Uncategorized

JLL’s new 2023 Banking and Finance Outlook indicates that banks and financial services companies are “prioritizing and strengthening their investments in technology to increase speed, resiliency and drive cost efficiency.” In their immediate sights is development of artificial intelligence solutions. These companies are anticipated to spend an additional $31 billion worldwide by 2025 on artificial intelligence (AI),…

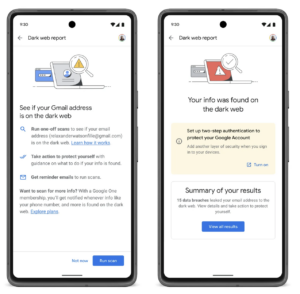

Read MoreThe Dark Web is being successfully utilized more and more by fraudsters Email addresses can be harvested via legitimate web sites Google has responded with new security features In earlier posts we’ve mentioned the Dark Web and how it’s becoming a more and more accessible “market” for fraudsters — and a danger to unwitting visitors…

Read More“Check washers” remove original written info from checks to create forgeries Demand for these checks has led to thefts and assaults Gel pens have been touted as “wash-resistant” A few weeks ago we explored the utility of Gel Ink Pens as shields against check fraud. A WSAW-7 consumer alert cited gel pens as a simple way to…

Read MoreYahoo Finance reports that, this past Tuesday, Nvidia (NVDA) — founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem — recorded a landmark achievement in becoming the first chipmaker ever to reach a market valuation of $1 trillion. The Santa Clara, Calif.-based chipmaker became the ninth public company to ever hit the $1…

Read MoreCredit unions are hit hard by fraud While needing to combat fraud, credit unions do not want to impair the customer experience The answer is automation In the banking world, fraud has hit hard. Fraudsters have evolved their tactics, blending old school techniques such as check washing with new technologies such as leveraging the dark…

Read MoreCheck fraud is rising quickly There is an “open market” aiding check fraud on the internet Many banks grew complacent during a period when check fraud was stable Suparna Goswami, Associate Editor at ISMG, spoke to Trace Fooshee, strategic adviser at Aite Novarica Group, about problems banks have been facing in addressing the precipitous rise…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreMany people in today’s financial services industry applaud the emergence of AI technology as an excellent equalizer for financial institutions, allowing community banks and credit unions a level of parity with their larger competitors. After all, it’s just a matter of recognizing and embracing the emerging AI technology, right? It turns out things are not…

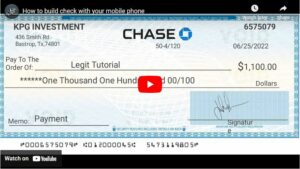

Read MoreCheck fraud is a growing problem “Lessons” in creating fake checks are available online YouTube is home to many tutorials One of the more disturbing aspects of mounting check fraud — beside the fact that postal workers are being physically assaulted to get “raw material” and mail drop box keys — is the fact that…

Read MoreCheck fraud continues to rise Check fraud has grown disproportionalty compared to other channels Checks haven’t changed in decades, making an easy target The latest NICE Actimize article is available for download, and it’s called Check Fraud Running Rampant in 2023. Talk about getting to the point! The report is full of valuable information and…

Read More