Omnichannel

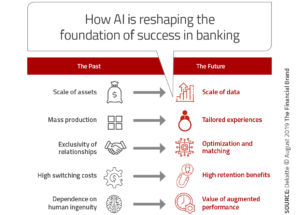

Let’s face it: Human beings are indispensable, but we are learning that in order to bring the level of service that is expected in today’s marketplace, machines and analytics have to work together and deliver quicker, more intelligent solutions than we’ve previously seen or experienced. This is the root of Artificial Intelligence and its value…

Read MoreChecks are still ubiquitous across generations. They remain popular, and they are — in spite of repeated premature eulogies — still alive and well in the world of treasury and B2B. Let’s say you have a check payment from a friend, or you’re running a small business on check payments, or you’re still getting a…

Read MoreThe ability of fraudsters to create an image of a check is not necessarily a new technique. What is newsworthy is accessibility.

Read MoreWhen Facebook announced its Libra payment system, reactions were varied, to say the least. Can a gigantic company that cannot be trusted to safeguard our heretofore private information be ready to handle cryptocurrency? PYMNTS.com wonders if another giant company, Walmart, might have a better chance to succeed in the payments field, particularly in light of…

Read MoreIt seems like not so long ago cloud computing was a nifty pie-in-the-sky idea (see what we did there?) that we’d eventually embrace along with personal jet packs and resorts on the moon. While the jet packs and moon lodgings are still off in the future, let’s make one thing clear: cloud computing is not…

Read MoreAs reported at McKinsey.com, an analysis by the McKinsey Global Institute (covering more than 800 jobs and over 2,000 work activities) showed that: Globally, almost half the activities employees perform—which account for nearly USD 16 trillion in wages—could potentially be automated using existing proven technologies. Automation will transform far more jobs than it will eliminate.…

Read MoreThe Federal Reserve announced last week that it is working on a real-time payments system, the biggest infrastructure upgrade embraced by the government body since the ACH system went online in 1972. At a speech in Kansas City, Mo., Fed Governor Lael Brainard confirmed what the payments industry has long awaited, and she said the…

Read MoreMicrosoft Corp. will stop supporting its Windows 7 operating system next January, which is a bellwether to both independent operators of ATM machines and large financial institutions — time to update! Digital Transactions reports that independent ATM operators seem to have the upper hand in the conversion race: Independent ATM owners’ decision to eschew Windows…

Read MoreIn the banking industry, AML/KYC (Anti Money Laundering and Know Your Customer) was previously a very slow, methodic process — the government would put out their lists of sanctioned bad guys (hostile governments, drug kingpins, organized crime organizations and affiliates, etc.) and compliance teams would then carefully (and manually) check onboarding customers to make sure…

Read MoreIn the third annual edition of its “The Best Bank for You” report, Kiplinger identifies top picks among national, regional, and internet banks, as well as credit unions, that offer the best combination of high rates, low fees, and a customer-friendly focus. Many of these institutions are customers of OrboGraph, so it’s is great to…

Read More