OrboNation Newsletter: Check Processing and Fraud – May 2024

Check Fraud Accounts for Nearly 20% of SARs Filings in 2023

Thomson Rueters reports that the number of suspicious activity reports (SARs) — the documents that financial institutions must file with the federal government’s Financial Crimes Enforcement Network (FinCEN) upon detection of behavior by employees or customers that may be associated with money laundering, fraud, or other types of criminal activity — is steadily rising.

This is significant because SARS is regarded as one of the most accurate measures of the prevalence of financial crime in any given year in the United States. Not surprisingly, the number of SARs have been steadily rising.

Jacob Denman, Risk and Fraud Product Manager at Thomson Reuters, goes on to note that even areas of fraud that declined slightly in 2023 -- check fraud, for instance -- will likely maintain a steady pace into 2024 as well. “Honestly, it’s hard to see how check fraud could go any higher,” Denman said, but he concedes that it might.

While the number of check-fraud SARs fell just a bit in 2023 to 665,505, even that number is shocking, Denman says.

“Check fraud accounts for almost 20% of all SARs filed,” Denman says. “And if you consider that more than half of all SARs are filed by the top five or six banks in the country, and those banks are getting hit close to 100,000 times a year — that’s nuts.”

OrboGraph Announces Successful Check Fraud Roundtable

and Innovation Conference

Highlights Include Check Fraud Trends, SARs Analysis, OrboAnywhere Sherlock 5.3, and Deposit Fraud

Burlington, MA, May 23, 2024 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, reports successful Check Fraud Roundtable and Innovation Conferences on May 14-16, 2024, at the Hilton Tampa Downtown. These two distinct meetings brought together check fraud professionals from financial institutions and representatives from leading fraud solution providers and service bureaus. The conferences addressed ongoing on-us and deposit fraud challenges and presented solutions including the latest features of OrboAnywhere Sherlock 5.3.

“The OrboGraph Check Fraud Roundtable and Innovation Conferences provided a unique opportunity to bring together financial institutions, fraud technology vendors, and service bureaus to discuss ever-changing on-us and deposit fraud challenges, while also receiving invaluable feedback from our clients/partners to improve upon our technologies,” said Barry Cohen, CEO at OrboGraph.

Embracing Data Consortiums to Prevent Payments Fraud

PYMNTS.COM reports on Tech Against Scams, a newly announced anti-fraud consortium that includes crypto companies Coinbase, Kraken, Ripple, and Gemini; dating app business Match Group; social media parent company Meta; and the Global Anti-Scam Organization. The consortium aims to respond to and prevent online fraud and financial scams by sharing data with competitors.

Data-sharing consortiums are not a new concept for check fraud. Most are familiar with Early Warning Systems and Advanced Fraud Solutions and their database of shared-data. These are excellent tools in the fight against deposit fraud, as FIs can access the data to verify different facets such as insufficient funds, closed accounts, or even duplicate checks.

Collapse of Synapse Highlights Need for Neobanks and Traditional Banks to Choose Stable Partners

The American Prospect features a rather alarming story illustrating the higher risk faced by neobanks as compared to conventional financial institutions, and the dangers for FIs partnering with unstable companies.

One example: because so much fintech architecture remains unregulated, federal officials have been unable to step in to extricate customers from the failure of middleman Synapse, which has led to hundreds of thousands of customer accounts being frozen at various fintech companies like Yotta, Juno, and Copper.

Reliance on third party technologies that can essential remove access to customer funds is a stark reminder that financial institutions need to be wary of the companies with whom they partner.

Even long-established organizations are seeing turmoil these days, reflected in major changes with their leadership and shaken investor confidence...

Be Aware: Fraudsters Are Opening LLCs to Commit Check Fraud

We all are aware of check washing/alterations and how effective this method is for stealing funds. However, the success rate is not guaranteed, particularly when it comes to business checks. More and more businesses are adopting payee positive pay solutions to fight back against fraudsters, making it more difficult for them to be successful. Fraudsters changing the payee to either their name or a false identity, or adding a name at the end of the payee, are being flagged at higher rates as the system will compare the payee name with the issuer file.

