OrboNation Newsletter: Check Processing and Fraud – January 2025

Strategies and Tools for Combating Mobile Check Deposit Fraud in 2025

Our friends at Advanced Fraud Solutions kicked off the new year with recommended strategies for credit unions and community banks to combat mobile check deposit fraud in 2025.

The article notes that payments fraud continues to surge, with 80% of organizations reporting fraud attempts or successful breaches, up from 65% in 2022.

The dominant form? Check fraud, affecting 65% of respondents.

For smaller financial institutions, combating mobile check deposit fraud is especially challenging. However, each strategy below can be utilized by FIs of all sizes for check fraud detection:

- Account Activity

- Transaction Types

- Balancing Convenience with Security

IRS Deploys AI Tools to Combat Emerging Tech’s Role in Fraud Schemes

The 2025 tax season is now upon us, and we all know what that means...fraudsters are ready to pounce on billions of dollars in tax refunds.

In 2023 to 2024, the Biden administration set out to boost IRS headcount by 30,000 employees. This hiring spree came with five objectives.

The Future of B2B Payments WILL INCLUDE Paper Checks

As we kick off 2025, another article selling checks short as a major payment channel appears.

PYMNTS.com notes that paper checks are a "speed bump" slowing the pace of advancement and innovation. Seamus Smith, executive vice president and group president at FIS, summarizes the state of checks: There is a relative high usage of the legacy payment channel, even with the risk of fraud and inherent inefficiencies.

The article continues to tout new technologies like open banking and real-time payments, noting their advantages and portraying businesses still utilizing checks in a negative light.

Payee Positive Pay Essential for Businesses That Still Use Checks

The Bottomline blog pulls no punches with the title of its latest entry, How to Beat Check Fraud: Go Digital, Get Positive Pay, or Get Swindled.

Blog editor Owen McDonald notes that the business world is facing a “startling resurgence in check fraud,” with a 385% increase reported in 2024. Further, he asserts – and we agree – that this alarming trend has caught many businesses off guard.

That’s a serious problem in business payments, as the ongoing reliance on paper checks can turn a $500 or $5,000 problem into a $500,000 nightmare.

Industry Insights: OrboGraph’s James Bi Breaks Down mRDC Check Fraud on Wespay Podcast

It's not a stretch to say that fraudsters LOVE technology -- particularly when it comes to banking. Since the pandemic, the majority of financial institutions offer mobile remote deposit capture through their banking apps. This deposit channel s the most convenient method of depositing a check -- and, unfortunately, the most convenient method for fraudsters to commit deposit fraud as well.

In the latest episode of the Wespay Payments Perspective Podcast, OrboGraph's own James Bi, Marketing Manager and Check Fraud Detection Specialist, joins host Jeff Duffy to discuss mRDC and how fraudsters are leveraging this deposit channel to commit check fraud.

During the podcast, Mr. Duffy and Mr. Bi discuss 5 major topics:

- Types of fraud FIs are seeing in their remote deposit capture systems

- Why financial institutions would not take advantage of their ability to delay funds availability for greater lengths of time (Reg CC)

- How financial institutions can implement changes like longer holds and deposit limits

- Artificial intelligence for mRDC check fraud detection

- How FIs can become more adept at evolving along with fraudsters to detect and prevent their schemes

New FDIC Chair Pledges Sweeping Bank Regulation Review

As reported in PYMNTS.com, the newly appointed acting head of the Federal Deposit Insurance Corporation (FDIC), Travis Hill, has announced plans for a "wholesale review" of bank regulations and guidance. This comes as the banking sector anticipates a period of relaxed regulation under the new presidential administration.

Back in February 2017 during his first term, Trump issued Executive Order 13772, outlining "Core Principles for Regulating the United States Financial System." This order directed the Treasury Department to review existing financial regulations and recommend changes to align with these principles, emphasizing the need to foster economic growth and vibrant financial markets through more rigorous regulatory impact analysis.

AI Technologies Needed to Achieve True Automation in Banking

Forbes Magazine features a post by Julien Villemonteix, the CEO of UpSlide, which is a software company that creates documents for investment banking and financial advisory firms.

He notes that the banking industry is abuzz with excitement over the potential of artificial intelligence (AI) to transform the sector. With the global AI market projected to reach $826 billion by 2030, banks are rushing to embrace this new technology. However, industry leaders must approach AI investments with caution.

Warning Signs Not Enough to Detect Fraudulent Checks?

