OrboNation Newsletter: Check Processing and Fraud – May 2025

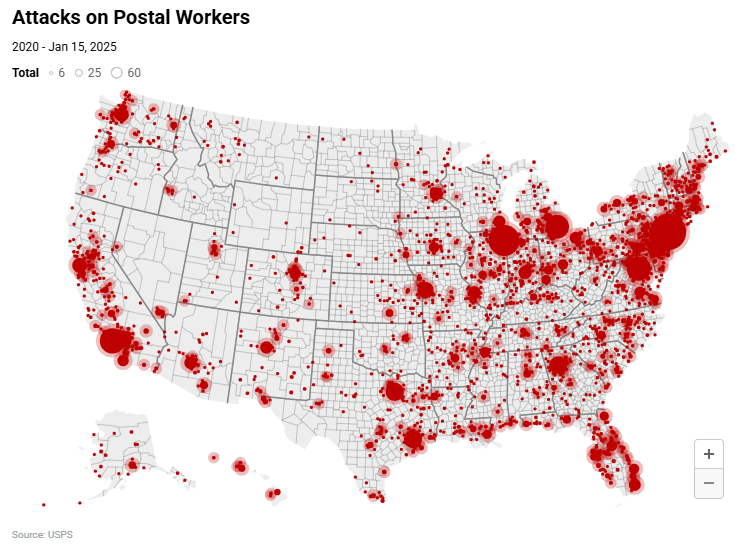

Examining the “Hotspots” for Mail Theft/Stolen Checks

Mail theft and mail carrier robberies are a major factor contributing to the rise in check fraud over the past half decade. Criminals know that within those familiar USPS blue mailboxes are hundreds of documents that can fetch a small fortune, including credit/debit cards, personal identification information -- and, of course, paper checks. To get easy access, criminals are targeting mail carriers to steal the arrow keys to unlock the mailboxes.

In a new article from 7 On Your Side Investigates, the news station notes:

282 postal keys were reported lost or stolen in New York alone last year. That's almost double the amount of 155 from the year before. We're on track to surpass that in 2025.

New Jersey had 191 keys in 2023 and 2024 combined. The small state of Connecticut, 143, for the same time period.

Why We Can’t Just “Write Off” Paper Checks

"I think we’re probably rushing towards the point where checks just aren’t going to be a thing anymore."

This is a quote directly from a new Q&A post on Payments Dive from Tom Warsop, President and CEO of ACI Worldwide -- who has decades worth of experience the finance and payments industry.

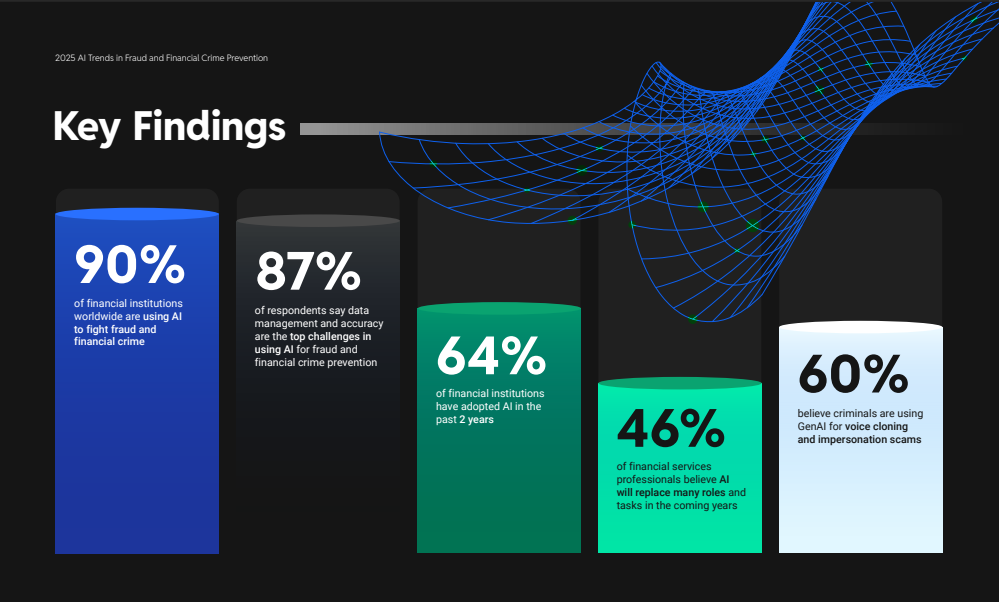

Feedzai Report: 90% of FIs use AI to Fight Fraud and Financial Crime

We've all heard the buzz around AI and its potential for fighting fraud -- including check fraud. Well, FIs have put it into action.

According to the Feedzai's 2025 AI Trends in Fraud and Financial Crime Prevention, "90% of financial institutions worldwide are using AI to fight fraud and financial crime."

So, how are FIs deploying AI to fight fraud? Let's dive deeper into the report.

