OrboNation Newsletter: Check Processing and Fraud – March 2025

Check Fraud SARs Rise in 2024 to Near 2022 Record-Setting High

According to a recent report from the Thomson Reuters Institute, the total number of Suspicious Activity Reports (SARs) filed by U.S. financial institutions in 2024 declined slightly from the record-setting numbers seen in 2023 but nevertheless remained near all-time highs.

The report estimates that the final 2024 SARs total will land somewhere between 4.5 and 4.6 million, roughly on par with the previous year's record. Official numbers are expected to be published in April/May of 2025.

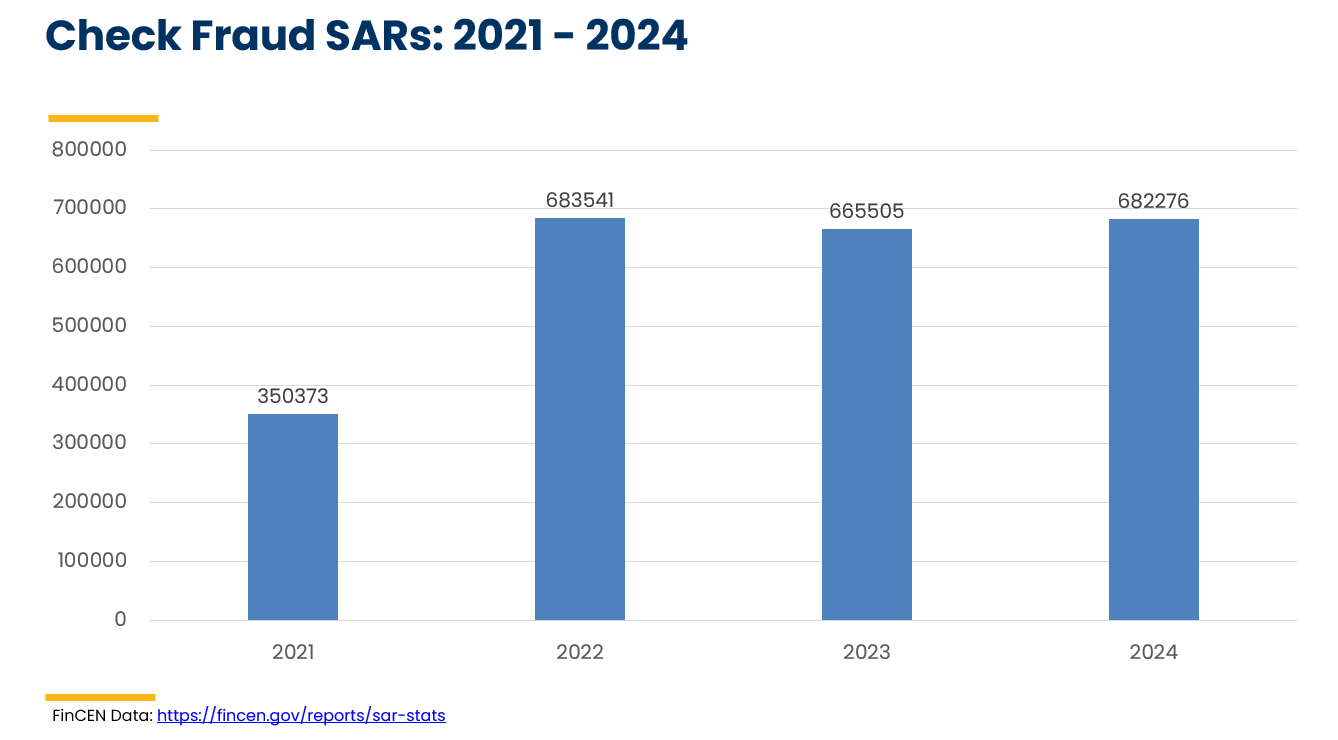

While the overall total number of SARs appears to have slightly declined in 2024, this is NOT the case for check fraud SARs. As many may remember, check fraud SARs exploded in 2022 to hit a record-setting high of 683,000, nearly doubling from 2021 levels (350,000). This led to a alert distributed by FinCEN warning FIs to be vigilant for check fraud. In 2023, we saw a slight decline to 665,000 check fraud SARs filed.

Fast forward to 2024, it appears that the number of check fraud SARs are back to 2022 levels, with Thomas Reuters reporting 682,276 being filed.

Data-Sharing Consortiums: The Solution for Bank Deposit Fraud?

