OrboNation Newsletter: Check Processing and Fraud – Best from 2024

Check Fraud Accounts for Nearly 20% of SARs Filings in 2023

Thomson Reuters reports that the number of suspicious activity reports (SARs) — documents that financial institutions must file with the federal government’s Financial Crimes Enforcement Network (FinCEN) upon detection of behavior by employees or customers that may be associated with money laundering, fraud, or other types of criminal activity — is steadily rising.

This is significant because SARS is regarded as one of the most accurate measures of the prevalence of financial crime in any given year in the United States. Not surprisingly, the number of SARs have been steadily rising.

In mid-2023, a Thomson Reuters Institute special report on the surge in SAR filings predicted that approximately 3.75 million SARs would be filed in 2023, a 4.5% increase over 2022 SARs and a historic record. While that prediction was accurate but fell a bit short — the final SARs tally for 2023 ended up being 3,809,823 SARs, a 5% increase over 2022 and yet another record in terms of filing volume.

Check Consortiums: The Advantages of Open Models for Fraud Detection

Consortiums have been a major resource in the fight against check fraud. Many financial institutions are leveraging consortiums like Advanced Fraud Solutions TrueChecks and Early Warning Systems as part of their deposit fraud detection.

An article from Global Fintech Insights notes that, while Fintechs are increasingly turning to fraud consortiums to bolster their defenses against more and more sophisticated fraud attacks, these consortiums come with their own set of challenges.

Another Publication Attempts to Discredit Checks — Are They to Blame for the Inherent Issues?

Evan Sparks, editor-in-chief of the ABA Banking Journal and senior vice president for member communications at the American Bankers Association, poses the question: Is it time to kill the paper check?

He leads with a Saturday Night Live sketch from 2019 called “Cheques,” a mock bank commercial that plays up the scandalous drama of check-writing — “because there’s nothing like furiously scribbling on a piece of paper, tearing it, flicking your wrist and saying, ‘I trust this will suffice.’”

Supercharging Positive Pay Systems to Combat Check Fraud

Positive pay is not a new innovation for fighting check fraud. Many financial institutions offer this service through Treasury Management; with the increase in check fraud, many businesses have deployed this solution to mitigate check fraud losses.

As noted in a blog post from our friends at Advanced Fraud Solutions:

Standard Positive Pay: This basic form of Positive Pay service matches the check number, dollar amount, and account number of each check presented against a list provided by the business. It ensures that only checks with matching details are processed.

75% of Organizations Still Use Paper Checks According to New PYMNTS Report

PYMNTS recently reported that, despite growing adoption of digital solutions, many businesses still continue to choose paper checks as their preferred method of B2B payment. In fact, according to PYMNTS' "Getting Paid: Digital Payments for Improving Cash Flow and Customer Experience,” 75% of organizations still use paper checks, despite their high costs and inefficiencies. This is a slight decline from a 2022 report from PYMNTS that noted "81% of businesses still pay other firms via paper checks, making it the most common B2B payment method, even amid companies’ digitization efforts."

However, despite these benefits, checks continue to thrive in B2B payments for several reasons:

- Established payment that requires no procedural changes

- Both sides of transaction must utilize other payment channels, whereas check payments are universal

- "Float time" helps SMBs manage their accounts

- Paper trail for all payments

- Credit card payments come with 3-5% fee

Industry Insights: OrboGraph’s James Bi Breaks Down mRDC Check Fraud on Wespay Podcast

In the latest episode of the Wespay Payments Perspective Podcast, OrboGraph's own James Bi, Marketing Manager and Check Fraud Detection Specialist, joins host Jeff Duffy to discuss mRDC and how fraudsters are leveraging this deposit channel to commit check fraud.

Mr. Bi discusses how alterations (washed checks) were predominant early on, but fraudsters evolved and adopting "check cooking" -- using technology to digital recreate checks -- as the primary method for check fraud.

Paper Checks Continue to Persist in Healthcare Payment Reimbursements

Healthcare is a complex industry. From the delivery of care for patients to insurance paying the healthcare provider, there are dozens of systems utilized by each party. The result is that, even though there have been innovations across the entire spectrum, paper persists at all levels.

This includes revenue cycle management -- where paper dominates for healthcare payments and explanation of benefits (EOBs). In fact, according to the Council for Affordable Quality Healthcare (CAQH), the healthcare industry is leaving $426 million on the table.

