OrboNation Newsletter: Check Processing Edition – August 2022

The Financial Brand: Quick Guide to Successful Digital Banking

At The Financial Brand, Jim Marous, industry influencer and CEO of The Digital Banking Report, and BK Kalra, Global Head of Banking and Capital Markets at Genpact, offer their four essentials for success in the digital banking space.

Here is a summary of the list created by Marous and Kalra:

- No Banking Provider Can Do it Alone

- Fast Follow Is a Viable Strategy

- Find the Right Mix of Partners

- Don’t Ignore the Back Office

News Release: OrboGraph Acquired by Revenue Management Solutions (RMS)

Check Fraud and Recognition Solutions Business Will Continue to Run Independently

Billerica, MA, August 16, 2022 – OrboGraph, a premier supplier of check processing automation, fraud detection, and healthcare payment electronification, announced today that Revenue Management Solutions (RMS), a provider of automated healthcare payments reconciliation services, has acquired OrboGraph. Thompson Street Capital Partners (TSCP), a private equity firm based in St. Louis, MO, funded the acquisition under the TSCP’s first Continuation Fund...

Insikt Group Report: Fraudsters Conducting and Advertising Bank Fraud

In their new expansion of The Business of Fraud: An Overview of How Cybercrime Gets Monetized, Recorded Future's Insikt Group® -- Recorded Future’s threat research division, comprising analysts and security researchers with deep government, law enforcement, military, and intelligence agency experience -- analyzed current data from the Recorded Future® Platform, dark web and special-access sources, and open-source intelligence (OSINT) between March 2021 and March 2022. The latest report: The Business of Fraud: Bank Fraud, observed and identified exactly how threat actors are conducting and even advertising the following types of bank fraud...

PYMNTS Intelligence: Digital Tools vs. In-Branch Banking for SMBs

It's an open secret that the types of products and services corporate clients demand from their financial institutions (FIs) are shifting to digital banking solutions.

This month PYMNTS Intelligence takes a look at recent changes in corporate clients’ requirements for online versus in-branch banking as well as how banks can use embedded and open banking to meet these expectations...

Fraud Rate Decreases 22.6% Since Last Year — But Fraud Cost Per Attempt Increases 13%

American Banker reports that data suggest in the beginning of 2022, the number of fraud cases being reporting has decreased from previous two years -- nearing pre-pandemic levels. While many may see this as a positive, further analysis of the data provides a stark reality: Fraud is more expensive!...

Will Cash Restrictions be Implemented in the US?

A report on the Globes website gives us a look at restrictions on cash payments in Israel that have been in effect since January of 2019.

The law limits the use of cash in any transaction worth more than NIS 11,000 with a business and more than NIS 50,000 in a transaction between private individuals. In a loan or donation above these sums, the business and the individual may pay or receive cash amounting to up to 10% of the loan or donation or NIS 11,000, whichever is the lower. In the case of a gift, a business or private individual may give or receive 10% of the gift or NIS 50,000, whichever is the lower.

