OrboNation Newsletter: Check Processing and Fraud – April 2025

Check Payments Most Often Subjected to Fraud According to New 2025 AFP® Payments Fraud and Control Survey

Earlier this week, AFP released the results of their "2025 AFP® Payments Fraud and Control Survey". This report is an important tool for FIs and the banking industry, as it displays the challenges that their customers are facing. The data is from 2024; the survey was conducted in January of this year and received responses from 521 corporate practitioners representing organizations of varying sizes and a broad range of industries.

According to AFP's press release, 79% of responding organizations report that they were victims of attempted or actual payments fraud activity in 2024 -- slightly down from 80% in 2023.

Which payment method was most impacted by fraud?

You guessed it: Checks.

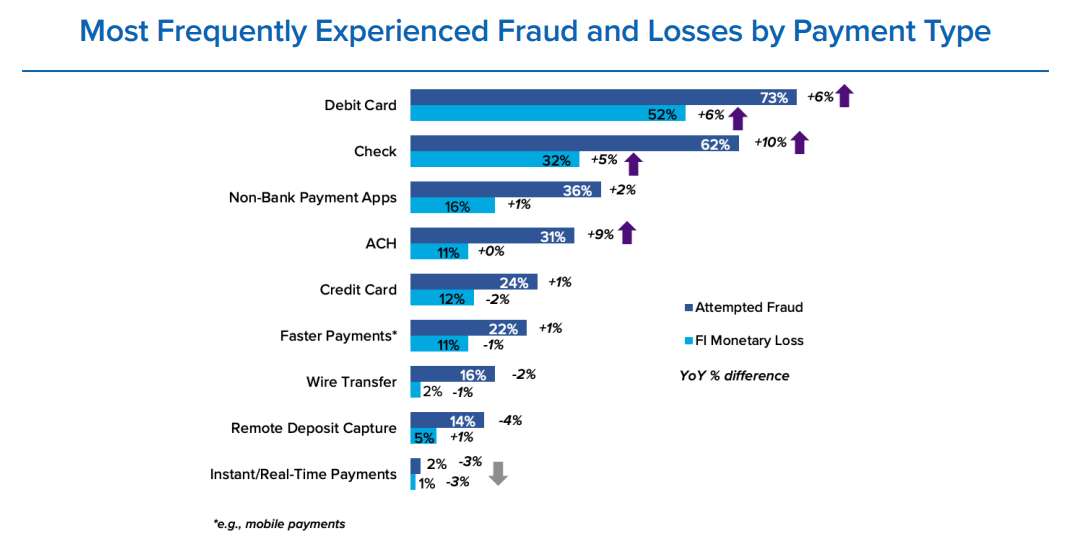

The survey revealed 63% of respondents reporting that their organizations faced check fraud in 2024 -- slightly down from 65% in 2023.

Check Fraud Accounts for 30% of Fraud Losses, According to Fed Survey

Earlier this month, the Federal Reserve published its findings from the Annual Federal Reserve Financial Services (FRFS) Financial Institution Risk Officer Survey (2024).

The most prominent payments for fraud: checks and debit cards.

The Future of Open Banking Relies on Today’s Technology

A recent post at Forbes.com points out that open banking is revolutionizing the financial services industry by enabling secure data exchange between banks and third-party providers. The European Union's Revised Payment Services Directive (PSD2) has played a crucial role in making open banking a reality across Europe

Audit of Sacramento Post Offices: 143 Missing Arrow Keys

Last year, we examined a USPS audit where, out of 84 postal facilities inspected, 76 facilities across 25 states and the District of Columbia found untracked or unsecured arrow keys from 2019 to 2024. This is particularly concerning as mail theft and mail carrier robberies are a major source for stolen checks.

The USPS has responded to the rise in mail theft with the launch of Project Safe Delivery in 2023, where antiquated locks were to be replaced with new electronic systems. Not much information has been published on these new locks; however, Birmingham, Alabama Postmaster John Richardson provides some details in a recent news article:

AFP Survey: Despite Fraud Risks, Paper Checks Surged in ’24

Despite mainstream media pushing the narrative that "checks are dying," the reality is the paper checks surged in 2024.