Spotting a fraudulent check is not an easy task. Fraudsters have finely honed their craft, and even the most seasoned fraud investigator can miss a fraudulent check. Heck, even those who have taken our Check Fraud Detection Challenge have reached out with comments confessing incorrect assessments.

Nevertheless, it's still important for financial institutions to be aware of check fraud warning signs. A recent article on LinkedIn posted by Independent Correspondent Bankers' Bank provides their list of 10 Warning Signs of Check Fraud Every Community Banker Should Know:

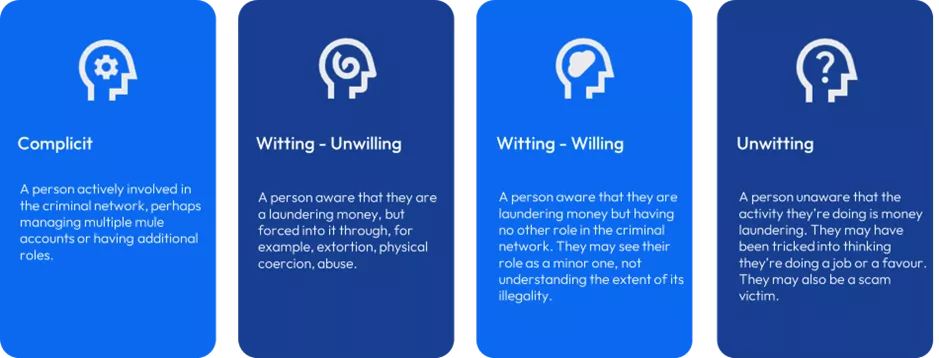

Money Mules: A Growing Global Threat

Sarah Cassidy, a senior consultant at FICO specializing in fraud, takes a look via the FICO Blog at money mule fraud, a major and growing problem worldwide.

She notes that a recent global crackdown uncovered over 10,000 money mules, with losses of around 10 million EUR. However, it's very likely that this only scratches the surface - the UK alone estimates £10 billion in illegal money is laundered through money mules each year.

Back-Office AI Highlighted in Forbes Top 10 Banking and Financial Trends 2025

As we kick off 2025, Forbes.com has come out with their list of "The 10 Most Important Banking and Financial Technology Trends That Will Shape 2025." The article notes:

As technological disruption and economic uncertainty continue to reshape the financial landscape, alongside dramatic shifts in consumer behavior and regulatory requirements, 2025 promises to be both challenging and opportunistic for banking and financial services.

ABA Podcast: “60% of Fraud Attacks and Losses Associated with Check Fraud”

In a new podcast from the ABA, Glenn Fratangelo, Director, Product Marketing, NICE Actimize, opens the interview with Patrick Smith, SVP, Fraud Operations, ABA, with the following:

"Check fraud is a significant threat to financial institutions and companies. We have some clients reporting that almost 60% of fraud attacks and losses are associated with check fraud."

