Uncategorized

LinkedIn — the world’s largest internet professional network — is a great way for professionals to connect with colleagues and other industry leaders, strengthening relationships to advance their careers. Over the past few years we’ve seen many of these professionals use the LinkedIn platform to take an active role in spreading news and content that…

Read MoreEven as we read more and more about the popularity of digital banking, a study by PYMNTS reveals that many consumers are not yet prepared to cut ties with their traditional financial institutions (FIs) and go fully digital. In their new collaboration with Treasury Prime entitled “How Consumers Use Digital Banks,” 2,124 consumers were surveyed regarding…

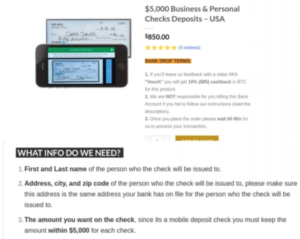

Read MoreBanks and law enforcement have much to teach one another “Simple theft” is often the first step toward more sophisticated scams Check fraud is an easily accessible and “quick payback” scam methodology “Crime doesn’t pay” is a familiar statement. The deeper meaning is that the punishment outweighs the benefits. However, if we take the statement…

Read MoreBAI examines the ongoing transformation of the branch experience: Long before the pandemic hit, many banks were well on their way to rethinking their branches to better accommodate customers’ increased use of digital channels. With the net closure of nearly 3,000 branches in the U.S. last year and a similar pace in the first half of 2022,…

Read MoreAn exploration of the latest fraud trends Includes a step-by-step look at the manual marketing of fraud Yes, it’s true – fraudsters advertise their services to scammers In a new webinar presented by Abrigo, Mara Gibor, VP Of Intelligence Operations; Maria Noriega, Senior Cyber Threat Intelligence Analyst at Q6 Cyber; and Jess Kelley, Senior Cyber…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIt’s an open secret that the types of products and services corporate clients demand from their financial institutions (FIs) are shifting to digital banking solutions. This month PYMNTS Intelligence takes a look at recent changes in corporate clients’ requirements for online versus in-branch banking as well as how banks can use embedded and open banking…

Read MoreIf you get a “wrong number” text, it may be a scam attempt Text scammers are very patient “I want to say she waited 20 days and a thousand text messages before she got into investments.” Many times we hear about scams and scammers that do their work quickly and move on. They rely on…

Read MoreA report on the Globes website gives us a look at restrictions on cash payments in Israel that have been in effect since January of 2019. The law limits the use of cash in any transaction worth more than NIS 11,000 with a business and more than NIS 50,000 in a transaction between private individuals.…

Read MoreWalmart has a reputation as a “one-stop” shopping destination Toward that end, Walmart offers money transfer services Unfortunately, a lawsuit alleges they did not protect these transactions Walmart has enjoyed a reputation as the “one-stop” center for consumer needs, and, true to their reputation, they expanded into the money transfer space so their customers could…

Read More