OrboNation Newsletter: Check Processing and Fraud – February 2025

Lack of “Check Experts” Hindering FIs with Check Fraud Liabilities

One major issue that many financial institutions are facing when it comes to check fraud is understanding which financial institution is liable. Unfortunately, as checks slowly declined over the past few decades, we've seen a lack of banking professionals' focus on the payment channel -- leading many FIs without an internal "subject matter expert" to resort to an outside consultant when check fraud occurs.

As noted by James Bi, OrboGraph's Marketing Manager and Check Fraud Detection Specialist:

"Over the past few years, I've been privileged to travel across the country and speak at various banking and payment industry events on check fraud. Inevitably, at each event I would be approached by banking professionals of all levels of experience -- from newbies to veterans -- with questions about certain cases of check fraud and which bank was liable. It's apparent to any keen observer that there is a lack of expertise in the industry."

While there is no federal law that governs check transactions, many states utilize the rules and regulations of UCC as guidelines.

New Infographics Provide Advice for Identifying Money Mules and Check Fraud

In an effort to further educate society on the dangers of criminals stealing checks in the mail to commit check fraud, The American Bankers Association Foundation and the U.S. Postal Inspection Service have teamed up to provide three new infographics that help identify money mule scams and check fraud to protect consumers.

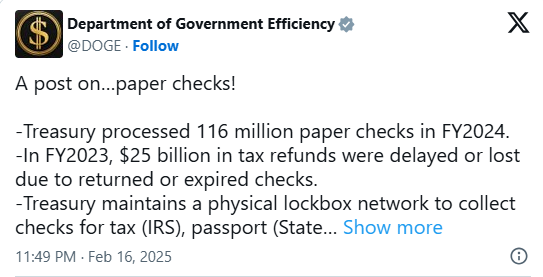

Trump’s DOGE Targeting Paper Checks?

A recent post from Department of Government Efficiency (DOGE), the Elon Musk-led advisory group, proposes another drastic change -- this time, eliminating paper checks.

According to DOGE, there were 116 million paper checks processed by the U.S. Treasury in 2024 -- with many coming from tax refunds.

Additionally, DOGE goes on to note a few key issues, including the fact that $25 billion in tax refunds were delayed or lost due to returned or expired checks in 2023, and the $2.40 cost to process checks through their lockbox network.

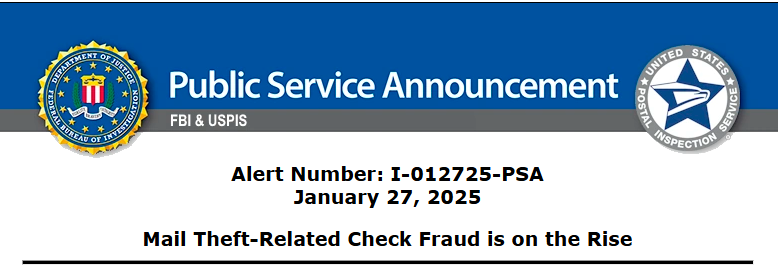

FBI & USPIS PSA: Check Fraud-Related Mail Theft Is on the Rise

On the heels of the ABA and USPS teaming up to create three infographics to fight against check fraud and money mules, the FBI has issued a very detailed warning to all who are sending or receiving checks via mail.

This alert is getting national media attention as well via news reports, bringing the information into living rooms across the country.

Mainstream Media Continues Its Attack on Paper Checks

A recent Fortune article got right to the point in its title: Paper checks are dying. Here’s what you should use instead.

Indeed, the article paints a bleak picture for the future of paper checks. According to the piece, personal checks are rapidly becoming obsolete as digital payment methods like debit cards, credit cards, and money transfer apps take over.

This downward trend is likely to continue, with major retailers such as Target discontinuing acceptance of personal checks as of 2024. Other big names like Aldi, Whole Foods, Old Navy, and Lululemon have followed suit, moving towards what industry experts are calling a “check zero” policy.

While it's true that check usage has declined in recent years, we’re not convinced the world is headed for a "check zero" future any time soon. The article itself notes that there are still situations where paper checks remain necessary, such as for small businesses, large transactions, and individuals without bank accounts.

Check Fraud Detection: Understanding the Different Types of Positive Pay

In a recent article, BAI looks ahead to check fraud defense in 2025, outlining several strategies financial institutions can use to combat the growing threat of check fraud -- which remains a major threat to financial institutions, even as digital payments become more prevalent. According to the Association for Financial Professionals (AFP), 65% of organizations faced check-related fraud attacks in 2023, and overall payments fraud is up 15% year-over-year.

In addition, criminals are also increasingly stealing checks from USPS mailboxes and postal workers, with serious crimes against postal property doubling between 2019 and 2023.

Will Halting the Consumer Financial Protection Bureau Affect Open Banking?

As the new administration continues to make its adjustments, one major change that is affecting the banking industry is the halting of all activities from the Consumer Financial Protection Bureau (CFPB).

According to an email seen by Reuters:

U.S. Treasury Secretary Scott Bessent, who took over on Monday as President Donald Trump's new acting consumer finance watchdog, has halted virtually all pending activities at the U.S. Consumer Financial Protection Bureau, including investigations, rule making, litigation and public communications.

Major Shake Ups at the USPS — What This Means for Stolen Checks

Over the past few weeks, the USPS has made the headlines with Postmaster General Louis DeJoy announced his resignation from the USPS and President Trump preparing an executive order to dissolve the leadership of the U.S. Postal Service and absorb the independent mail agency into his administration.