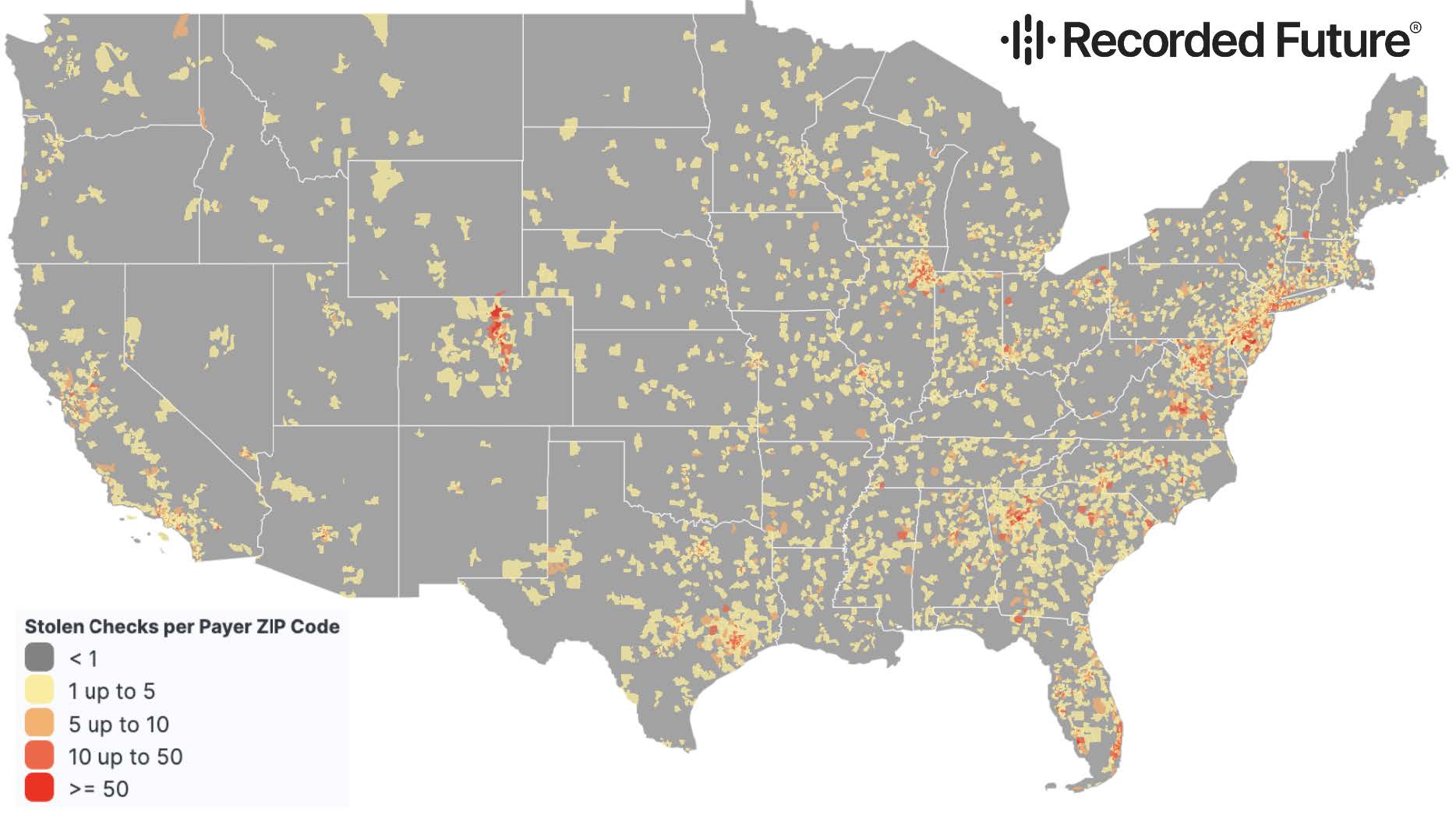

Recorded Future Report Analyzes 700 Telegram Channels for Stolen Checks

Telegram is a major communication channel leveraged by criminals due to its encryption and anonymity. This makes it an attractive method for selling stolen checks. Previously, we outlined research from Dr. David Maimon and the Georgia State Evidence-based Cybersecurity Research Group at Georgia State University where they monitored over 80+ different Telegram channels and dark web markets for stolen checks -- yielding an average of 9000+ stolen checks sold per month.

In a new report from Recorded Future, their Payment Fraud Intelligence takes a deeper dive into Telegram and stolen checks, analyzing 700 Telegram channels in H1 of 2024.

NICE Actimize: Check Fraud Insights from Industry Experts

In a recent post from NICE Actimize, Kim Hamilton, Vice President, Premier Product Management, gathered practitioners and experts from different FIs to offer their unique perspectives as to why check fraud is increasing -- and what can be done to proactively mitigate it.

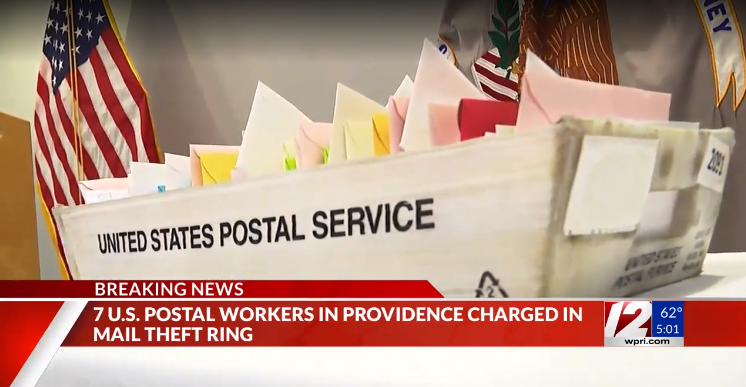

USPS New Hires the Latest Threat for Stealing Checks?

It looks like the U.S. Postal Service is being infiltrated by "opportunistic" new hires who are not interested in delivering mail, but rather using their positions for nefarious purposes.

As noted on msn.com, the Inspector General of the U.S. Postal Service Office released a report in October that revealed employees “brought personal belongings onto the workroom floor,” such as bags or heavy coats, “which were used to conceal stolen mail and packages.”