Teller Image Capture

Suppliers want quick reimbursement; buyers prefer slower payments Checks are popular among SMB buyers Faster payments actually mean cash flow gains It’s a quandary old as commerce itself: Suppliers of goods and services want access to their funds as quickly as possible — like, right now — while buyers, on the other hand, often look…

Read MoreAutomation has been a popular topic in the world of banking for decades (and discussed here recently as well). However, according to BankingDive.com, there is a new term now picking up steam in the banking world: Banks, of course, have been focused on automating processes to improve efficiency and customer service for well over a…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreChecks are still widely used by various age groups and industries Pros and cons of using checks Investment in check automation is crucial As we continue to explore the relevancy of checks as a payment avenue, it’s important that we keep in mind some data previously noted in our blog: Checks still account for nearly 23%…

Read More78% of renters still pay by check Other industries dominated by checks Investments in tech to automate check processing As we noted in a previous blog, checks are NOT going away. In fact, our friends at Alogent reported that of non-cash payment methods, checks accounted for nearly 23% of the total value of payments in…

Read MoreWant to keep up in the banking industry? Follow the example of executives at eight in ten banks, who noted that their 2022 technology budget was up from the previous year, with an average increase of 11% over 2021. In fact, Gartner Inc. predicts that in 2022, banks and financial firms will invest an estimated…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreRecently, the Association of Financial Professionals — in conjunction with JP Morgan — released its 2022 AFP Digital Payments Survey. The survey was conducted to measure the adoption of digital payments in the US and Canada in light of recent global challenges. In particular, the survey focuses on the shift from checks to digital alternatives.…

Read MoreAs we noted in a previous blog, business remote deposits continue to be a leading service — particular for checks, with tremendous growth of +25%. And, according to Fiserv’s Mobile Deposits Adoption Program Director, Ryan Williams, 85% of consumers currently using mobile deposit plan to continue doing so. With all that being said, Williams recently shared…

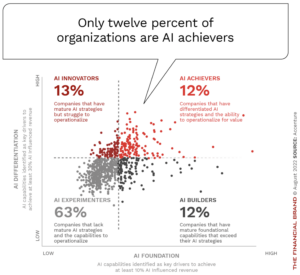

Read MoreA post at The Financial Brand by Jim Marous, Co-Publisher of The Financial Brand, CEO of the Digital Banking Report, and host of the Banking Transformed podcast, paints a grim picture of AI development and adoption progress in the banking industry. Despite the importance of leveraging data and artificial intelligence for risk management, enhanced operations,…

Read More