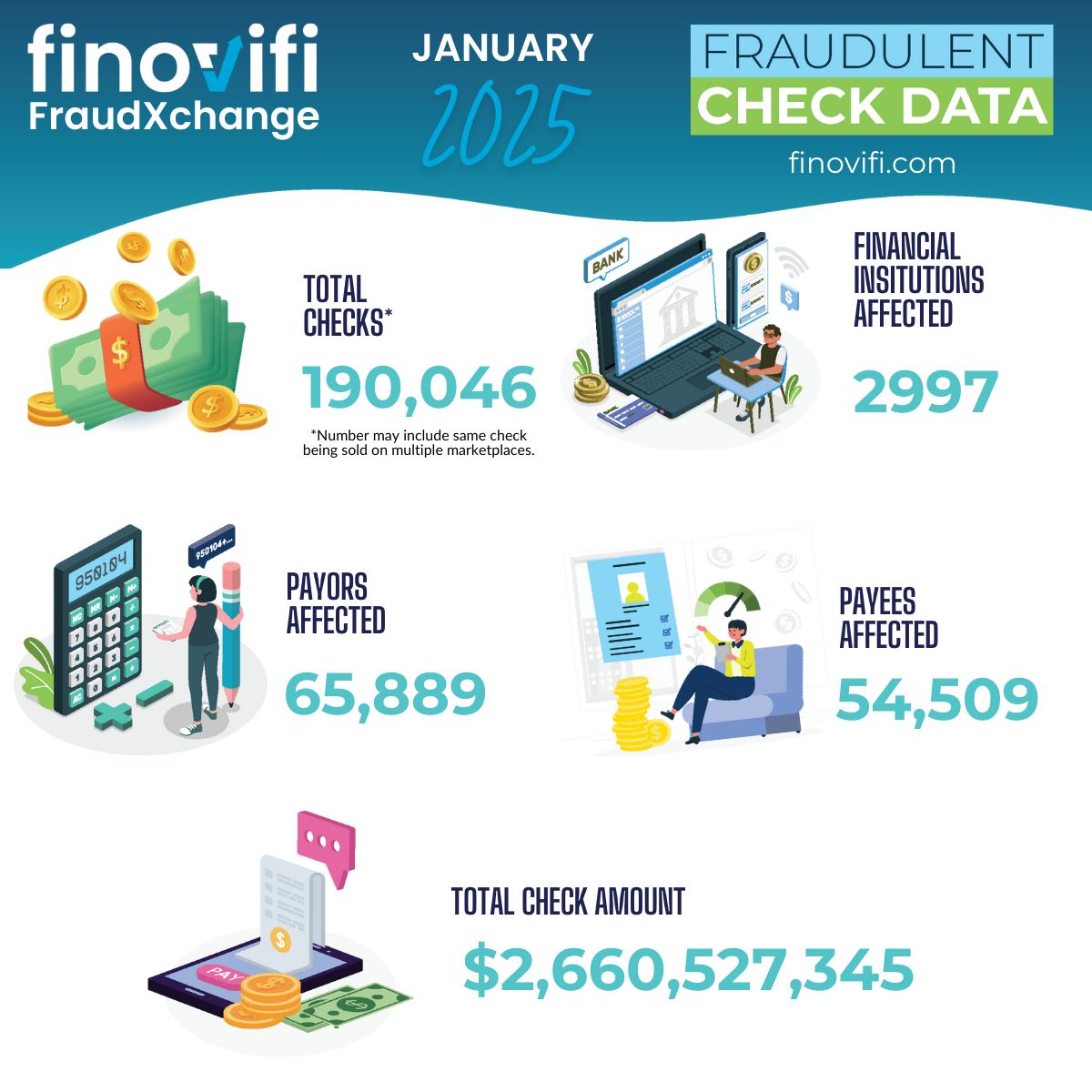

Dark Web: A Thriving Stolen Check Marketplace

Dark Web marketplaces are specialized online forums or “shops” that exist on networks that require anonymizing software to access. Since these marketplaces are not indexed by conventional search engines, buyers and sellers are shielded from immediate detection.

Transactions on these platforms are typically conducted using cryptocurrencies such as Bitcoin or Monero. The use of digital currencies and layered encryption protocols enhances the anonymity of users, making it more challenging for law enforcement agencies to trace financial flows back to individuals.

Reimagine Banking Via Innovative Tech & Ecosystems for 2025 and Beyond

![shutterstock_2527549225 [Converted]-01 shutterstock_2527549225 [Converted]-01](https://orbograph.com/wp-content/uploads/2025/02/shutterstock_2527549225-Converted-01-scaled.jpg)

It’s no secret to anyone involved in the banking industry that innovations are appearing very quickly – keeping up is a real challenge! However, given society's growing on-demand expectations and need for speed, "keeping up" is not only a good idea, but a matter of survival.

Looking ahead to 2025, financial institutions will need to prioritize agility and innovation in order to keep pace with rapidly evolving customer demands and tech advancements.

Alloy Research: 60% of Respondents Report Fraud Growth in 2024

Alloy recently published its 2025 State of Fraud Benchmark Report, revealing 60% of FIs and fintechs reported fraud growth in 2024. For check fraud, 22% of respondents in the US are concerned with check fraud, with 11% reporting check fraud as the most frequent fraud event in the past 12 months.