OrboNation Newsletter: Check Processing and Fraud – June 2024

OrboGraph Announces Open Consortium Strategy at Innovation Conference, Initiating with Advanced Fraud Solutions TrueChecks®

Robust consortium data set currently includes 2,500 institutions and 25,000 routing numbers

Burlington, MA, June 11, 2024 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, announced the successful integration of Advanced Fraud Solutions TrueChecks® within its OrboAnywhere Sherlock 5.3 release as part of an open consortium strategy to reduce deposit and on-us fraud across the industry. The AFS check consortium mega-metadata currently consists of fraud information from over 2,500 financial institutions, 25,000 routing numbers, and nearly 100 million accounts represented in total.

A consortium is an agreement, combination, or group (as of companies) formed to undertake an enterprise beyond the resources of any one member. Consortiums take various flavors, as many are focused on collaboration and open information sharing while others are technical products or services only accessible to a limited group of members. Consortiums serving the check fraud industry that are directory-based include: ABA, The Clearing House (ECCHO), and NACHA, all offering contact information to expedite return handling.

OrboGraph’s flagship platform, OrboAnywhere, provides consortium enablement for service bureaus, bankers' banks, associations, and business partners, as well as correspondent banks and other aggregators. By doing so, this strategy enables data sharing and collaboration within consortium nodes.

ThreatAdvice Interviews Frank Abagnale for His Thoughts on Modern Fraud

Who better to give fraud-avoidance advice than a famous (infamous) ex-fraudster?

Steve Hines of ThreatAdvice sat down with Frank Abagnale, a former con-artist turned 40+ year FBI consultant, as well as spokesperson for ThreatAdvice cybersecurity solutions. Mr. Abagnale's misadventures were the basis for the film Catch Me If You Can.

Mr. Abagnale came from a broken family -- his parents divorced when he was a child -- leaving him to largely fend for himself at an early age. As he grew up, he learned to bend the rules.

I went to New York City, which was just a 30-minute train ride, but I soon realized I had to find a way to support myself. I did have a little money in a checking account that my dad had set up for me from working so I started writing checks and I found it very easy to go in and ask somebody to cash a check for me and they did -- you know, there was fifteen, twenty dollars -- but it then started to get more difficult they'd start to ask me, "you don't have a bank account here we can't cash your check for you."

OrboGraph Announces Successful Check Fraud Roundtable and Innovation Conference

Highlights Include Check Fraud Trends, SARs Analysis, OrboAnywhere Sherlock 5.3, and Deposit Fraud

Burlington, MA, May 23, 2024 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, reports successful Check Fraud Roundtable and Innovation Conferences on May 14-16, 2024, at the Hilton Tampa Downtown. These two distinct meetings brought together check fraud professionals from financial institutions and representatives from leading fraud solution providers and service bureaus. The conferences addressed ongoing on-us and deposit fraud challenges and presented solutions including the latest features of OrboAnywhere Sherlock 5.3.

“The OrboGraph Check Fraud Roundtable and Innovation Conferences provided a unique opportunity to bring together financial institutions, fraud technology vendors, and service bureaus to discuss ever-changing on-us and deposit fraud challenges, while also receiving invaluable feedback from our clients/partners to improve upon our technologies,” said Barry Cohen, CEO at OrboGraph.

Why Prediction of Precipitation is a Lot Like Check Fraud Detection

Many parts of the U.S. have been on the blunt end of some "interesting" weather of late. Whether it's flooding rains, high winds, or excessive heat, it's been important to be "weather aware."

Effective weather prediction -- the kind that helps you postpone that camping trip when storms are ahead, or make sure the snowblower is operable when a blizzard is forecast -- is the result of analyzing patterns, utilizing historical data, and applying advanced technology to anticipate future occurrences. When these tools are used effectively, fewer short- and long-term "weather surprises" confront us.

As it turns out, check fraud detection has a lot in common with weather prediction. In fact, both meteorologists and check fraud prevention systems rely on four primary tools:

Detecting check fraud is similar, as AI and ML technologies perform numerous analyzations to provide reviewers an overall risk score for a check.

Is America Ready for Open Banking?

After a late start, it looks like the United States is finally ready to adopt Open Banking.

Open Banking, a system that allows consumers to share their financial data with third-party providers, enables access to a wider range of financial services. It's popular all over the world.

As reported at MicroSoft Start, banks in the U.S. are working to prepare for it, but it's slow going.

Three-quarters of banks say they aren’t ready for open banking, according to recent data published by Sopra. The changes within the banking sector are spurring banks to develop their innovations and partner with data aggregators and potential competitors in the fintech sector to improve their offerings.

