Central Bank Digital Currencies (CBDC): “Canadians Don’t See a Need”

Previously, we covered the United Kingdom and their push for the "digital pound." While there are many benefits for a central bank digital currency (CBDC), the real question remains: "Is there a desire or need for them?"

This is the question being pondered in Canada. In a story covering a recent report from the Bank of Canada, Payments Journal reports on a possible snag in that goal:

The report, “Unmet Payment Needs and a Central Bank Digital Currency,” explains that for a digital currency issued by the central bank to work well, consumers would need to use it frequently. That’s an important factor when it comes to merchant acceptance. When businesses offer such a payment method, consumers are more likely to frequently use it. In this case, widespread merchant acceptance would lead to increased use of the digital currency.

However, there’s an abundance of payment methods currently out there, particularly digital ones—and many consumers still heavily lean on cash when paying for purchases. Therefore it’s no surprise that many consumers in Canada are not very motivated to use CBDCs frequently, especially on a big scale. This lack of enthusiasm also means that businesses aren’t racing to widely accept this digital currency.

The Bank of Canada asked "what will happen if Canada becomes truly cashless? Would it be worth replacing cash with a digital equivalent?"

Well, according to their findings, the answer is no.

Old Habits Die Hard

While the idea of CBDCs is catching on worldwide, only a few countries have, in fact, implemented them. The largest use case may be China -- where a majority of payments in the metro areas are conducted with WePay -- but this is not truly a CBDC.

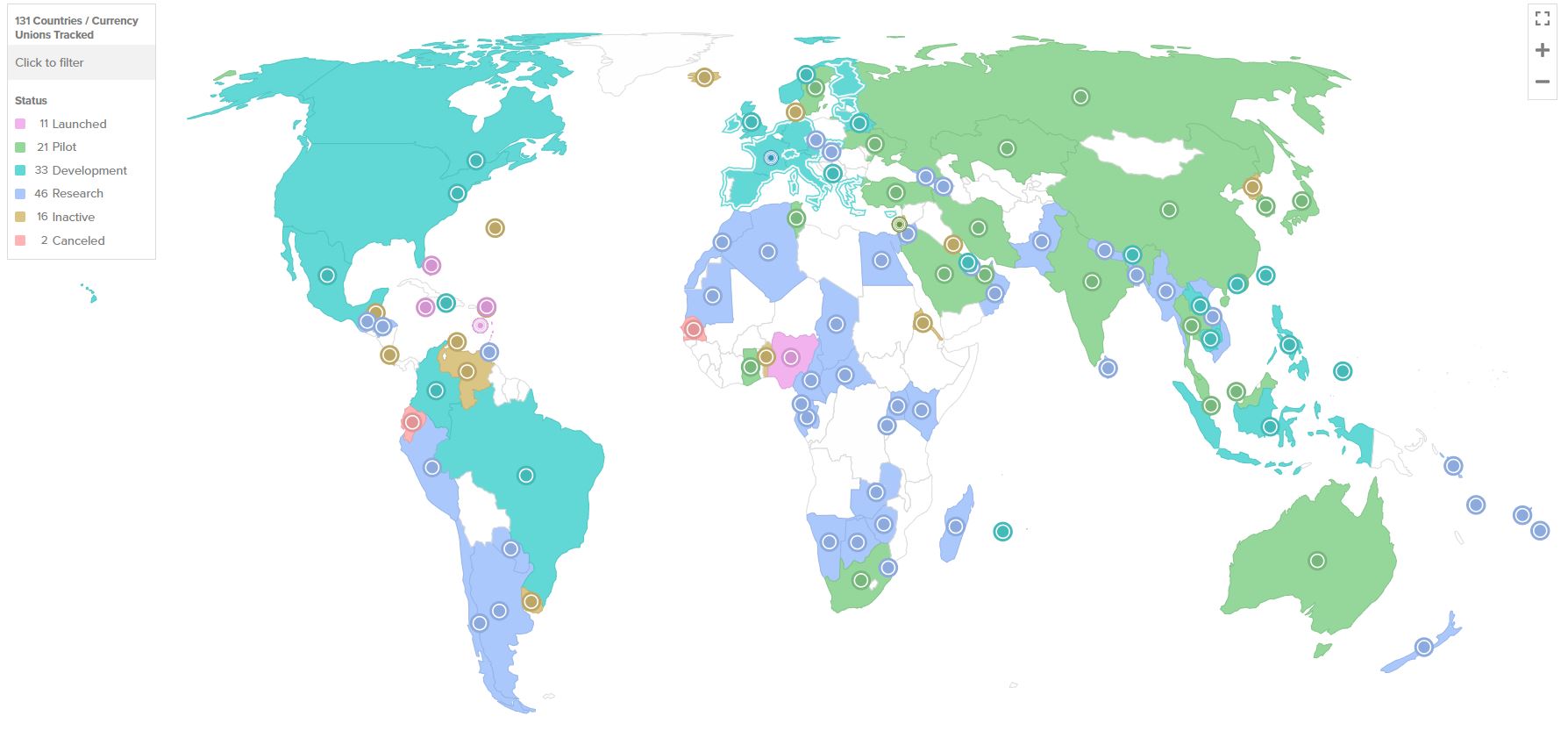

According to www.atlanticcouncil.org, only 11 countries have fully launched a digital currency.

Source: Atlantic Council

Aside from a lack of a desire for a CBDC, the Atlantic Council notes additional risks and challenges:

There are several challenges, and each one needs careful consideration before a country launches a CBDC. Citizens could pull too much money out of banks at once by purchasing CBDCs, triggering a run on banks—affecting their ability to lend and sending a shock to interest rates. This is especially a problem for countries with unstable financial systems. CBDCs also carry operational risks, since they are vulnerable to cyber attacks and need to be made resilient against them. Finally, CBDCs require a complex regulatory framework including privacy, consumer protection, and anti-money laundering standards which need to be made more robust before adopting this technology.

While it's too early to tell where the future of currency and payments will head, it appears that the majority of individuals are comfortable with current payment methods. This includes credit cards, ACH, and even checks.

For financial institutions, it will behoove them to ensure that they've optimized and secured the current payment channels such as check processing and automation, while keeping a finger on the pulse of where the consumer desire is trending.