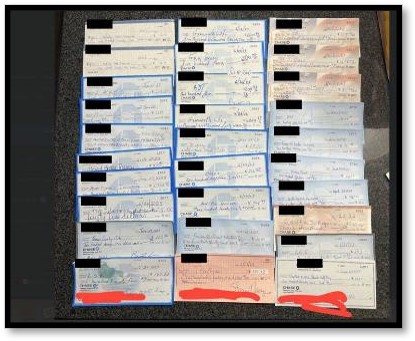

Nearly 20,000 Stolen Checks Worth Over $485M Found on Telegram

In order to commit check fraud, the first step for a fraudster is simple: obtain a legitimate check. Sure, a fraudster can purchase blank check stock, but they still need to acquire the routing and account numbers to print onto the check stock. This is why the majority of stolen checks are obtained via USPS mail.

But, how many stolen checks are available for purchase on the dark web. Well, Dr. David Maimon -- now SentiLink's Head of Fraud Insights -- recently took a "deep-dive" into some of the "darker" Telegram channels.

How Financial Institutions Can Detect TikTok’s “Infinite Money Glitch”

TikTok trends are all the rage now. While YouTube remains the leader for content created by individuals, many are addicted to the short-form videos provided by TikTok. However, whatever the platform, this has contributed to poor advice or "tips" going viral -- particularly when it comes to the financial realm.

This has culminated in a viral trend where individuals unwittingly commit check fraud -- dubbed the Infinite Money Glitch.

The “Open Banking Era” Begins as Financial Data Rights Rule Finalized

As we noted previously, Open Banking is a hot topic for financial institutions. It allows consumers to share their financial data with third-party providers and enables access to a wider range of financial services. It's popular all over the world, but only recently emerged in the United States.

Global Government Fintech reports that the U.S. Consumer Financial Protection Bureau (CFPB) has finalized a transformative open banking rule under the Dodd-Frank Act, enabling consumers to control their financial data and share it with third-party service providers. This initiative aims to increase transparency and competition within the financial sector, granting consumers more freedom to choose services that best fit their needs.

Fed Expands FedDetect to Cover Commercial Checks, But Is It Enough to Stop Check Fraud?

Via a recent press release, "FedDetect Duplicate Notification underscores the Federal Reserve’s purposeful investment to support banks and credit unions as they fight fraud related to check clearing."

The capability to detect duplicate commercial checks will be a new feature available alongside the existing Treasury check notification service. FIs will now be able to access the deposit information and images of potential duplicate commercial checks. Additionally, this new feature will be available at no additional cost.

Jack Henry’s 2024 Strategy Benchmark Report: 75% of FIs Indicate Check Fraud as a Major Concern

Our friends at Jack Henry & Associates have recently published the 2024 Strategy Benchmark report. Conducted between January and February of 2024, an online survey was distributed to core clients with responses from 127 bank and credit union CEOs -- representing a diverse sample of Jack Henry clients across the U.S., with assets ranging from under $500 million to more than $10 billion.

The reports that "80% of all financial institutions plan to increase technology spend over the next two years, but credit unions are more bullish on budgets."

Paying with Checks: Reviewing Advantages and Disadvantages

While thought of as "old school," there are still advantages to using checks. For many, checks still offer respite from carrying physical money. At the same time, growing fraud makes caution necessary. Alternative Payments offers a comprehensive look at the advantages and disadvantages to paying with checks, along with a bit of history and key terminology.

Millions in IRS Refund Checks Stolen and Altered

When you think about different types of checks, which do you believe is most desirable to fraudsters?

The answer is treasury checks. When a fraudster is able to steal a treasury check, they can simply alter the payee and deposit the check into a drop account -- typically by mRDC of ATM to avoid a bank employee reviewing the physical item. And, since treasury checks are seen as "good items," the funds are available to the account owner faster (depending on your financial institution's funds availability policies).

Is Check Fraud Putting mRDC at Risk?

Mobile Remote Deposit Capture (mRDC) has been around for decades, and it's the most convenient method for individuals and some businesses to deposit checks. This method became crucial during the pandemic, as many smaller financial institutions and credit unions quickly adopted the technology to ensure that their customers were able to deposit checks without needing to risk being out in public.

Collapse of Synapse Highlights Need for Neobanks and Traditional Banks to Choose Stable Partners

The American Prospect features a rather alarming story illustrating the higher risk faced by neobanks as compared to conventional financial institutions, and the dangers for FIs partnering with unstable companies.

One example: because so much fintech architecture remains unregulated, federal officials have been unable to step in to extricate customers from the failure of middleman Synapse, which has led to hundreds of thousands of customer accounts being frozen at various fintech companies like Yotta, Juno, and Copper.

Learn the Lingo: The Fraudster Glossary

Eric Huber is the Cybercrime Research & Analysis Leader at TD Bank, and now curator of Fraudsterglossary.com, a growing glossary of terminology and slang used by fraudsters to communicate on internet sites like Telegram.

One of the reasons I fired up this project was to encourage others to get into the fight by getting on Telegram to educate themselves about what the fraudsters are doing. I figure the easier I make it to get up and running, the better the chance more people will do it.