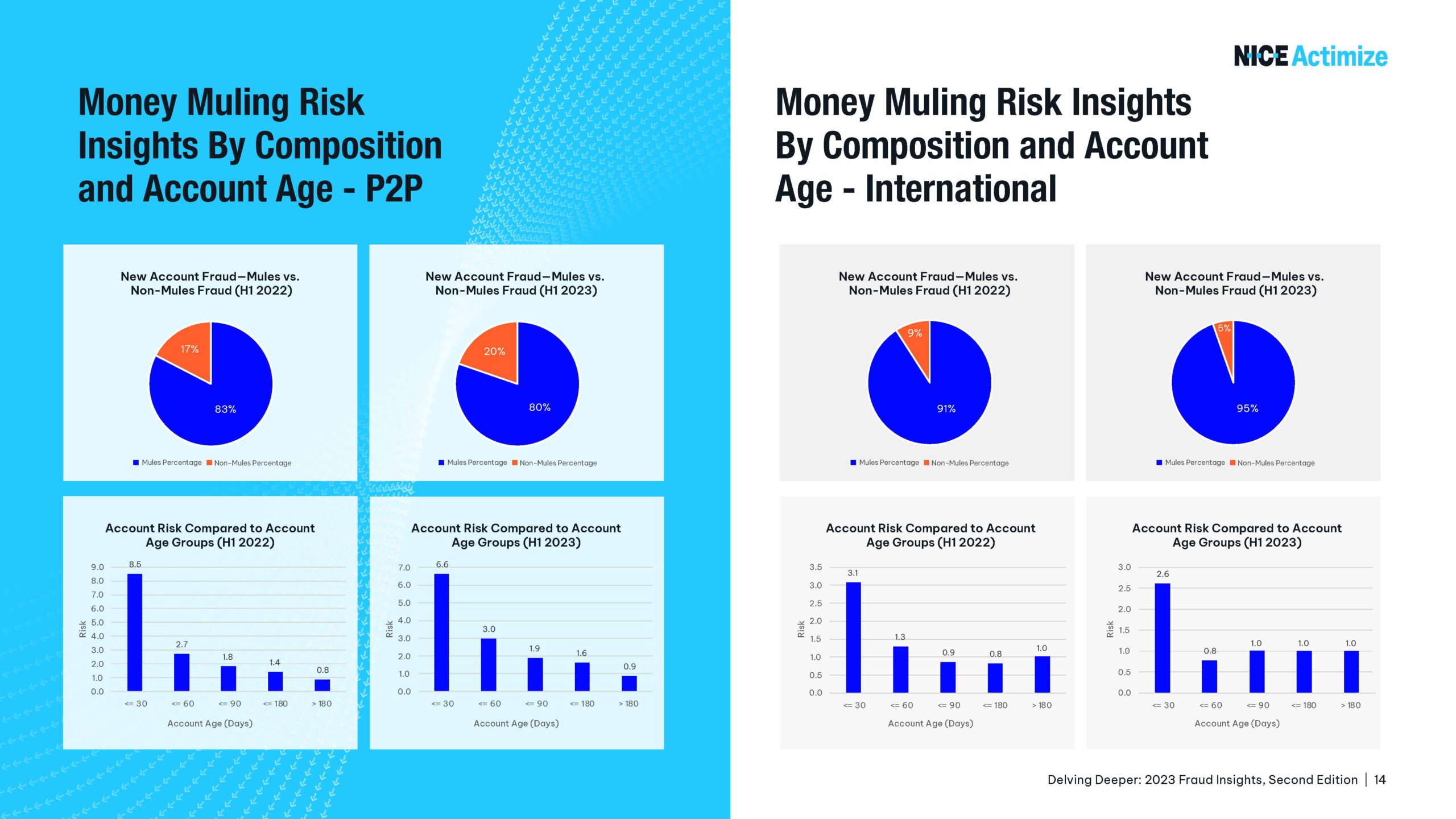

NICE Actimize Highlights Growing Threat of Money Mules in Account Fraud

NICE Actimize has gathered and published some in-depth research that clearly shows a precipitous rise in banking fraud, which is understandably a growing concern for Financial Institutions (FIs) and consumers alike. Fraudsters are becoming increasingly sophisticated, shifting their tactics from traditional account takeover and unauthorized fraud to more complex authorized payments fraud, or scams.

Here are just some of the threats -- constantly growing -- facing FIs today, including an unexpected twist when it comes to checks:

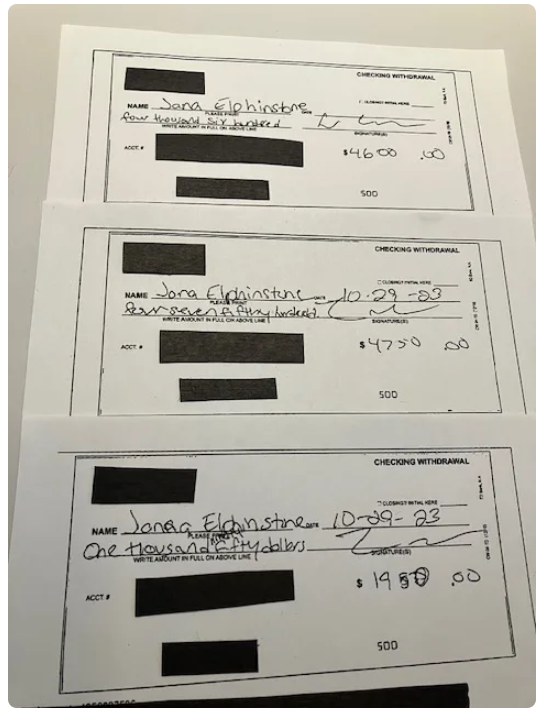

Use Case: How A Stolen Check Led to Identity Theft and Fraud

Jenna Herron, a columnist at Yahoo Finance, recently found herself on the wrong side of a case of identity theft.