7 Key Factors for Successful Banking Platform Modernization

We've said it before, and we'll say it again: Platform modernization is a critical priority for banks, driven by competitive pressures and the need for greater efficiency. However, these transformative programs are fraught with challenges that even the most cautious leadership teams often underestimate.

“Most companies don’t realize the full cost of their legacy payments back-office systems,” says Jared Drieling, Chief Innovation Officer at TSG. “It’s not just the ongoing maintenance and labor costs—it’s the missed opportunities to grow and adapt.”

Product Innovation Briefing: OrboGraph Releases OrboAnywhere Turbo V6.0

New AI infrastructure optimized for speed and latency with improved check fraud detection

Burlington, MA, May 8, 2025 – OrboGraph, a leading provider of check fraud detection and image recognition solutions, is excited to announce the general availability of their new OrboAnywhere Turbo 6.0 release. The release is focused on speed, efficiency, and modernization of AI infrastructure.

The release has several important infrastructure changes, including:

- Modernization of AI Infrastructure to ONNX (Open Neural Network Exchange).

- Certification of NVIDIA L-Series GPUs. The L-Series is a new GPU model which provides cost-effective processing power.

- CPU certification: Beginning with V6.0, OrboAnywhere modules can run on CPU processors only.

Former Scammer Details How He Learned to Perform Check Fraud from Behind Bars

A factor that we commonly bring up when discussing fraudsters is their willingness to teach each other the tips and tricks needed to commit check fraud. And, while many times this occurs digitally through social media and other messaging platforms, there are still those who learn in-person...and, in today's case, in a prison cell.

Rules Engine: Balancing Check Fraud Detection and Customer Experience

In a recent ATM Marketplace podcast, Bradley Cooper spoke with Scott Fieber, Chief Strategy Officer at Cook Solutions Group, and Austin Smith, Director of Product Development at Cook Solutions Group, about the delicate balance banks must strike to prevent check fraud without compromising the customer experience.

Despite the rise of digital payments, checks remain a valid form of payment, especially for businesses and individuals. With mobile deposit and ATM deposits, it's more convenient than ever to deposit a check. However, this brings with it a risk for fraud.

Did 90’s Disney Movie “Blank Check” Glamorize Check Fraud?

When thinking of a movie glamorizing check fraud, most instantly think of the hit film Catch Me If You Can, directed by Steven Spielberg and featuring A-listers Leonardo DiCaprio and Tom Hanks.

But, what if we told you that there was a Disney Film that glamorized check fraud?

Indeed, Disney's 1994 movie Blank Check follows the story of a young boy, Preston, who comes into possession of a blank check and proceeds to exploit it for his own financial gain.

Modernizing Payments Back-Office Crucial for Survival

The fraud landscape is set to become even more challenging for banks and credit unions in 2025, according to Jim Houlihan, partner and principal consultant at Paladin Fraud. In a recent BAI Banking Strategies podcast, host Rachel Koning Beals discusses with Mr. Houlihan the current state of fraud and also outlines three key trends that will define the fraud front line in coming years.

$50M Check Fraud Case Highlights the Major Threat of Organized Crime Rings

In a shocking case of financial fraud, four men have been accused of stealing checks from the mail and cashing in over $50 million by altering the names and dollar amounts. This massive scheme stretched across multiple states, from New York to Florida, and involved sophisticated tactics to exploit the banking system.

FBI’s 2024 Internet Crime Report (IC3): $16.6 Billion in Fraud Losses for Individuals

The FBI's Internet Crime Complaint Center (IC3) has released its latest annual report, detailing a significant increase in internet-enabled crimes in 2024. The report distills information from 859,532 complaints submitted to the FBI, with reported losses exceeding $16.6 billion - a 33% increase from 2023.

IC3 marks its 25th anniversary as a crucial platform for reporting cyber-enabled crimes, fielding over nine million complaints since its inception.

Satire Speaks Truth: Fraud Technology Overhype vs. Real Innovation in Check Fraud Detection

Frank McKenna of the ever-entertaining Frank on Fraud blog posted on April 1, 2025, about Fraudinator.com -- a new AI company that promises to "eliminate fraud analysts forever" with its "Thrice Enabled Fraud Detection" system. The post included cameos from Karisse Hendrik, Founder of the Fraudology podcast, and Hailey Windham, Fraud Ops Manager at Mission Omega.

Evolution from Tellers to Universal Bankers: A Work in Progress

The Financial Brand reports that, more than a decade after banks and credit unions began rebranding their tellers as "universal bankers," the model continues to be a work in progress across the financial services industry. The goal of this transformation is to turn tellers into "jacks-of-all-trades" who can handle a wide range of customer needs, from basic transactions to product recommendations and digital banking support.

Bank Branch Dynamics: Expanding Physical Footprint to Enhance Customer Service

Only a couple of decades ago, financial institutions across the US were aggressively expanding their physical footprint, opening branches in new territories AND increasing more branches in locations to make it more convenient for customers.

Fast forward only a few years; advancements in technologies are making digital and online banking more convenient. Add in the pandemic and, all of the sudden, branches are becoming less important, right?