However, fraudsters are highly adaptive and have already found a way around this technology.

Dr. David Maimon notes in a LinkedIn Post that fraudsters are now opening up LLCs to commit fraud.

Check Fraud Detection at the Dawn of the ’80s vs. Today

An interesting artifact from way back in the '80s depicts a fraudster's-eye view of the techniques in play a little over 40(!) years ago. The film follows a smooth character who has decided, for some reason, to share with the viewing audience his bag of state-of-the-art (circa 1979) tricks for check fraud.

Our narrator and guide is also known as a "passer." Home computers and printers are not yet available, so his methodology is "of the times" -- he has to steal checks from a "legit office" (while wearing a classic "I'm a robber" newsboy hat on his head). We know his friend is also a "bad guy" because she's in her bathrobe, smoking in bed while watching TV during daytime (before answering the phone so she can pretend to "verify" a bogus check, she pushes "play" on a tape recording of manual typewriters).

eBook: Check 21 – A Blockbuster Story

The Check Clearing for the 21st Century Act or aka Check 21 is perhaps the most important event for checks in history. It was signed into law on October 28, 2003, and became effective on October 28, 2004. Check 21 is a federal law that is designed to enable banks to handle more checks electronically, which should made check processing faster and more efficient. Today, banks often must physically move original paper checks from the bank where the checks are deposited to the bank that pays them. This transportation can be inefficient and costly.

And, while many check and banking professionals know of Check 21, many are able to recount some of the memories behind it.

Check 21 – A Blockbuster Story is a book about the people and events that initiated, passed, and implemented the historic Check 21 Act. Phyllis Meyerson and David Walker tell a serious story told with a bit of humor, self-deprecation, some education on banking, payments, and congressional lobbying. The Law facilitated the transformation of 40 billion items valued at $40 trillion. Moving from an archaic, paper-based system to an electronic check image exchange system in a little over 6 years, the fastest in payments history!