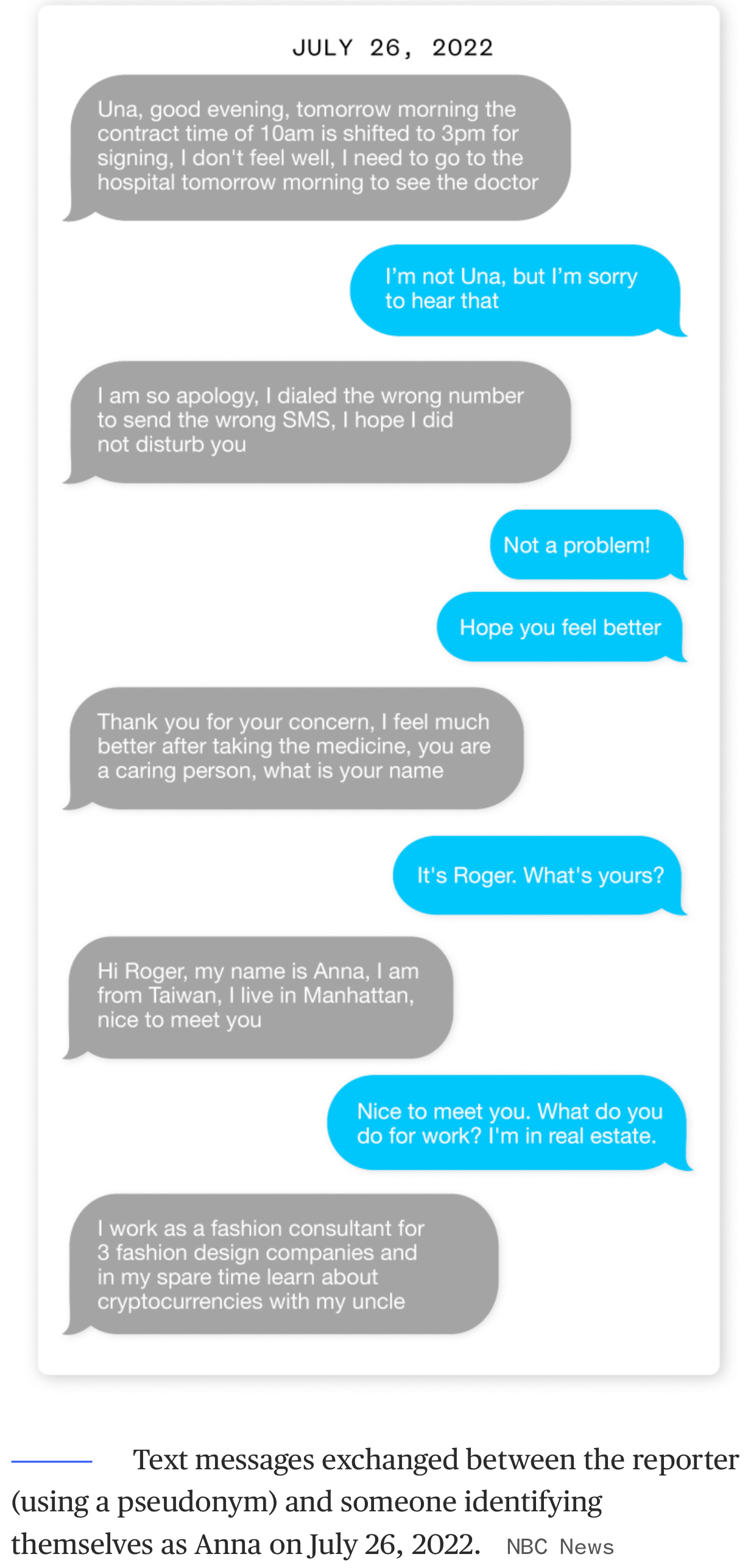

“Wrong Number” Text Message Scam: 244 Victims = $42.7M Stolen in One Week

Many times we hear about scams and scammers that do their work quickly and move on. They rely on "quantity of attempts" in order to come out ahead -- something quick and efficient attempted three dozen times will pay off if only two of their targets fall for the ploy.

A new scam in the news takes a bit of that approach, but then mixes it with a "long game" that is resulting in much, much bigger individual payouts...

Businesses Need to Integrate SaaS to Modernize Payments

PYMTS.com reports on Cat (aka Caterpillar) -- the manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives -- providing a very good example of how, via their business planning and practices, "ye shall reap what you sow."...

Under Scrutiny: FTC Sues Walmart for Facilitating Money Transfer Fraud — Costing Customers Hundreds of Millions

Walmart has enjoyed a reputation as the "one-stop" center for consumer needs, and, true to their reputation, they expanded into the money transfer space so their customers could handle transactions at the same place they get their milk and potato chips.

Walmart offered an impressive suite of services, including money transfers, credit cards, reloadable debit cards, check cashing, bill payments and more...

Gartner Inc. Predicts $623B Tech Investments in 2022 by Banks and Financial Services Firms

In a press release by Gartner, Inc., the company boldly predicts that banks and financial firms will boost their technology products and services investments in 2022 to the tune of $623 billion. Gartner Inc. goes on to identify what they consider the top three tech trends emerging in banking and investment services.

Alogent: “Checks Are Not Going Away”… with Data to Back It Up!

A post at Alogent starts with a very clear -- and, by now, familiar proclamation:

"Checks are not going away."

Indeed, while many people talk up the latest and greatest digital payment methods and apps, they either forget or take for granted the following attributes cited by Alogent that only checks possess...