Uncategorized

There is no doubt that the pandemic has created opportunities for fraudsters. Atlas VPN reports that cybercrime cost the world more than $1 trillion in 2020, which works out to around 1% of global GDP. Access via online “pirating” to information like email addresses and social security numbers creates opportunities for phishing and other attacks.

Read MoreThe Architecture, Infrastructure, and Operations Booklet is one in a series of booklets that compose the Federal Financial Institutions Examination Council (FFIEC) Information Technology Examination Handbook (IT Handbook), prepared for use by examiners. As described at the FFIEC website: With the publication of this booklet, the FFIEC member agencies replace the “Operations” booklet issued in July 2004.…

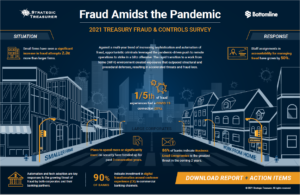

Read MoreOnce again, we see evidence that the COVID pandemic boosted the frequency and sophistication of fraud activity. As tallied in the 2021 Treasury Fraud & Controls Survey by Strategic Treasurer and related by Omri Kletter, global VP for fraud and financial crime at Bottomline, a good deal of fraud is due to the contortions businesses had to make — in a hurry — to accommodate remote work.

Read MoreThe No Surprises Act — which is part of the Consolidated Appropriations Act introduced earlier this year — is a pretty straightforward proposition: It is designed eliminate some of the surprises that group health plan participants encounter from unexpected charges. Health Affairs This Week Podcast provides a tidy summary of the act. An initiative that affects revenue cycle needs further discussion : Advanced EOBs.

Read MoreArtificial Intelligence can be a dizzying technology to understand. While the term gets tossed around everywhere you turn, it’s important for financial institutions to have a strong baseline of knowledge on the different types of AI, in order to better leverage the technology.

Read MoreBanks in New Jersey were taken for many thousands of dollars The scam was a fairly elaborate, multi-step affair $250,000 had been stolen before the scammers were caught We all know about scams involving passing fake or altered checks, but what about elaborate multi-step operations? Here’s an interesting “What if?” exercise — could your bank…

Read MoreThis comes as no surprise to anyone in the industry: The COVID-19 pandemic did a number on the healthcare economy, ravaging volumes, revenues, and other financial metrics. We may be on our way to recovery, however. Kaufman Hall’s latest Hospital Flash Report paints an optimistic picture, reporting increases across hospital volumes, revenues, and margins last month compared…

Read MoreRecently, Royal Bank of Canada (RBC) has taken an approach similar to that of OrboGraph’s OrbNet AI Innovation Lab to bring AI technology to the financial industry; partnering with NVIDIA and Red Hat to create Borealis AI. But what is Borealis AI? And what do they do? Well, Borealis AI describes themselves as: A world-class AI research…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreStimulus and unemployment check proliferation requires higher-than-ever vigilance Scammers are using the phone to go after checks Which states are the biggest targets? As noted in this space previously, an unfortunate side-effect of the distribution of stimulus checks has been heightened activity by scammers attempting to take advantage of the situation via various fraud tactics.…

Read More