Not long ago, someone posed as me at three bank branches and drained thousands of dollars from my checking account.

Chances are higher now that something similar will happen to you.

This kind of old-fashioned in-person identity theft is on the rise after fraudsters grew more sophisticated during the pandemic, improving their illicit supply chain that makes it easier to pull off these crimes.

In-person identity theft is on the rise, with criminals posing as victims to steal money from bank accounts.

Paying with Checks: Reviewing Advantages and Disadvantages

Alternative Payments offers a comprehensive look at the advantages and disadvantages to paying with checks, along with a bit of history and key terminology.

The use of checks dates back to ancient times, with early forms appearing in Persia around the 1st century. Checks were introduced to the United States in the late 17th century by British banker Lawrence Childs. Before this, transactions were carried out through handwritten IOUs.

The article notes that following advantages in using checks:

Fiserv: Steps to Better Check Fraud Protection

Detecting check fraud is -- to say the least -- complex. There are many variables that need to be considered, along with the cumbersome check deposit process. What is clear is that the technology currently exists to achieve 95% detection rates -- with newer technologies being released in H2 of 2024 to achieve 98%.

An article by David Reim, Product Director, Deposit Solutions at Fiserv, discusses four steps financial institutions can take right now to better protect against check fraud.

ATMs — A Goldmine for Stealing Checks?

As reported by the American Banking Institute, ATMs -- deposit and withdrawal devices that are more popular than ever -- are becoming goldmines for thieves.

ATMs have become lucrative targets for criminals, with the FBI reporting a significant increase in the number of bank ATM robberies beginning in 2020. As one banker noted during a panel discussion on ATM crime at ABA’s Annual Convention last year, it seems many would-be bank robbers have concluded there is less risk — and potentially more profit — in hitting an ATM than a teller window.

The Three Main Ways Banks Leverage AI

BizTech Magazine examines AI and the three primary ways banks are deploying this new tool. Consumers, too, are met regularly with AI advantages in daily life.

Consumers interact with artificial intelligence daily without even realizing it. Spam filters use machine learning algorithms, a subset of AI, to determine which emails to divert. And many businesses use AI to monitor for fraudulent transactions and automate processes. It’s a powerful tool for protecting consumers and improving their experiences, but AI is also becoming essential to protecting banks themselves.

This also means that consumers are expecting AI services and protection in more and more areas of their life.

Check Fraud Highlighted in House of Fraud Podcast Pilot Episode

A few weeks ago, we talked about the ease with which fraudsters open LLCs in order add an additional layer of "realism" to their schemes. While setting up a fake business is not new, fraudsters are shifting focus from consumers to businesses.

This is a subject addressed by the House of Fraud, which describes itself as "an invite-only community for fraud experts" wherein you can "build meaningful relationships with experts who understand your specific challenges. No more struggling alone as you navigate your career."

In their inaugural YouTube video, hosts Jordan and Brian take some time to explore how LLCs can be used by fraudsters -- but not before assuring us that even persons deeply involved in the business of fraud identification can be taken in

Check Fraud Accounts for Nearly 20% of SARs Filings in 2023

Thomson Rueters reports that the number of suspicious activity reports (SARs) — the documents that financial institutions must file with the federal government’s Financial Crimes Enforcement Network (FinCEN) upon detection of behavior by employees or customers that may be associated with money laundering, fraud, or other types of criminal activity — is steadily rising.

This is significant because SARS is regarded as one of the most accurate measures of the prevalence of financial crime in any given year in the United States. Not surprisingly, the number of SARs have been steadily rising.

eBook: Check 21 – A Blockbuster Story

The Check Clearing for the 21st Century Act or "Check 21" is perhaps the most important event for checks in history. It was signed into law on October 28, 2003, and became effective on October 28, 2004. Check 21 is a federal law that is designed to enable banks to handle more checks electronically, which should made check processing faster and more efficient. Today, banks often must physically move original paper checks from the bank where the checks are deposited to the bank that pays them. This transportation can be inefficient and costly.

And, while many check and banking professionals know of Check 21, many are able to recount some of the memories behind it.

Check Fraud Detection at the Dawn of the ’80s vs. Today

An interesting artifact from way back in the '80s depicts a fraudster's-eye view of the techniques in play a little over 40(!) years ago. The film follows a smooth character who has decided, for some reason, to share with the viewing audience his bag of state-of-the-art (circa 1979) tricks for check fraud.

And, yes, this film is old enough to have been projected on a screen in a darkened room.

Now, some crooks use guns. Me, I stick them up with paper -- bogus checks and false ID to back it up. Actually, I make a pretty good living convincing all those marks -- uh, clerks, that all this paper is good.