Omnichannel

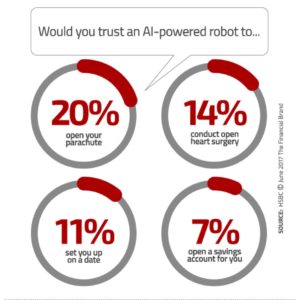

Artificial Intelligence, chatbots and robo-advisors are coming. Here’s an interesting example of how perceptions can yield crazy statistical results. A “Trust in Technology” report published by HSBC found that consumers are leery of allowing chatbots and robo-advisors to help them open a savings account or provide mortgage advice – – but they would trust them more for heart surgery! In an article…

Read MorePymnts.com reports that electronic payments are rising, according to a Viewpost study. Small and large businesses are recognizing the advantages of electronic payments. But, for all the rah-rah about electronic payments seeping into the consciousness of American businesses, there are no victory dances quite yet: Every single one of the business owners surveyed by Viewpost…

Read MoreBillerica, MA, June 7, 2017 – OrboGraph, a premier developer and supplier of intelligent electronic/paper automation solutions in healthcare revenue cycle management (RCM), as well as recognition solutions, image validation and check fraud detection for the U.S. check processing market, recently presented its OrbyAwards for excellence and inducted eight recipients to the OrboGraph Hall of Fame…

Read MoreThe American Banker podcast is a pleasant way to spend your commute. Their latest segment features a conversation from our business partners FIS, Doug Brown, senior vice president. He examines a recent survey that shows 14% of small and medium-size businesses switched banks last year and 18% are considering switching this year. “Business owners gravitate toward things that make…

Read MoreLast month at the RDC Forum: Atlanta, an event hosted by RemoteDepositCapture.com, a new unified platform for processing check and ACH transactions was discussed by a Fed spokesman. It’s expected to make its debut at the central bank later this year. The changes are a modernization of the Fed’s own internal systems, and appears to hold…

Read MoreRecently we looked at whether or not the bank teller and associated “human touch” was disappearing from the banking experience (Verdict: happily, bank tellers are not yet “endangered species.”) In this interesting take from India, the writer, a sociologist, wonders whether the very same tech that makes transactions quick and easy – – mobile apps,…

Read MoreTo say the 2017 Orbograph Client Conference in Atlanta turned out to be a great event would be shameless self promotion, which we would never do. So speaking objectively, it all started with a must-see introduction movie trailer. Then, on the check and payments side, we recruited a number of the best companies and speakers in…

Read MoreIf Tom Brady was in healthcare payment processing, he’d get to 100% automated posting of insurance payments… but he wouldn’t get there the way you think. Does he have the physical tools? Sure – – but that’s not enough. Attention to detail, discipline and hard work factor in even more than a strong arm. As much…

Read MoreAndrew Davies, Vice President of Global Market Strategy, Financial Crime Risk Management at Fiserv, makes several great points about how quicker transactions – and the customer expectations attached to that speed – can be dangerous in terms of exposing fraud and theft opportunities. (Read it HERE.) Mr. Davies describes a “perfect storm of factors,” broadly consisting of: Greater demands…

Read MoreNew technologies by the FINTECH community continue to grab the spotlight in the market. FINTECH is pushing hard on digital payment varieties and all kinds of scenarios to make P2P, B2B, and P2B via mobile devices and new card/chips options, taking volume from the branches. Banks are looking for ways to better serve millennials, too.…

Read More