Retail Banking

Bob Legters of American Banker goes out on a limb and makes the following predictions for the new year. Visit the link for his expansion of each prediction. Legters begins with specifying things he thinks we won’t see in 2019, followed by developments he believes will come to fruition before year’s end. How many do…

Read MoreThis time of year we hear, more than ever, about how e-commerce has pushed retailers to the brink. Smart companies, however, survived and thrived, as Dawn Wotapk reports in Banking Strategies explains, by offering consumers as many consistent and seamless options as possible—letting them quickly jump between the offline and online worlds and learning about those consumers…

Read MoreThe Federal Reserve, following through on plans disclosed earlier this year, formally unveiled the U.S. Faster Payments Council, an industry group charged with collaborating to spur the adoption of faster payments and identify market opportunities. According to DigitalTransactions.net: The 22 inaugural members range from retailing giant Walmart Inc. to Visa Inc. and Mastercard Inc. to…

Read MoreFortune Magazine is not sold on chip-enables credit cards as the fraud-stopper the tech promised. New chip-enabled credit cards, which were rolled out to U.S. consumers starting in 2015, were supposed to put an end to rampant credit card fraud. So much for that. A new report from the research firm Gemini Advisory has…

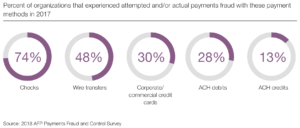

Read MoreThe Association for Financial Professionals (AFP) reports in its annual study of payments fraud risks and realities that nearly 8 in 10 U.S. organizations were targets of payments fraud in 2017. What’s the best way to protect your organization? US Bank has some solid tips: Provide comprehensive training: All employees should receive training to help them…

Read MoreBankNews.com reports on a study that lends considerable weight to the concept of upgrading technology in the retail bank space: According to the 2018 Payments Industry Report from Sydney, Australia-based Accuity, the majority of financial institutions and payments providers provide customers with the validation of key payments data elements prior to remittance, and many have…

Read MorePYMNTS.com reports on the Federal Reserve’s efforts to gather input on making payments faster across all channels. Federal Reserve Governor Lael Brainard said, in remarks made on Oct. 3rd., that the Federal Reserve’s infrastructure underpinning payments could use a bit of modernization in a bid to support fast payments “for all.” Brainard, speaking in Chicago at the Fed…

Read MorePersons who are older than 30 may feel the urge to gloat about this: Millennials – – the cohort, according to the Pew Research Center, born between the years 1981 and 1996, and who watch with glee as older folks struggle with social media and Ubers – – are currently the primary target when it…

Read MoreWhile the consumer “civilian” world has pretty much learned and accepted the “don’t take checks from strangers” rule, the corporate world is both slow to adopt that guideline — and often unable to. This is due to the fact that suppliers like the “float” advantage they enjoy with check payments. (“We paid you on Tuesday…

Read MoreIs it important for financial institutions to deploy the best possible tools to fight fraud? Consider this: According to LexisNexis Risk Solutions in its 2018 True Cost of Fraud study for the financial-services sector, for every dollar of fraud a financial institution absorbs, it drains an additional $2.92 in associated costs — that’s up 9% from…

Read More