Uncategorized

We previously took a look at the similarities and differences between The Matrix experience and OrboGraph’s OrboZone experience. Both offer a truly dynamic experience, so we would be remiss not to take a deeper dive into another key pillar in The Matrix Film Series: The AI driving the Machines. With the release of The Matrix…

Read MoreThe challenge: 55% of credit union members have used a product or service from a different bank or financial institution, according to the Credit Union Tracker produced by PYMNTS, in collaboration with PSCU. That means more than half of all credit union members are effectively “comparison shopping.” How do credit unions hold on to their members?…

Read MoreOrboGraph’s Fraud Technology recognized by The Enterprise World Research & development vital to OrboGraph’s success Collaboration through client services enhances outcomes OrboGraph is proud to be recognized by The Enterprise World as one of the “Top 5 Fraud Detection & Prevention Software Companies in 2021.” With check fraud persisting as an issue for banks and…

Read MoreKLA Corporation (Nasdaq: KLAC) — parent company of OrboGraph — recently released their September 2021 earnings, announcing that revenue grew 8% sequentially and 35% year-over-year to $2.08 billion, finishing toward the upper end of the range of guidance. About KLA Corporation Expand KLA Corporation (“KLA”) develops industry-leading equipment and services that enable innovation throughout the…

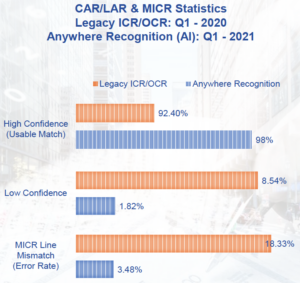

Read MoreLast week, the OrboNation blog featured the NVIDIA GTC Virtual Conference, highlighting the importance of GPUs to Artificial Intelligence in financial services. These dynamic sessions provided attendees with information invaluable to advancing financial services, particularly the banking industry. To further display the benefits and results of artificial intelligence in banking, we collaborated with our friends…

Read MoreFraud remains a growing threat Offenders are low-impact/high frequency, or high impact/low frequency – which do you concentrate on? When it comes to fraud prevention, cooperation and teamwork trump competition BAI welcomed Andy Shank, vice president of fraud and risk product management at Vericast, to discuss via their BAI Banking Strategies podcast how banks and…

Read MoreWith the recently released trailer for The Matrix Resurrections — the fourth installment in The Matrix Franchise — we took at a look at the simulated world created by the machines and compare it to our own simulated world known as #OrboZone.

Read MoreNVIDIA’s GTC virtual conference is set to take place November 8-11, and it promises to be a valuable resource for getting (and staying) up to speed on the latest technology in use and development across myriad industries. If you are not familiar with the conference: NVIDIA GTC is a global conference that brings together developers…

Read MoreCheck fraud ranges from “craftsmanship” to cut-and-paste Businesses and individuals are being defrauded, at work and at home Underfunded AI and deep learning tools at small banks may be to blame for “easy fraud” WTHR-13 News of Indianapolis takes a fascinating look at the range of “craftsmanship” that goes into check fraud, all the way…

Read MoreCommunity banks and credit unions are at a disadvantage. Their lack of necessary internal resources and budget to upgrade their systems and integrate new technologies compared to big banks means the “cutting edge” services that a new generation of consumers have come to expect are slower to arrive at “non-giant” institutions.

Read More