OrboNation Newsletter: Check Processing and Fraud – Best of 2025

Highlighting the “Hotspots” For Check Fraud in the USA

Back in May of this year, we wrote a post pointing out which regions of the USA were "hotspots" for mail theft/stolen checks. These hotspots were focused around large metropolitan areas, where we surmised a correlation with population and the number of businesses.

In a recent article by Visual Capitalist, author Jenna Ross and graphic designer Zack Aboulazm have created a visual map to highlight the regions in the USA that are hotspots for check fraud. Sponsored by Citizens Bank, the recent report "Check Fraud by State, Mapped," analyzes depository institution filings with the Financial Crimes Enforcement Network between September 2024 and August 2025, revealing geographical trends that underscore both the scope and shifting nature of check fraud risks.

Why Speed and Latency are Critical in Check Processing

In a recent Medium blog post, banking transformation leader Amit Batra draws a sharp distinction between two metrics that quietly determine whether AI-powered banking feels seamless or painfully slow: throughput and latency.

Lack of “Check Experts” Hindering FIs with Check Fraud Liabilities

One major issue that many financial institutions are facing when it comes to check fraud is understanding which financial institution is liable. Unfortunately, as checks slowly declined over the past few decades, we've seen a lack of banking professionals' focus on the payment channel -- leaving many FIs who lack an internal "subject matter expert" to resort to an outside consultant when check fraud occurs.

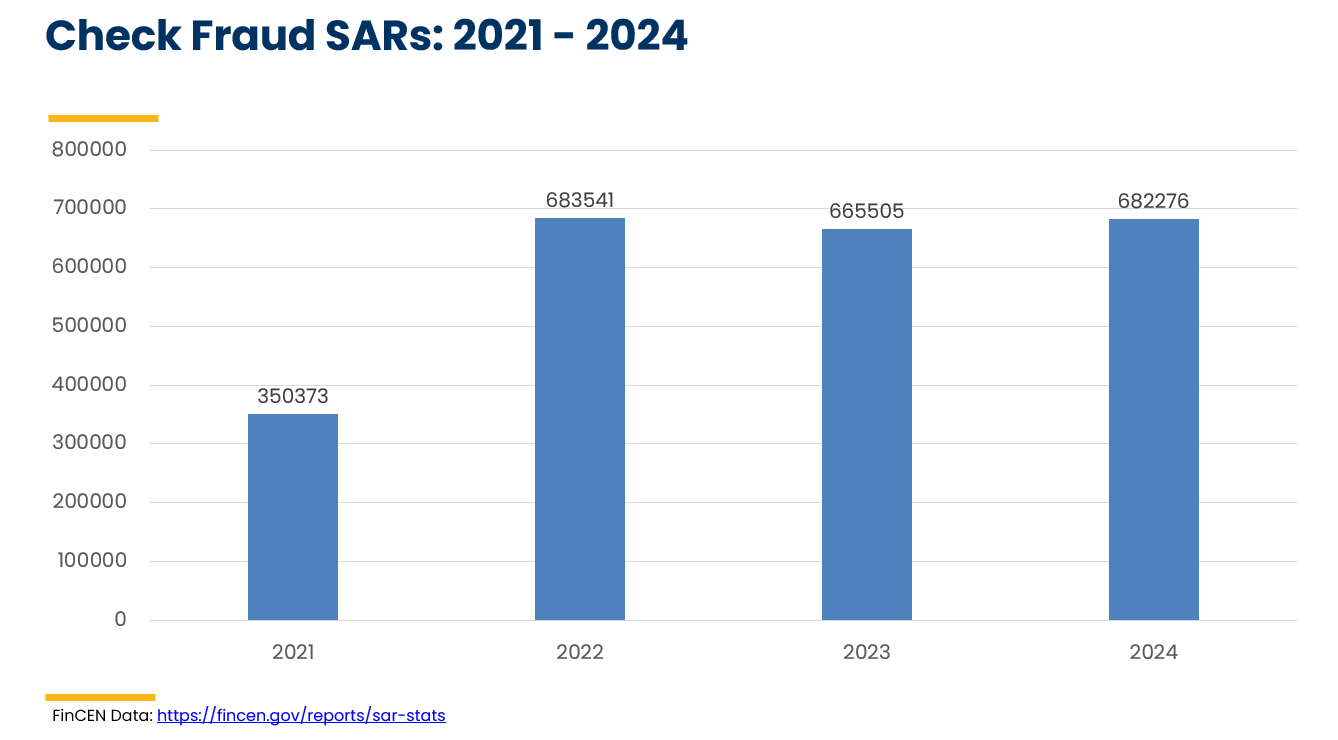

Check Fraud SARs Rise in 2024 to Near 2022 Record-Setting High

According to a recent report from the Thomson Reuters Institute, the total number of Suspicious Activity Reports (SARs) filed by U.S. financial institutions in 2024 declined slightly from the record-setting numbers seen in 2023 but nevertheless remained near all-time highs.

Phyllis Meyerson’s Lasting Legacy: The Blockbuster Story Behind Check 21

On October 15, 2025, the payments industry lost one of its icons. Phyllis Meyerson was a 50-year payments and check-processing veteran, accumulating numerous professional certifications and making a lasting impact on the payments industry through her leadership and service.

