OrboNation Newsletter: Check Processing Edition – October 2022

BAI: Majority of Banks See Checks as Biggest 1st & 3rd Party Fraud Concern

The latest BAI Deep Dive takes on "The fraud prevention balancing act: protection vs friction." Much of the discussion involves changes seen in fraud prevention techniques as consumer attitudes and expectations have evolved and changed in the face of new technology and the pandemic.

Guests for the discussion are:

- Jen Martin, Head of Enterprise Fraud Services at KeyBank

- Kevin Sanchez, Senior Vice President of Digital Financial Crimes at US Bank

- Karl Dahlgren, Managing Director of Research at BAI

- Holly Hughes, Chief Marketing Officer at BAI

Karl Dahlgren explains that fraud resides in two different "buckets": first party and third party. First party fraud is undertaken under the fraudsters own identity, while in a third party scenario he/she adopts another identity. According to BAI Research: 62% of banks indicated that third party check fraud is their biggest issue, and 59% of banks indicated the first party check fraud is their biggest issue...

Check Fraud Roundtable

Over a dozen banks participated in the second session of the Check Fraud Roundtable (10/13/2022). The focus of the session was the topic of deposit fraud. During the session, OrboGraph announced the launch of the #OrboIntelligence Check Fraud Hub - the centralized resource for primary and secondary research, industry trends, and 3rd party reports.

To read the agenda, summary notes from the first two sessions, or to participate in future roundtables, visit www.orbograph.com/check-fraud-roundtable.

A Deeper Dive into the 2022 AFP Digital Payments Survey

Recently, the Association of Financial Professionals -- in conjunction with JP Morgan -- released its 2022 AFP Digital Payments Survey. The survey was conducted to measure the adoption of digital payments in the US and Canada in light of recent global challenges. In particular, the survey...

Alogent: Why Payments Fraud Costs Are Up 10% from Pre-Pandemic Levels

The proliferation of fraud across the globe is no secret. While numbers vary from source to source, it is acknowledged by most banks that we are seeing unprecedented levels of fraud attempts and losses. This is exacerbated by the increase of the in costs for fraud, according to a recent article from our friends at Alogent.

The dollar value of payments fraud is significantly up, confirming it’s still one of the largest external threats for banks and credit unions. According to a 2022 survey from the Association for Financial Professionals, 71% of the responding banks and credit unions were victims of attempted payment fraud last year.

Fiserv: Steps and Technology to Drive mRDC Growth

As we noted in a previous blog, business remote deposits continue to be a leading service -- particular for checks, with tremendous growth of +25%.

And, according to Fiserv's Mobile Deposits Adoption Program Director, Ryan Williams, 85% of consumers currently using mobile deposit plan to continue doing so.

With all that being said, Williams recently shared advice for FI's looking to continue the growth of their mobile check deposits.

Fraud/ol/ogy Podcast: Highlighting the Rise in Check Fraud

Fraud Fighter Karisse Hendrick has taken her passion for the world of fraud prevention and chargeback reduction and created the Fraud/ol/ogy Podcast. On the podcast, Karisse dives into all areas of Fraudology from the perspective of a fraud-fighter. Podcast guests range from former cybercriminals, to fraud-fighters at Fortune 500 companies, to law enforcement and others.

While the podcast focuses on online and digital fraud, Hendrick welcomed Frank McKenna, Chief Fraud Strategist and Co-Founder of PointPredictive Inc. and owner of the Frank On Fraud blog, for an enlightening discussion of fraud trends and the disturbing escalation to violence that check fraud has inspired recently.

Competition for Banks & Neobanks: Walmart Announces Entrance into Banking

The newest episode of This Week on PYMNTS.COM covered, among other topics, the impending entry of Walmart into the banking space. PYMNTS’ Karen Webster spoke to Ingo Money CEO Drew Edwards, who is sometimes referred to as “the OG [Original Gangster] in FinTech."

