Customer Acquisition

The American Banker podcast is a pleasant way to spend your commute. Their latest segment features a conversation from our business partners FIS, Doug Brown, senior vice president. He examines a recent survey that shows 14% of small and medium-size businesses switched banks last year and 18% are considering switching this year. “Business owners gravitate toward things that make…

Read MoreMobile check deposit rolled out almost five years ago, and at that time it was used mainly by tech-savvy leading-edge early adopters. The “mainstream” bank customer, however, felt intimidated by the tech, or was discouraged by the limits set on deposits. Undaunted, BBVA Compass aggressively addressed theses concerns over the past year. The bank increased its check amount limits,…

Read MoreRecently we looked at whether or not the bank teller and associated “human touch” was disappearing from the banking experience (Verdict: happily, bank tellers are not yet “endangered species.”) In this interesting take from India, the writer, a sociologist, wonders whether the very same tech that makes transactions quick and easy – – mobile apps,…

Read MoreTo say the 2017 Orbograph Client Conference in Atlanta turned out to be a great event would be shameless self promotion, which we would never do. So speaking objectively, it all started with a must-see introduction movie trailer. Then, on the check and payments side, we recruited a number of the best companies and speakers in…

Read MoreWithin the first months of 2017, there will be a number of important market studies released related to check volumes via FED research, fraud losses (ABA Deposit Account paper), and retail banking (BAI). As OrboGraph looks to the future in check payment innovation, we believe the following trends will feed market innovations. Check volume declines…

Read MoreRecipients of the 2016 FinTech Forward awards discuss how evolving technology will reshape banking in the next five years. Some of the key takeaways: Data, data, data. Huge value in data analytics for those who efficiently gather it. It will be crucial to respond to the shift occurring in the next five years toward “banking where and…

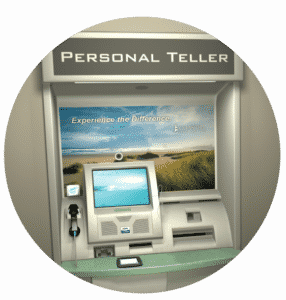

Read MoreWe’re excited to see that, of the Top 5 Tech Innovations Your Bank Can’t Ignored, we can actually contribute significantly to three of them! Let’s call them the “Key 3”: Continue to embrace Check 21 Leverage electronic workflows Automated tellers Part of the shared theme of the Key 3 is that the branch bank is far from obsolete. Online…

Read MoreIt’s not a live-in-person teller, and it’s not an ATM. But, based on conversations I’ve had with some of my older, more set-in-their-ways relatives, it may be the only way to get certain people to make use of a “machine” to do their banking. The interactive video teller machine certainly looks like an ATM, but the remote…

Read MoreIn an article ostensibly about a new mobile pay program introduced by a little company called Google, there is interesting challenge that mobile payments needs to overcome to go truly mainstream. Volume decline…

Read MoreEnd of the physical bank branch? Not at this rate!

Read More