Uncategorized

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIn what might very well become an industry standard practice, Bank of America (BAC) is the latest major financial institution to announce that it is ending fees for insufficient funds. They also plan to cut overdraft fees from $35 to $10. These new policies go into effect in February. CNN Business Reports “Bank of America said that once all…

Read MoreThe pandemic has created a definite uptick in fraud Rather than reactive, FIs should be PROACTIVE in their approach to combatting fraud It’s time to “think like a fraudster” James Ruotolo, a senior manager in the fraud and financial crimes practice at Grant Thornton, contributed a valuable article to ABA Bank Compliance magazine which discusses…

Read MoreAs we start off the new year, an article from the American Banker highlights seven bank trends to watch in 2022. The key, according to their analysis, is providing ultraconvenience to customers. As you take a look at the list below, we strongly recommend you compare the trends to your bank’s plans for the new…

Read MoreA special research team has been closely studying fraud Check fraud can lead to cybercrimes such as identity theft Check fraud is growing and supported by an “underground” structure Many of us in the banking industry rely heavily on check fraud data from various industry sources such as the American Bankers Association (ABA), Association of…

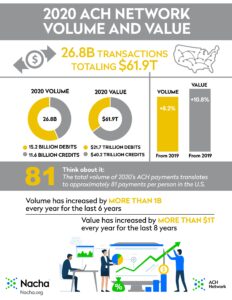

Read MoreThe COVID-19 pandemic has impacted almost every facet of the lives of individuals, as well as how business operates. This also includes how payments are made. With businesses shuttering offices and many millions of jobs moving to hybrid or fully remote positions, the way individuals and businesses make payments for goods and services has changed…

Read MoreChecks can be “washed” Many businesses buy checks with anti-fraud features Deploying forensic AI technology thwarts “check washers” Since checks are most often delivered by mail — via what are generally non-secure receptacles that can be emptied by any sticky-fingered thief willing to open a public mailboxes or stolen directly from home mailboxes — they…

Read MoreAmerican Banker sheds some light on an example of modernization in action at Viewpointe, which was founded by big banks over 20 years ago primarily to store digital images of checks. When the physical transportation of checks temporarily halted after 9/11 — compounded by legislation known as Check 21, which allowed banks to handle more…

Read MoreThe pandemic has made digital solutions more vital than ever Credit unions faced a disadvantage in getting aboard the “digital services train” AI and ML solutions are giving CUs the leverage they need PYMNTS.com takes a look at how the pandemic has forced consumers to “rush to digital channels to tackle daily tasks including grocery shopping,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read More