Uncategorized

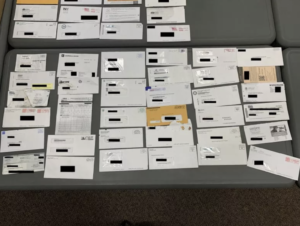

In a story from The Boston Globe, we learn about a counterfeit check scheme involving recruitment (and intimidation) of homeless and transient people from Providence to commit fraud in Maine, Massachusetts, Rhode Island, and Connecticut. This was not a pandemic-related scheme; the four suspects began their scam in the fall of 2018, cashing or attempting to cash 450 counterfeit checks amounting to an estimated $450,000, according to an affidavit filed in U.S. District Court in Providence.

Read MoreForbes took a look at new research from Cornerstone Advisors and found that that more than three-quarters of Americans who have a smartphone are now mobile banking users. Mobile banking adoption is approaching ubiquity among Gen Zers and Millennials (ages 21 to 40) with 88% of each of the two generations accessing their bank accounts using a mobile device. The adoption rate dips just a bit to 78% among Gen Xers (41 to 55 years old), and then drops to 57% of Baby Boomers and 41% of smartphone-owning Seniors.

Read More“Wonder when I’ll get my stimulus check? Unfortunately, some Washington state residents are out of luck for a while. They are being warned to be diligent about monitoring mailboxes after police found more than 100 pieces of stolen mail — including some stimulus checks — in a vehicle in Olympic National Park.

Read MoreScammers often flatter targets into submission Social media offers a buffet of possible targets In this case – a happy ending! One thing that can be said for fraudsters is that they know how to take advantage of human nature. The Los Alamitos-Seal Beach Patch reported recently on an enterprising “photographer” who used Instagram to…

Read MoreClose on the heels of Venmo’s new check-cashing service for their mobile app, “Cash a Check,” fee-payment processing platform AdvicePay — which is designed specifically for financial advisors — rolled out a new mobile check deposit feature for large businesses, according to their mid-March announcement. This is great news for financial advisors and the like;…

Read MoreNew and innovative payment rails — the payment platforms or a payment network that moves money from a payer to a payee — are designed to bring some of the biggest legacy pain points of the financial services industry down to size. Fast, smooth passage of funds is a plus for all sides of a transaction.

Read MoreThe Center for Statistics and Applications in Forensic Evidence, or CSAFE, hosted a webinar on forensic handwriting analysis on March 11, 2021. OrboGraph was one of hundreds attending the session. The Center for Statistics and Applications in Forensic Evidence (CSAFE) is building a statistically sound and scientifically solid foundation for the analysis and interpretation of forensic evidence, as well as improving quantitative literacy among forensic practitioners, legal professionals and other stakeholders through educational opportunities.

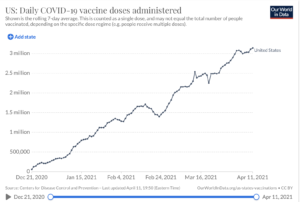

Read MoreThe good news is this: COVID vaccinations are becoming easier and easier to get for more and more people in the United States. Many states are opening up vaccinations to the general public after early limited availablity, making it possible for anyone to get vaccinated against the COVID-19 virus and (so far) its variants. As more and more people get immunized, we head toward “herd immunity” and — dare we hope? — normal life again. As of mid April, half of all US adults will have been vaccinated.

Read MoreTried-and-true merges with new digital tech — Venmo recently announced that it will begin to offer a new check-cashing service, “Cash a Check,” in the Venmo mobile app. Via TechCrunch.com: The feature … can be used to cash printed, payroll and U.S. government checks, including the new stimulus checks, the company says. Though typically there will be fees associated with the Cash a Check feature, Venmo says these are being waived on stimulus funds for a limited time.

Read MoreWhile it would be nice to hear that the goal pandemic has slowed down scammers much like it has impacted above-board businesses of all kinds, the opposite is unfortunately true. The FBI has seen more complaints over the last year than years prior. As reported at KimKomando.com, The FBI’s Internet Crime Report annual release has revealed a shocking scope of online scams in the 2020 version. The FBI logged 791,790 complaints in 2020 — that’s 300,000+ more than in 2019.

Read More