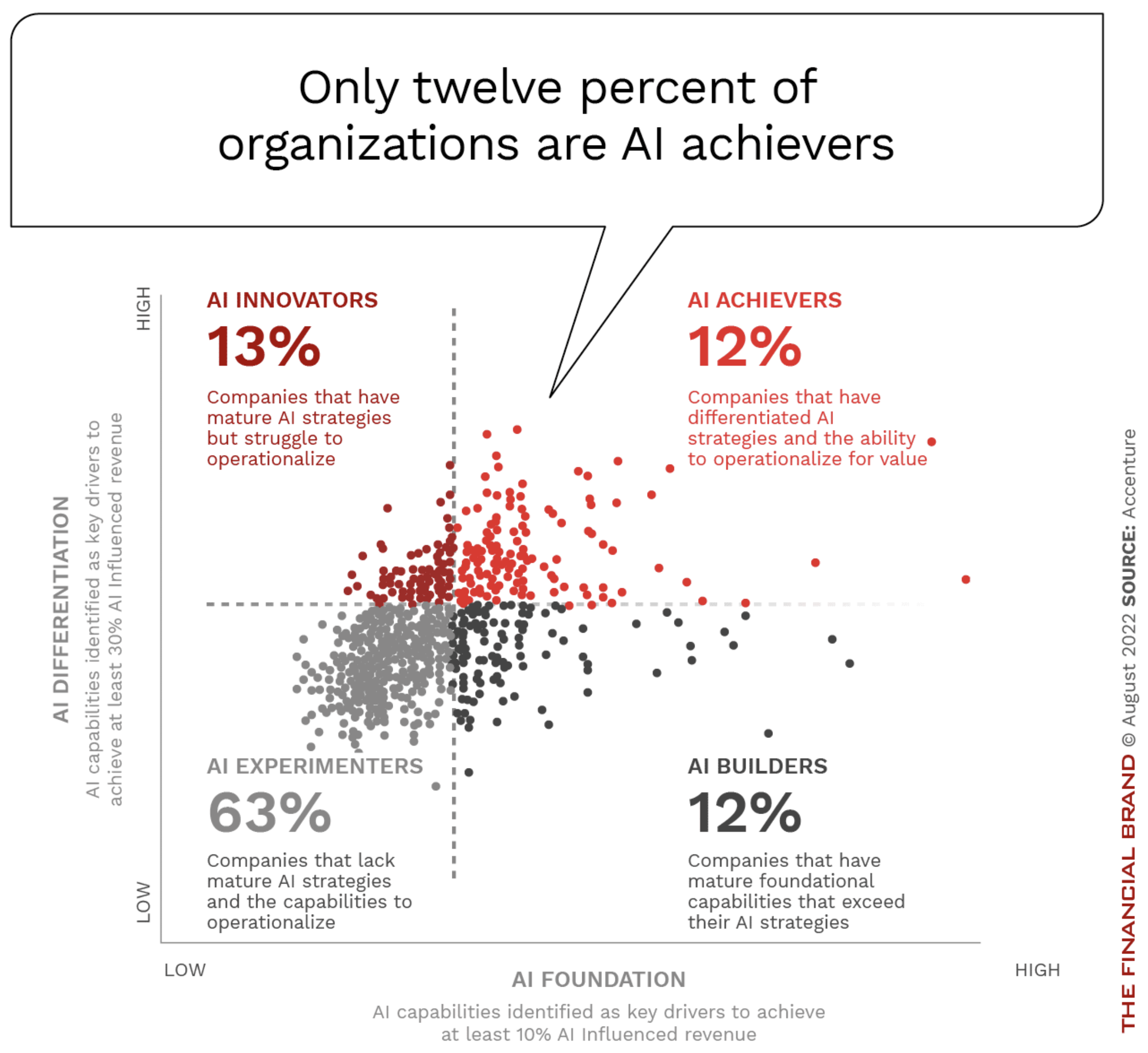

75% of FIs are Still in the Early Experimental Stage of AI Development

A post at The Financial Brand by Jim Marous, Co-Publisher of The Financial Brand, CEO of the Digital Banking Report, and host of the Banking Transformed podcast, paints a grim picture of AI development and adoption progress in the banking industry.

Despite the importance of leveraging data and artificial intelligence for risk management, enhanced operations, revenue generation and improved customer experiences, the vast majority of banks and credit unions are only in the formative stages of development. In fact, Accenture ranks banking at the bottom of all industries in AI maturity.

What’s New on LinkedIn: #CheckFraud & #FraudFightersUnited

LinkedIn -- the world's largest internet professional network -- is a great way for professionals to connect with colleagues and other industry leaders, strengthening relationships to advance their careers.

Over the past few years we've seen many of these professionals use the LinkedIn platform to take an active role in spreading news and content that is most important to them. For the banking industry -- given the rise in check fraud -- more and more pros are spreading information utilizing the hashtags #checkfraud and #fraudfightersunited.

Consumer Financial Protection Bureau (CFPB) Tightening Rules for Fraud Money Transfers

According to a report published in The Wall Street Journal, the Consumer Financial Protection Bureau (CFPB) plans to tighten rules around fraudulent money transfers via services like Zelle, primarily by pushing banks to repay more customers harmed by these alleged scams.

As we noted in a previous blog post published in April 2022, the "CFPB issued detailed guidance to banks regarding the kinds of fraudulent losses they’re required to repay. The regulator made it clear that banks must reimburse customers for losses on transfers that were 'initiated by a person other than the consumer without actual authority to initiate the transfer' -- including those who obtain a victim’s device through fraud or robbery. However, it did not address who is responsible for a fraudulently induced transfer if the customer hits the buttons by accident or by trickery."...