Uncategorized

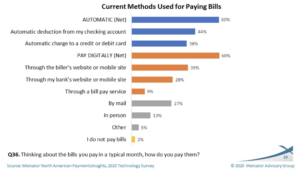

The report presents results from questions exploring how adults in the United States use and pay for “box of the month” clubs and online subscription services. It also explores the ways consumers pay their bills and the increasing importance of digital bill payment. …When it comes to paying bills, the majority of consumers (6 in…

Read MoreThe Financial Crimes Enforcement Network (FinCEN) recently issued an advisory to banks that outlined fourteen red flag indicators to be on the lookout for (and report) related to pandemic related economic relief payments. “Advisory on Financial Crimes Targeting COVID-19 Economic Impact Payments” is based on FinCEN’s “analysis of COVID-19-related information obtained from Bank Secrecy Act (BSA) data, public reporting, and law enforcement partners.”

Read MoreIn a recent OrboNation Blog article, we covered the need for key fintech players — like banks and firms — to continue to invest in modernizing their processes and payment methods as “the need for automation has never been more pressing. Clients want quick, efficient solutions that enable them to do more with less. From lending decisions to payments risk management, only technology can provide the necessary support that businesses need.” One approach that banks and financial institutions are starting to pay attention to is Open Banking.

Read MoreWith the third round of stimulus checks being distributed at the time of this article, there is a question many are pondering: Have we learned our lesson? Here’s where the numbers get really frightening: The Labor Department inspector general’s office is estimating that more than $63 billion has been paid out improperly through fraud or errors – roughly 10% of the total amount paid under coronavirus pandemic-related unemployment programs since March.

Read MoreIn the pandemic era, with relief checks being mailed regularly, there is growing concern over the fact that these documents are being transported via fairly low-security boxes on street corners.

The Philadelphia Inquirer reports that fraudsters have begun to look upon mailboxes as buffet lines for scams: “The thieves have been stealing checks, forging signatures, and amassing personal information from the mail to commit identity theft, according to interviews with victims, Philadelphia police, and postal sources. Of the more than a dozen victims The Inquirer has interviewed, the total funds stolen over the last three months amounts to at least $100,000. Multiple individuals had more than $15,000 stolen. The speed and breadth at which the thieves are compromising the mail, and the lack of any physical damage to the structures, suggests they may have keys to the boxes, law enforcement and postal experts say.”

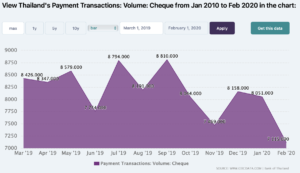

Read MoreCEIC Data was founded in Hong Kong in 1992 by a team of expert economists and analysts, and today employs data analysts in multiple offices around the globe. They currently offer “exclusive access to unparalleled coverage of 200+ economies around the globe, helping analysts and economists make sense of the world economy.” From their website: First and foremost, our products are about people. Our relationships with primary sources in numerous countries around the globe mean that our clients have access to most detailed and credible data in the world…

Read MoreAFS Positive Pay is a new product being rolled out by Advanced Fraud Solutions (AFS). The new product looks to advance the capabilities of a traditional positive pay solution by assisting financial institutions (FIs) and enterprise customers examine the changes in payments information to prevent fraud. As reported on PYMNTS: AFS Positive Pay will allow FIs and businesses to monitor payments and receive immediate notices when payment information from vendors, including routing numbers, account information or amounts, doesn’t correctly correspond, the release stated.

Read MoreSurprise! Barry McCarthy the CEO of Deluxe, is a proponent of checks as payment tools. Even with the pivot for consumers to digital payment options, business-to-business is still reliant upon an older payment method: checks. Yes, you read that right. Although check usage has decreased significantly since the mid-2000s, physical checks accounted for 42%of B2B transactions in 2019 despite the explosion of digital options.

Read MoreLexology recently released their Economic Sanctions and Anti-Money Laundering Developments: 2020 Year in Review report, examining economic sanctions and anti-money laundering (“AML”) developments and trends in 2020 as well as a look at the year ahead under the new Administration in Washington.

Read MoreIn a world where COVID-19 has made on-site collaboration a more and more distant memory — with no end in sight for the growth of remote work as the norm — PaymentsJournal reports: The need for automation has never been more pressing. Clients want quick, efficient solutions that enable them to do more with less. From lending decisions to payments risk management, only technology can provide the necessary support that businesses need.

Read More