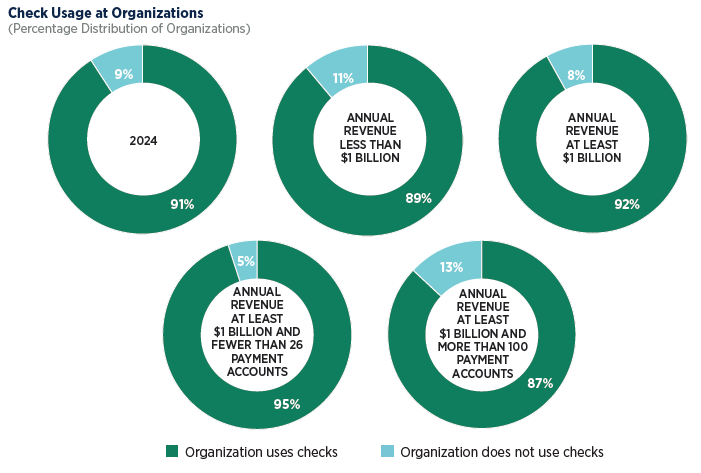

According to the AFP's 2025 Annual Payments Fraud and Control Survey, the number of respondents reporting use of paper checks jumped from 75% in 2023 to 91% in 2024. The survey was conducted in January of 2025, receiving responses from 521 treasury and other financial department executives from a broad range of industries.

Commentary from a recent Payments Dive article notes that the association seemed at a loss to explain the rather counterintuitive result.

The report offers a few theories as to why paper checks surged between 2023 to 2024.

Reverse Positive Pay for Personal Checking Accounts — Strong Fraud Mitigation or Shifting Liability?

Over the past few months, we've explored the efficacy of Positive Pay systems, noting that "77% of Businesses Using Positive Pay Report Fewer Check Fraud Attempts or Losses" according to research by the NEACH Payments Group. Businesses benefit from this service provided by their FIs, as check transactions are compared to issue files. Payee Positive Pay is most effective in identifying altered payees.

Modernizing Banking Technology Through “Composability”

In a recent discussion with BAI.org, Carlos Lopez, Strategic Initiatives Analyst at Jack Henry, addresses the challenges financial institutions face when it comes to modernizing their technologies. As we all know, FIs are prioritizing the ability to harness the power of data within their systems -- described as the "lifeblood of a financial services organization."

However, even though FIs possess this vast amount of data, there are still concerns regarding how the data is being collected, its quality, and how the data is being managed.

Elder Abuse: How Can FI’s Better Protect America’s Most Vulnerable Generation

What makes the elderly our most vulnerable population when it comes to fraud? Is it because they are the least technologically savvy? Are they more trusting than other age ranges? Whatever the reason(s), As noted in new post from BAI, FIs and fintechs need to pay special attention to this generation.

There are several specific ways that fraudsters will scam the elderly, as laid out in a list compiled by the FBI.

The “Fraud Front Line”: Three Focuses for FIs in 2025

The fraud landscape is set to become even more challenging for banks and credit unions in 2025, according to Jim Houlihan, partner and principal consultant at Paladin Fraud. In a recent BAI Banking Strategies podcast, host Rachel Koning Beals discusses with Mr. Houlihan the current state of fraud and also outlines three key trends that will define the fraud front line in coming years.

33% of US Consumers View Physical Branches as “Essential”

Forbes.com reports that the banking industry is undergoing a major transformation, as financial institutions strive to meet the quickly evolving needs and preferences of modern customers. For instance, according to a recent survey, 33% of U.S. consumers still view physical bank branches as "essential" for their banking activities, across all age groups.

Are U.S. Consumers Satisfied with Banks and Their Protective Measures?

One facet of fraud that gets overlooked is the consumer satisfaction factor. Anytime fraud is not detected, there is a victim -- whether it's an individual or a business. When it comes to individuals, fraud is especially damaging; half of Americans have less than $500 in savings and 40% keep less than $500 in their checking accounts, according to Yahoo.

Customer satisfaction appears to be positive from consumers, according to a new national survey from the ABA, conducted on their behalf by Morning Consult.