Uncategorized

Artificial intelligence and machine learning technologies are making a big impact in the banking industry, as their ability to process millions and even billions of transactions in mere seconds is unparalleled. However, the astounding amount of data being processed means it’s not without its pitfalls, particularly when it comes to decision making for complex tasks.…

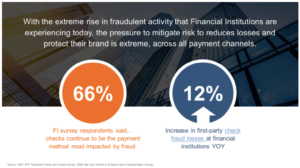

Read MoreMany large companies have been stung by check fraud Almost all instances could have been prevented by currently available fraud detection tech AI-powered transactional-analysis systems protect orgs from internal and external fraud Though digital payment options are popular (and there seems to be a new one every week), the fact is that checks remain a…

Read MorePYMNTS and Ingo Money have collaborated on The Money Mobility Playbook — an exploration on how Fintechs and FIs can provide clients and customers with optimal money mobility regardless of the type of payment or disbursement they choose to make. One of the many discoveries revealed within is that a considerable amount of payments made…

Read MoreBad fraud practices are pervasive Attention to a short list of bad practices can bring improvement Banks must stay consistent and constant The always-informative Frank on Fraud blog discusses — with accompanying highly entertaining imagery and GIFs — the 10 Worst Fraud Practices and How to Avoid Them. Frank recognizes that the same mistakes seem…

Read MoreIn a press release by Gartner, Inc., the company boldly predicts that banks and financial firms will boost their technology products and services investments in 2022 to the tune of $623 billion. Gartner Inc. goes on to identify what they consider the top three tech trends emerging in banking and investment services. Generative artificial intelligence…

Read MoreUse of AI and machine learning expected to escalate against fraud A majority of organizations plan to increase their anti-fraud tech budgets The pandemic has certainly been a factor The Association of Certified Fraud Examiners and SAS released their Anti-Fraud Technology Benchmarking Report 2022 — a report exploring how organizations are using anti-fraud technologies and which ones…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreRecent aggressive interest rate increases by the Federal Reserve, as well as geo-political uncertainties, have combined to create an environment wherein banks will be in high competition to not only gain new customers, but also retain customers — and, more importantly, their deposits. As we are all aware, deposits are crucial for banks in generating…

Read MoreCheck fraud is rising Remote deposits are more popular and create more fraud opportunities Tools are available to effectively fight check fraud The PaymentsJournal Podcast invited guests Bev Nichols, Product Director of Deposit Solutions at Fiserv, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group, to discuss the state of check…

Read MoreIt’s no secret that bank consumers are not fans of overdraft fees. A number of big banks eliminated overdraft and/or non-sufficient funds (NSF) fees in 2021-22, responding to governmental pressure and competition from neobanks. While this might be welcome news to the consumer, The Financial Brand reports that smaller community banks and credit unions face…

Read More