Twitter Bank — or “X” Bank — Becoming a Reality?

Twitter - or X, which is its new name (and the subject of some "sign controversy" recently at X's San Francisco headquarters) - has made it known they are entering the payments realm, having begun the process of applying for regulatory licenses and development of the software needed.

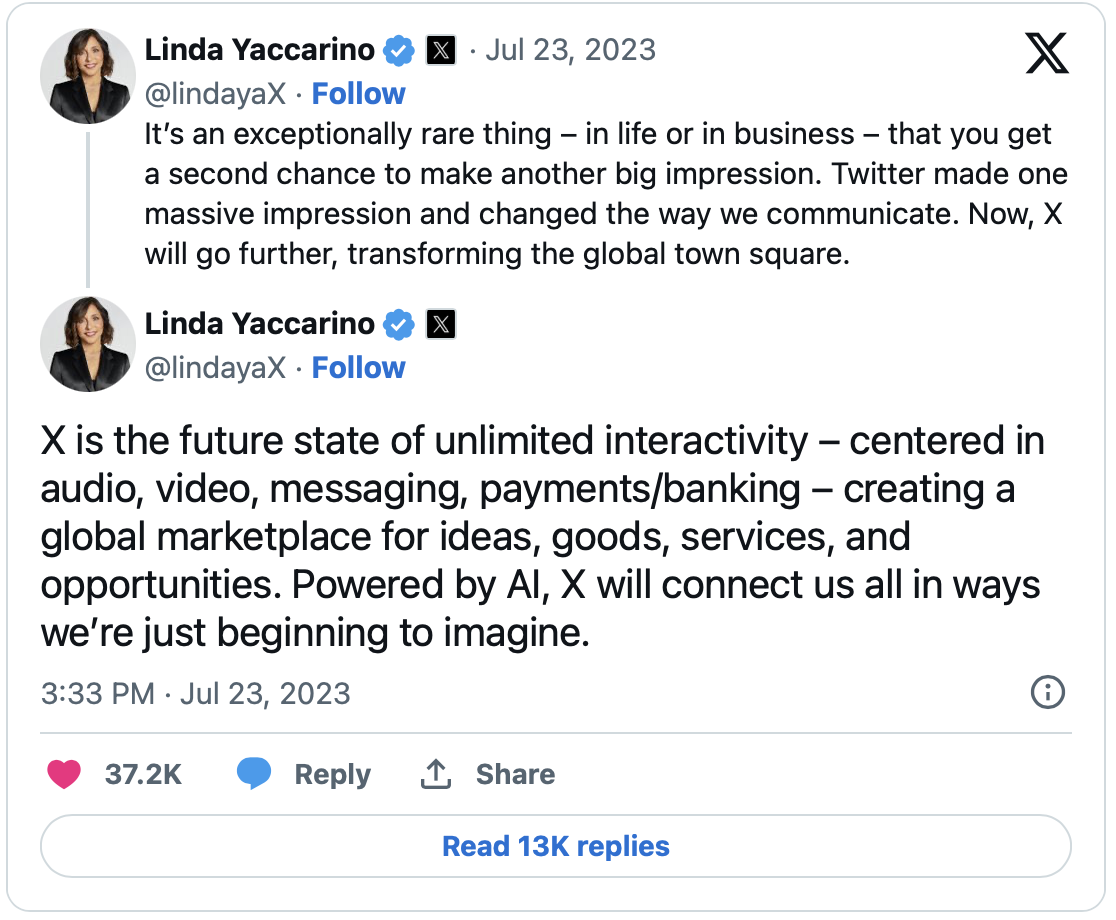

This is no real surprise, as Elon Musk is a cofounder of PayPal. He has also made it clear that X is widening its scope, as has his CEO:

Musk silhouetted in front of Twitter's now-defunct logo

Twitter's rebranding, now known as X, has officially kicked off, and CEO Linda Yaccarino has provided some insights into the company's future direction. In a series of tweets discussing the change, Yaccarino hinted that the new vision, under Elon Musk's leadership, may involve integrating payments and banking features.

The goal, according to many observers, is to make X the "everything app" for as many people as possible. Daily, routine financial transactions, of course, fall into that category.

Will "X" Mark the Financial Spot?

The popularity and ubiquity of a social media platform is by no means a guarantee of success in the realm of payments, as noted by Banking Exchange:

Facebook’s Libra set out to transform cross border payments, but died in the hands of regulators. Giants like Amazon and Google have attempted alliances with large banks that have not cracked the code in linking financial services to digital powerhouses.

He is a risk taker, but has also had the patience to bring about dramatic change over a long period of time. It may be the difference, as Musk has been able to innovate beyond the digital universe.

Of course, one of the biggest hurdles to get over in any industry innovation is "consumer comfort" with the status quo and loyalty to financial institutions:

Banks have greater loyalty and trust than almost any technology company. It would be Musk’s greatest triumph yet if he can manage to win consumers and lawmakers, but sometimes first mover advantage is not an advantage at all. It may be good timing on his part, even if the original acquisition of Twitter made the world’s richest man a lot poorer.

The Adoption of Consumer Payment Technology

The idea of an "everything" app is not a new concept. We've seen mass adoption in Asian countries -- specifically China -- where WeChat has experienced great success. When we focus on just mobile wallets, there are 2.3 billion mobile wallets globally, with 507 million that are Apple Pay. Who among us have not seen individuals use their phone or watch to tap on the POS system and make a payment? It does appear that there's a segment of individuals who've already adopted this style of payment.

And, let's not forget that Apple recently released a savings account, enabling more banking features for its users.

But, banking is more than just payments. Banks offer a variety of services that are heavily regulated -- including protections to the consumers that X simply cannot meet...for now.

Financial institutions have the brand recognition and reputation of a safe place to store money. Additionally, there are many instances where certain payments are just not accepted. For instance, most renters pay with a check as landlords do not accept digital payments. Financial institutions that invest now in technologies that streamline payment processes such as checks will always have the advantage over newcomers who simply cannot meet these needs.