Check Fraud Prevention

PYMNTS.COM takes a look at the implementation of Artificial Intelligence solutions in Financial Institution fraud departments — or, rather, the stunning lack thereof: AI systems are unique, can process large volumes of data in real time and can “learn” to quickly identify suspicious financial activity. Yet, few FIs leverage this technology in their anti-fraud efforts…

Read MoreWe’ve noted here before that there is a Millennial and sub-Millennial generation for whom checks are a bit of a novelty. Still, they will need to use checks more than they may expect or desire, so it’s important that they learn how to use them properly. Fraud is becoming easier and easier to overcome in…

Read MoreOne reason Financial Institutions don’t jump in the MSB banking ring is the perception that MSB’s don’t have what it takes from a compliance perspective. Au contraire! As an MSB (Money Service Business), these entities have strict guidelines for compliance. Just like financial institutions, the MSB must have a written policy and procedure, on-going training,…

Read MoreA Special Guest Host Blog Post by Bob Frimet, CAMS Millions of Americans depend on banking services each and every day, for everything from writing checks and paying bills to wiring money. But when was the last time you thought about the millions of “under-banked”? Where does that customer go? There are many reasons why…

Read MoreBank fees have been in the news lately, particularly with the ramp up of 2020 presidential candidates. Not only is the aggregate number, $15B, in question, but so also is the issue of whether or not fees are unfairly targeting persons with lower incomes. From WashingtonExaminer.com: One of the Democrats vying to run against President…

Read MoreSaturday Night Live debuted in 1975, meaning that if you were a member of the generation that watched the first seasons of the show, you’re in “the demographic that clings to checks.” according to the pundits. This past weekend, SNL enlightened viewers as to a few exaggerated benefits of “cheques” that we normally don’t promote…

Read MoreFIS was recently recognized by leading industry research and advisory firm Aite Group for its Code Connect application programming interface (API) gateway, naming it “Most Advanced API Strategy” in a newly released report. FisGlobal.com noted in an article: Code Connect provides a growing, constantly updated hub of APIs from both FIS and third-party developers for…

Read MoreThe Wall Street Journal recently ran an article headlined “The Problem for Small Town Banks: People Want High-Tech Services.” The gist of the article (available to subscribers only, alas) is that consumers in search of higher-tech interactions with financial institutions are bypassing smaller community banks in favor of “larger lenders offering online transactions.” The small…

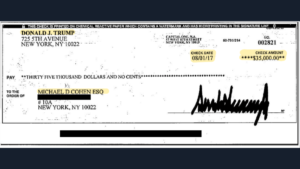

Read MoreBy now, images of the checks submitted into evidence by Michael Cohen as he testified before Congress have become ubiquitous. One of the checks, shown below, illustrates the power of data that is generated on a check. You see the courtesy and legal amounts, the date issued, maker/payer, payee and payee address, check number, and,…

Read MoreBAI Banking Strategies has assembled the wisdom of industry thought leaders in their new report: Decisions bankers need to make for 2019, a free download that will be worth your time to read as we make headway into 2019 and its new challenges, including the modernization priority that we hear about again and again. Venturing into the New Year, BAI has sought out its own thought…

Read More