The evolution of banking fraud has drastically changed over the past decade. Most notably, fraudsters are no longer performing their schemes solo. The internet has enabled fraudsters to not only accomplish more fraud, but also easily and effectively share tactics and data.

For financial institutions, taking a similar tactic and turning to data-sharing consortiums can combat these threats -- particularly deposit fraud, where FIs have limited to no information about the paying account.

Brand Loyalty: Americans Hold Same Checking Account for 19+ Years on Average

Brand loyalty is a huge factor for banks. How much, you ask? Well, according to a recent Bankrate survey, the average American has held their checking account for 19 years and their savings account for 17 years.

When asked the primary reason for this longevity, 43% of checking account holders gave responses that valued the convenience of staying put -- it's the account they've always had, the locations are easy to reach, or it would just be too much hassle to switch.

Jack Henry & Associates Reinforces “Multi-Layered Technology” Approach to Check Fraud Detection

In a recent Jack Henry Fintalk, Bette-Lou Rush notes that "the name of the fraud prevention games is layers."

To fight back against fraud effectively, you need to adopt a robust, multi-layered defense strategy ‒ one that provides layers of protection for your financial institution, staff, and accountholders, and also includes layers of transaction monitoring and solutions that provide you with meaningful and impactful alerts.

77% of Businesses Using Positive Pay Report Fewer Check Fraud Attempts or Losses

Within the arsenal for financial institutions to fight check fraud, Positive Pay undoubtedly plays a key role. While not a new technology, it's an effective tool that compares data extracted from the fields of the check with the "issuer file" provided by the corporate client. Any discrepancies are flagged, and the corporate client is able to confirm any issues with the payment -- enabling the FI to reject the check payment from the bank of first deposit.

This technology is a popular offering, and, as noted in the recent "Positive Pay Market Survey Findings and Recommendations" report by NEACH Payments Group (NPG), 80% of FIs offer Positive Pay.

However, 20% of FIs do not offer this service, citing cost/resource constraints and lack of client demand as primary reasons.

Diving deeper into the report, we can see why positive pay is such an effective tool.

$326B at Risk: Why Financial Institutions Must Embrace AI-Powered Fraud Detection

For financial institutions, the battle between utilizing the current legacy fraud systems vs. investing in modern fraud systems -- typically powered by AI -- continues to put pressure on both fraud departments and leadership. As noted in a recent post from American Banker, citing Juniper Research, fraud is forecasted to exceed $326 billion for the period between 2023 and 2028, showing that fraud will not be slowing down anytime soon.

AI Streamlining Check Payments — Added Value for Data Analytics?

We've made this important point in many earlier posts and news items we've shared: In today's digital landscape, banks must leverage advanced technologies to meet the ever-rising expectations of their customers -- the market has made it clear that public and business accounts tend to take their business to institutions that offer the most useful "bells and whistles."

A recent report from BAI explores in depth how data analytics and artificial intelligence (AI) are revolutionizing the customer experience in banking.

USPS Increases Offering $150K for Arrest in Mail Carrier Robberies

Over the past few months, we've seen a concerted effort by the USPS and the US Government to make drastic changes addressing major challenges within the agency.

In a news report from WKRC, the Postal Service now claims progress in countering mail theft and mail carriers -- citing, for instance, increased rewards.

43% of Credit Unions Cite Fraud Mitigation as Top Investment Area in 2025

As fraud incidents continue to surge, credit unions (CUs) are racing to implement cutting-edge technologies and forge strategic partnerships to safeguard their finances and maintain member trust. According to a new PYMNTS Credit Union Tracker Series Report, CUs are prioritizing innovative anti-fraud solutions, with 43% citing fraud mitigation as a top investment area for 2025.

President Trump Announces “U.S. Crypto Reserve” — First Step in Legitimizing Cryptocurrency as a Payment?

Earlier this week, President Trump made an announcement via his Truth Social media platform that has sent ripples through the payments industry. It's his intention to establish the U.S. Government's first "Crypto Strategic Reserve" -- a promise made by the President during his election campaign.

According to an article from NPR, this move would enable the US to buy and sell cryptocurrency -- a possible "game changer," not only for the cryptocurrency industry, but payments as well.

Once a “Luxury,” AI Becomes a Necessity Against Modern Fraud Tactics

There's no question about it: modern fraud detection systems -- including check fraud detection -- require the utilization of artificial intelligence to keep up with fraudsters.

Why, you may ask? Because AI is used in half of banks scams, according to Fortune.com.