Uncategorized

Digital is undoubtedly going to play a major role in the future of banking. As we noted previously, digital banking market valuation is predicted to exceed USD 13.5 trillion by 2032. The real question is: How each bank is approaching digital banking? From our friends at BAI, author Emily Steele, president and COO at Savana,…

Read MoreIn depth interactive agenda will focus on best practices in check fraud detection and prevention Burlington, MA, April 6, 2023 – OrboGraph, a leading provider of intelligent payment automation and check fraud detection solutions, officially announced its Charlotte Check Fraud Roundtable meeting scheduled on May 22-23, 2023, at the Hilton Charlotte Airport in Charlotte, NC.…

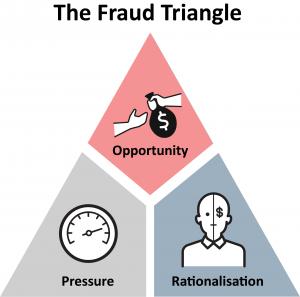

Read MoreAn ex-fraudster provides inside information on fraud methods Checks are a target because they are inexpensive to spoof Fraudsters have favorite targets Recently, we covered insider check fraud and the reasons individuals perpetrate it — even when they may not need the money. But what about the other side of the coin? The professional fraudster…

Read MoreCompany wins award back-to-back years for Hybrid Intelligent Systems category Burlington, MA, April 4, 2023 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, announced today that the company was selected as the winner of the prestigious 2023 AI Excellence Award in the Hybrid Intelligent Systems category for its…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

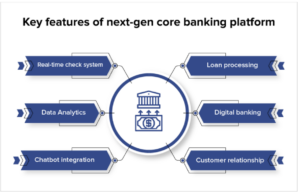

Read MoreAs reported at Mobil App Daily, competition in the banking industry is fierce and at a consistently high level — a good situation for consumers, and an ongoing challenge for the banks themselves. They want to dramatically improve the experience their consumers receive from their optimized digital banking services by utilizing the next-generation banking platform.…

Read MoreCheck alterations by employees can be an issue City government employees sometimes alter checks to pay themselves They are usually small amounts and therefor rarely attract attention Over the past year, most of the media coverage has spotlighted post office insider check fraud — where a postal employee is responsible or part of scheme to…

Read MoreCheck fraud is surging, particularly in business transactions Check fraud has a reputation as a low- or no-tech scam Scammers are “graduating” to high-tech strategies Abrigo’s new and informative downloadable PDF, Check Fraud: New Tech Driving Old School Scam by Kate Stoneburner, is a succinct look at the ways in which modern scammers are deploying…

Read MorePYMNTS talked to Manish Jaiswal, chief product and technology officer at Corcentric, about the ways AI technology can and will improve business payments by making them faster and — most importantly — safer. Source: PYMNTS.com “Real-time payments processing is becoming a reality in B2B,” Mr. Jaiswal noted. Still, there are challenges to address. Most companies, no matter the…

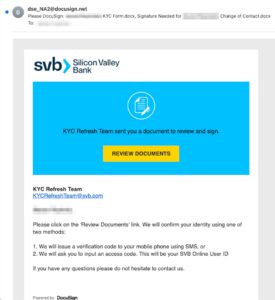

Read MoreIntroducing the “Threat Actor” Threat Actors respond to news trends and resultant anxiety The fall of Silicon Valley Bank is the newest boon for Threat Actors The Cloudflare Blog takes a look at the activities of a specific category of fraudster, the Threat Actor, in relationship to news events like the collapse and takeover by the…

Read More