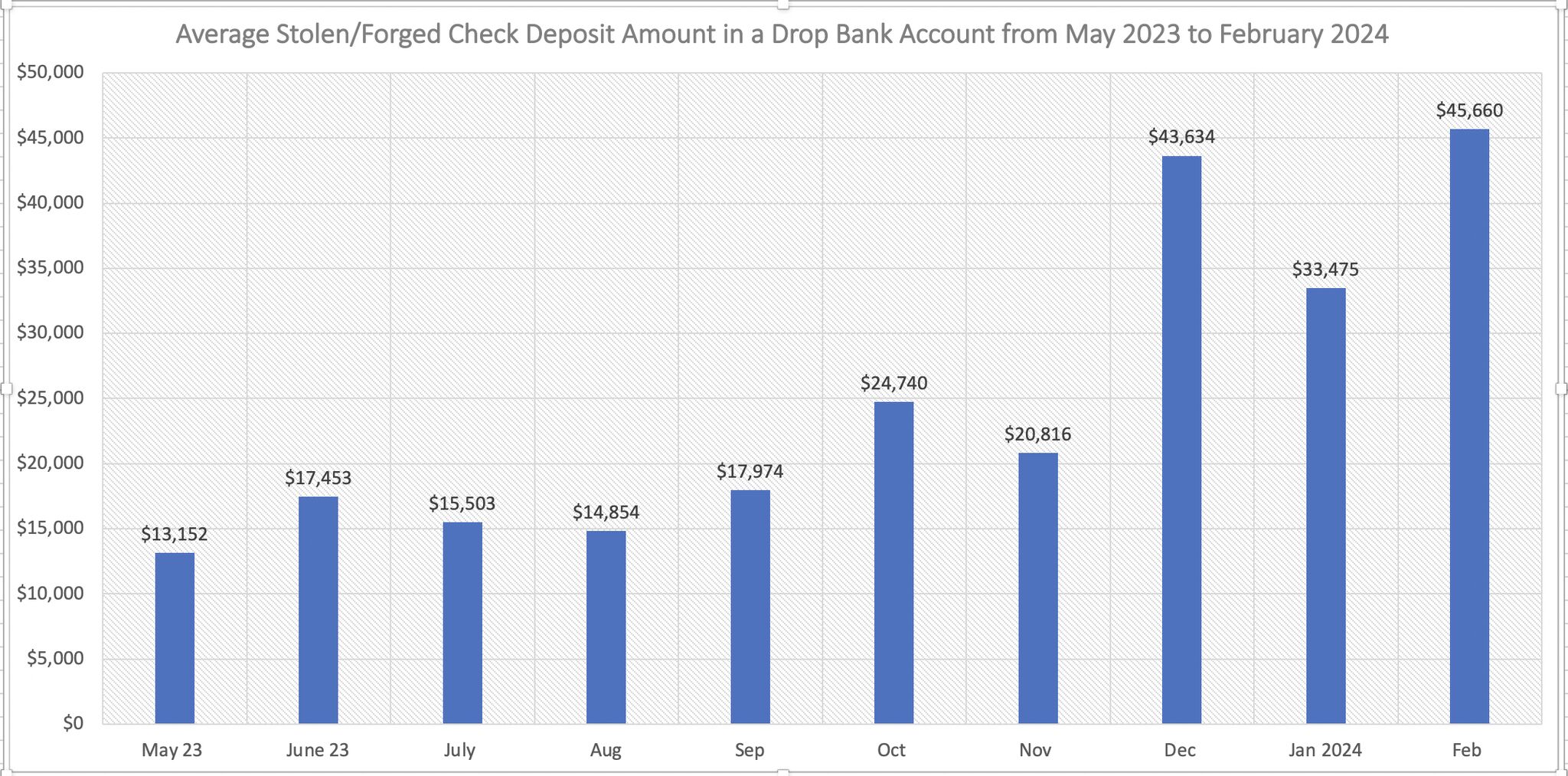

Establishing “Drop Accounts”: More Than Opening an Account

Many in the banking industry as are aware of one tool that is crucial to a fraudster: drop accounts. For those who are not as familiar, this is an account that fraudsters will utilize to deposit -- or drop -- fraudulent checks to steal funds from businesses and consumers. While there are many variations of drop accounts, typically there are two distinct ways that drop accounts are established.

One major key for drop accounts is that simply opening an account isn't enough. The account needs to be open and legitimate transactions need to occur for a period of time -- anywhere between one month to a year.

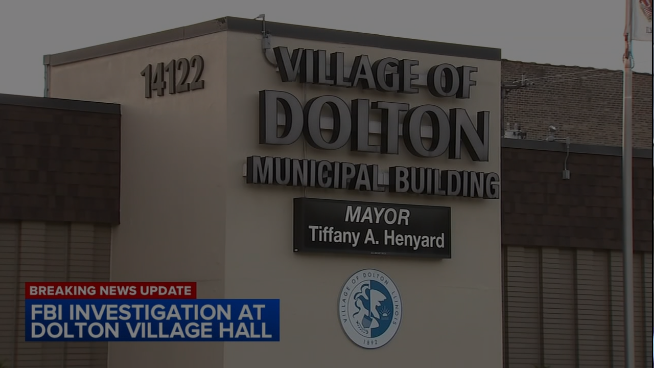

FBI Investigates Corruption Allegations — Including Forged Checks — Against Illinois Mayor

Unfortunately, politics and corruption seem to go hand-in-hand. The US is ranked number 24 out of 180 nations in terms of political corruption worldwide according to according to Transparency International -- we have certainly seen that there are some people in the world that take advantage of their position.