Phyllis was more than her professional achievements. She was known for her intelligence, her spirited nature, and her generosity. She inspired those around her, remained true to herself, and made a lasting impact on everyone she met.

Before her passing, OrboGraph had the great honor of collaborating with Phyllis and co-author David Walker on their eBook, Check 21 – A Blockbuster Story. This eBook isn’t just a technical or historical recount: it's a deeply personal narrative about the remarkable transformation of payments in the United States — told with humor, humility, and insight

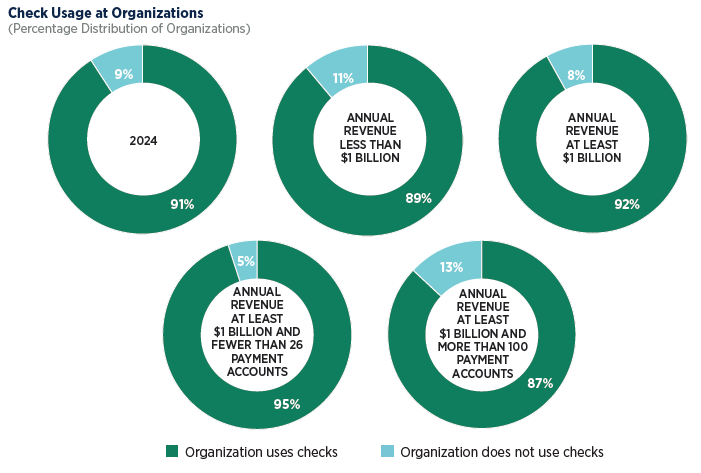

Paper Checks: Payment Substitutes are NOT Universally Reliable According to Atlanta FED Edit

Recently, data from AFP on business check usage noted that use of paper checks jumped from 75% in 2023 to 91% in 2024. Take On Payments, a blog sponsored by the Payments Forum of the Federal Reserve Bank of Atlanta, recently examined how innovations in payments acceptance play out in consumer check use.

Check Payments Most Often Subjected to Fraud According to New 2025 AFP® Payments Fraud and Control Survey

Earlier this week, AFP released the results of their "2025 AFP® Payments Fraud and Control Survey". This report is an important tool for FIs and the banking industry, as it displays the challenges that their customers are facing. The data is from 2024; the survey was conducted in January of this year and received responses from 521 corporate practitioners representing organizations of varying sizes and a broad range of industries.

USPS Report Shows Ineffectiveness of New eLocks for Mail Theft

A major component to Project Safe Delivery -- the USPS Initiative to fight back against mail carrier and mailbox robberies -- is the installation of new electronic locks that can only be opened utilizing an electronic device with a specific code or frequency to open the mailbox. The scanner, known as the Mobile Delivery Device – Technology Refresh (MDD-TR), was meant to deter criminals, as it could be deactivated if reported stolen.

NICE Actimize Report: Check Fraud Accounts for 52% of Overall Fraud-Value Attempts

In a recent press release, NICE Actimize published its annual report on fraud, based on 2024 data. The report, entitled "2025 NICE Actimize Fraud Insights Report, U.S. Retail Payments Edition," focuses on US payments, providing insight into market-specific fraud trends.

Has a Reactive Approach to Check Fraud Backfired?

While various publications and other media point out the sharp increase in check fraud over the past few years, many industry experts pinpoint the start of check fraud over a decade ago. OrboGraph's own Marketing Manager and Check Fraud Detection Specialist, James Bi, has spoken at dozens of payment and industry events over the past 2-3 years, noting in his presentations that all the data points back to introduction of the EMV chip as "starting line" for fraudsters gravitating towards paper checks.

Modernizing Payments Back-Office Crucial for Survival

BAI posted an article that first appeared at greensheet.com, discussing the fact that financial institutions must prioritize modernizing their payments back-office to stay competitive and defend against fraud. We see in report after report how legacy systems riddled with inefficiencies and high costs leave banks vulnerable to operational disruptions and missed opportunities.

What We Learned at the OrboGraph Check Fraud Roundtable

OrboGraph has been bringing together financial institutions and technology providers to collaborate on the future of fraud prevention. Our most recent milestone — the eighth overall and third in-person Check Fraud Roundtable — took place last week in McLean, VA. The event brought together top financial crime technology providers and financial institutions ranging from top 10 banks in the USA to community banks and credit unions, gathered to discuss the most pressing challenges in today's check fraud landscape.

TransUnion Reports US Businesses Lose 9.8% of Revenue to Fraud

Fraud is inflicting record-setting damage on businesses worldwide, according to TransUnion’s H2 2025 Global Fraud Report, which draws on proprietary data from TransUnion’s global intelligence network and surveys of business leaders in six countries and consumers across 18 countries. Their recent survey of 1,200 business leaders reveals that companies lost an astonishing 7.7% of their annual revenue to fraud in the past year.

Why We Can’t Just “Write Off” Paper Checks

"I think we’re probably rushing towards the point where checks just aren’t going to be a thing anymore." This is a quote directly from a new Q&A post on Payments Dive from Tom Warsop, President and CEO of ACI Worldwide -- who has decades worth of experience the finance and payments industry.