X Marks a Spot in Payments — Maybe

- Elon Musk, who now owns Twitter (rebranded as X), plans to launch a peer-to-peer payments feature on the platform in 2024.

- Musk said he expected payments to launch by mid-2024 pending regulatory approvals from states.

- Approvals from California and New York are seen as particularly important for the payments launch.

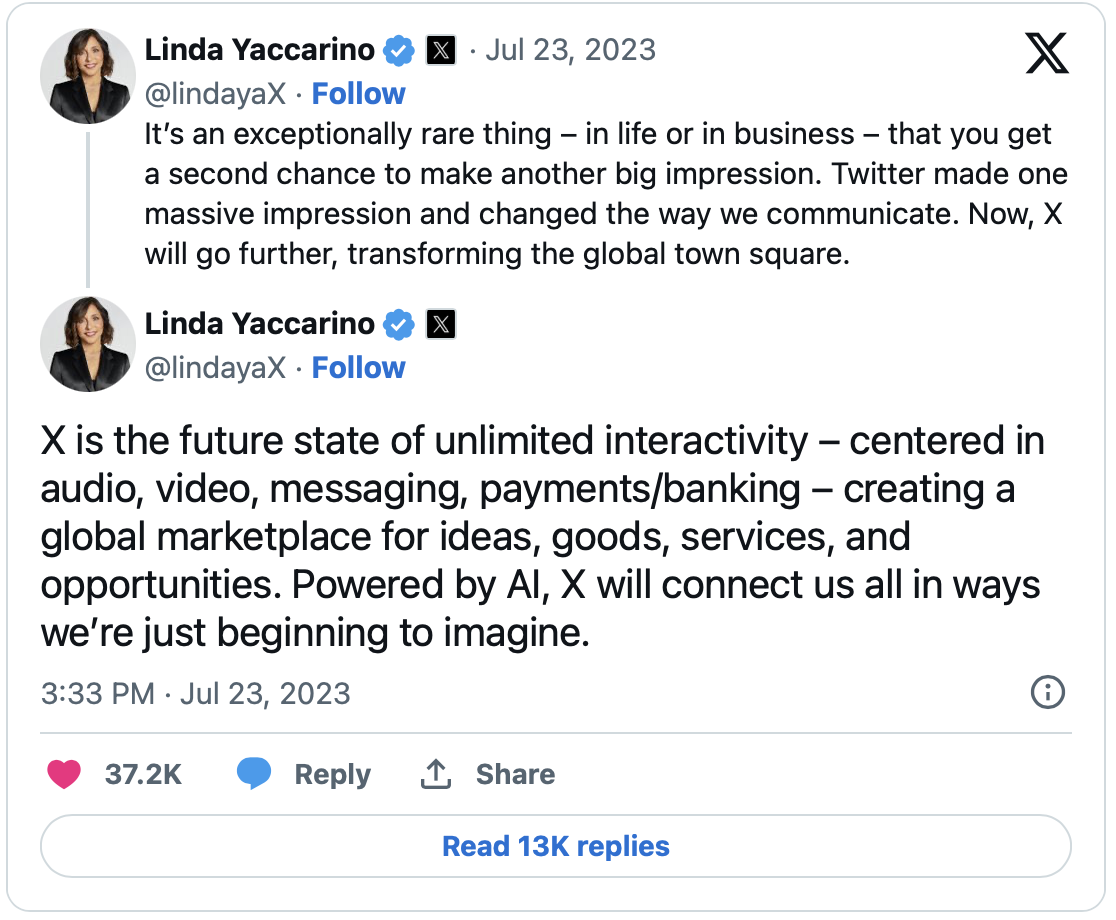

As noted in a series of tweets by X CEO Linda Yaccarino:

Well, Banking Dive reports that Elon Musk has made public his plans to launch peer-to-peer payments on the platform in 2024. This would allow users to transact directly on X, expanding its utility and commerce opportunities.

“I would be surprised if it takes longer than the middle of [2024] to roll out payments,” Musk said during a conversation last month with Ark Invest CEO Cathie Wood.

That target is, of course, pending regulatory approvals from states.

However, X’s own website lists just 15 state licenses, 14 of which are also listed on the Nationwide Multistate Licensing System. The 15th license is from the state of Florida, which does not list money transmitter licenses on the NMLS database, but lists the license on the website for the Florida Office of Financial Regulation.

The most important state money licenses, for the purposes of his payments plans, have yet to grant X licenses, Musk said. “It’s irrelevant until California and New York approve us,” Musk said during the interview. He did not go into detail as to why those states in particular were important.

Obstacles? What Obstacles?

Musk also told Wood that he did not know of any obstacles to X launching a payments feature. This is contrary to the fact that state approvals paused for nearly 90 days last year; New York City law firm Walden Macht & Haran sent a Sept. 8 letter to officials in all 50 states alleging that X was “unfit” to hold money transmitter licenses.

And, while Musk is confident there are no obstacles from a regulatory standpoint, skeptics raise a few concerns for X:

“It immediately seems to me to be farcical,” says Jason Mikula, consultant and publisher of Fintech Business Weekly. Mikula says that most people he knows aren’t even on Twitter. But they already use Zelle, Venmo or CashApp. So where is the incentive to sign up for Twitter payments?

“This is Elon Musk grasping at straws,” says Alex Johnson, creator of the Fintech Takes newsletter. The need to find something that will turn Twitter into an earnings powerhouse has him looking at payments and banking as a lever for profits, but it’s not even clear what he sees as Twitter’s role.

We also cannot ignore that the platform -- and social media in general -- may not have the support of its users:

Musk has the PayPal experience under his belt, but that doesn’t mean the public thinks tweets and dollars mix. A platform plagued by misinformation and bots — and the controversy that Musk’s chaotic management style adds to the mix — is not likely to inspire mainstream trust anytime soon. Social media in general suffers from a lack of public trust: In a fall 2022 survey by Morning Consult, 61% of respondents said they trust traditional banking institutions, but just over half that — 34% — trust social media.

X: The Future of Banking?

It remains to be seen if any fintech can be successful in their quest to infiltrate the banking industry. So far, the most successful appears to be Apple with their Apple Pay and Apple Savings Account -- which has accumulated $10 billion in deposits (according to a August 2023 article from Fintech Futures).

However, banks offer a variety of services outside of just payments and checking accounts -- services which are heavily regulated with vital protections for consumers. Also, banks have the brand recognition and reputation of a safe place to store money.

Banks need to continuously invest in their technologies across platforms, from user experience on their mobile apps, to streamlining and automating the processing of current legacy payments such as checks. Having a robust offering and enabling consumers to perform ALL of their financial functions within one location in a safe environment will make it extremely difficult for any big name fintech to overcome.