This leads us to the community of Dolton, Illinoi, where they are currently dealing with possible corruption in the Mayor's office, fueled by check fraud.

AI Set to Transform Open Banking Landscape? Not Without Fintechs!

The amount of banks are not operationally ready to participate in and implement open banking is as high at 75%, according to the latest Digital Banking Experience (DBX) report released by Sopra Steria and Sopra Banking Software, and as reported by The Fintech Times.

And, while many banks may not yet be ready for open banking, a hearty 74% recognize the potential of collaboration.

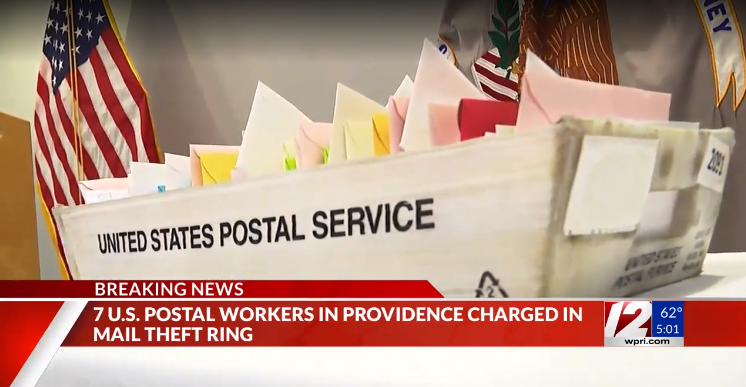

Bad Actors: Not Always Outsiders

We have in past posts related some pretty alarming tales of postal theft and efforts to stop it. Now there's news of an elaborate and ongoing "inside job" series of postal thefts in Rhode Island recently uncovered.

A supervisor and six workers collaborated to remove mail from a United States Postal Service distribution center in Providence, sorting, separating and concealing mail they believed to contain cash, checks or gift cards, officials said.

The gang was remarkably successful -- one worker had over $1.3 million in stolen checks. While many postal thefts involve procuring clever disguises, the methodology in this caper was far from complex or clever.

Over Half of All FIs Plan ML and AI Deployment to Combat Fraud

According to PYMNTS Intelligence’s “Leveraging AI and ML to Thwart Scammers,” a report created in collaboration with Hawk, a growing number of financial institutions (FIs) are deploying machine learning (ML) and artificial intelligence (AI) tools to fight back against fraud.

And with good reason. Bank fraud is on the rise -- check fraud in particular -- and perpetrators are taking advantage of highly effective and easily accessible technology.

PYMNTS Intelligence’s report is based on surveys with 200 FIs with more than $1 billion in assets under management. The FIs that now use ML or AI to address fraud are getting results in the form of steep declines in common forms of fraud.

Bank Earning Reports Spotlight Progress in Digital Payment Adoption

PYMNTS.com reports that the observed shift toward digital channels in financial services shows no signs of slowing down as reflected in latest earnings results from incumbent banks and financial services providers.

During the first quarter, Bank of America logged a staggering 3.4 billion digital logins, with digital sales accounting for half of its total sales, as outlined in its earnings supplementals on Tuesday (April 16).

Additionally, the bank reported a significant uptick in digital households, reaching 748,000 in the quarter, representing 86% of its installed base. This marked an increase from 717,000 households and 84% penetration in the previous year.

New Cooperative Effort to Fight Mail Fraud

Less than five years ago, check fraud was a niche topic, with very few outside the banking industry really understanding the in's and out's of check fraud. Well, fast-forward to the present and media across the country are covering the topic -- from news stations to podcasts.

The PaymentsJournal Podcast, hosted by Rima Katz, recently discussed the role of positive pay in financial institutions’ organizational security. She was joined by Bruce Dragoo, Manager Solutions Consulting at Q2, John Byl, SVP Product Development and Mercantile Bank, and Albert Bodine, Director of Commercial and Enterprise Payments at Javelin Strategy & Research.