaction.

Read MoreHopefully you’ve already registered for the ORBOIMPACT VIRTUAL CONFERENCE scheduled for October 29th and 30th. If not, what are you waiting for?

ORBOIMPACT will explore AI innovation in the fields of check payments, check fraud, and healthcare remittance automation. The event is FREE and is accepting a limited number of virtual attendees , so register today if you haven’t already!

Check out our star-studded lineup of speakers!

Read MoreIn a little over a month, OrboGraph will host the ORBOIMPACT Virtual Conference: AI Innovation for Check Payments, Check Fraud, and Healthcare Remittance Automation.

Read MoreTo the layman, much of the language in the AI space can be mystifying, particularly in deep learning. Take for example one of the core elements; the node. A deep learning node is “a computational unit that has one or more weighted input connections, a transfer function that combines the inputs in some way, and an output connection. Nodes are then organized into layers to comprise a network.”

Read MoreOver the past decade, we have seen a tremendous evolution in healthcare, particularly in healthcare payments and revenue cycle management. But how far have we come since 2014? In 2014 we sat down to talk to Mark Brousseau, President of Brousseau & Associates, to get his perspectives on the challenges and opportunities facing healthcare payments…

Read MoreMIT Sloan Management Review and Boston Consulting Group recently collaborated on a white paper exploring AI as a tool entitled Winning With AI (you can download the paper HERE). Subtitled Pioneers Combine Strategy, Organizational Behavior, and Technology, the white paper is a nice encapsulation of their global survey. Conducted in Spring 2019, the survey attracted…

Read MoreWe love this time of year! It’s a week when everyone the payments industry can take a deep breath, celebrate successes, reflect, and then blog about the future. And now that 2020 is upon us, what better time to “look ahead” toward 2030! PYMNTS.com is one of the first publications to make a prediction related…

Read MoreAnd another year comes to a close! It’s been our pleasure to share observations, insights, and solutions from across the industry via the OrboNation Blog. As 2019 comes to end, we have much to be thankful for. Most importantly, however, we’re thankful for the clients and customers that are crucial to OrboGraph’s success. Looking back,…

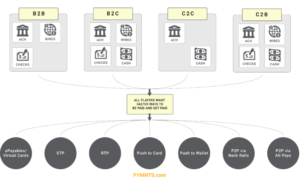

Read MoreThe FedNow Service, the Federal Reserve’s planned faster payments service, promises to have a positive impact on the speed with payments are processed. As the FED navigates their way toward a solution, The Clearing House continues to promote RTP (real-time payments). But the path to a world of real-time, integrated payments is not an easy…

Read More