Check Fraud Prevention

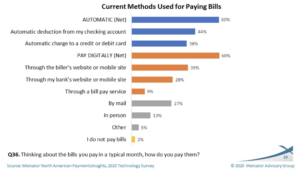

The report presents results from questions exploring how adults in the United States use and pay for “box of the month” clubs and online subscription services. It also explores the ways consumers pay their bills and the increasing importance of digital bill payment. …When it comes to paying bills, the majority of consumers (6 in…

Read MoreIn a recent OrboNation Blog article, we covered the need for key fintech players — like banks and firms — to continue to invest in modernizing their processes and payment methods as “the need for automation has never been more pressing. Clients want quick, efficient solutions that enable them to do more with less. From lending decisions to payments risk management, only technology can provide the necessary support that businesses need.” One approach that banks and financial institutions are starting to pay attention to is Open Banking.

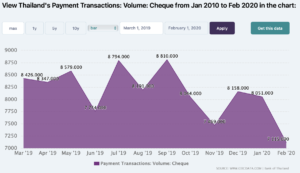

Read MoreCEIC Data was founded in Hong Kong in 1992 by a team of expert economists and analysts, and today employs data analysts in multiple offices around the globe. They currently offer “exclusive access to unparalleled coverage of 200+ economies around the globe, helping analysts and economists make sense of the world economy.” From their website: First and foremost, our products are about people. Our relationships with primary sources in numerous countries around the globe mean that our clients have access to most detailed and credible data in the world…

Read MoreSurprise! Barry McCarthy the CEO of Deluxe, is a proponent of checks as payment tools. Even with the pivot for consumers to digital payment options, business-to-business is still reliant upon an older payment method: checks. Yes, you read that right. Although check usage has decreased significantly since the mid-2000s, physical checks accounted for 42%of B2B transactions in 2019 despite the explosion of digital options.

Read MoreIn a world where COVID-19 has made on-site collaboration a more and more distant memory — with no end in sight for the growth of remote work as the norm — PaymentsJournal reports: The need for automation has never been more pressing. Clients want quick, efficient solutions that enable them to do more with less. From lending decisions to payments risk management, only technology can provide the necessary support that businesses need.

Read MoreWe have receive a tremendous amount of positive feedback from our recent #OrboZone launch, with a countless number of clients, partners, and industry experts raving about their “experience.” But what is #OrboZone? It’s dynamic content that combines high-impact videos, visual galleries, energizing music, and entertaining activities for your WFH environment.

Read MorePNC Bank N.A. announced on Jan. 27 that it has struck a definitive deal to buy payment gateway provider Tempus Technologies, Inc. This new team-up will allow their business customers to handle their receivables and payables via one channel, covering all rails. According to a report at Pymnts.com:

Read MoreAn article at PaymentsJournal.com cites a 2019 survey by Aite Group indicating that only 18% of banks were at that point moving from a transaction-based revenue model to a data-based approach. While this figure is unlikely to have changed significantly since, PaymentsJournal.com goes on to note that data-driven payments are increasingly on the agenda for banks and we can expect more movement towards this.

Read MoreA recent webinar sponsored by Fiserv highlighted reconciliation challenges faced by modern financial institutions as so many consumers adopt digital channels for payments. Fiserv’s 2020 Expectations & Experiences: Consumer Payments survey found that digital payments are indeed on the rise and confidence with virtual payment cards — the Apple Wallet, for instance — is growing.

Read MoreThe trading platform Blocktrade recently published their predictions for the coming year in the fintech and payment worlds. “We all know that 2020 was a highly unusual year – the Covid pandemic not only impacted the global economy, it also accelerated ongoing changes and developments in the Fintech and Payment industry.”

Read More