OrboNation Newsletter: Check Processing and Fraud – March 2024

The Importance of Deploying a Rules Engine in Check Fraud Detection

The importance of having a multi-layered technology approach to check fraud cannot be overstated. It's crucial to integrate myriad technologies -- such as transactional/behavioral analytics, image forensic AI, consortium data, dark web monitoring, and payee positive pay -- to increase check fraud detection capabilities while reducing fraud losses.

However, one key factor that is lesser known is what is called a rules engine.

Fraud rules engine, also known as a fraud detection rules engine, is specialized decision-making software used by financial institutions to detect and prevent suspicious activities.

OrboGraph Introduces OrboAnywhere Sherlock Version 5.3 to Address Increasing Check Fraud Attempts

Massive feature expansion delivers improved detection with reduced false positives

Burlington, MA, March 11, 2024 – OrboGraph, a leading provider of check fraud detection and image recognition solutions, is excited to announce general availability of their new OrboAnywhere Sherlock 5.3 Release.

Sherlock 5.3 provides a powerful list of new weapons which will assist financial institutions in their fight against check fraud, an ongoing and growing financial crime assault.

Highlights include:

- Data Attribute Expansion

- Embedded Rules Engine

- New Web-based Profile Editor

- Velocity Analysis

- Payee Integration

- Dark Web Matching

- Consortium Support

- Fraud Reporting

ICBA Addresses the Check Fraud Challenge for Community Banks

Over the past few years, the Independent Community Bankers of America (ICBA) have been on the forefront of taking on check fraud.

Last year, the ICBA worked with the USPIS to distribute an alert to community banks of red flags to look for, and they are continuing their efforts to help community...

OrboGraph Awarded AI Excellence Award by the Business Intelligence Group for Innovations in Check Fraud Detection

Burlington, MA, March 26, 2024 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, has won the prestigious AI Excellence Award in the Hybrid Intelligent Systems category for significant contributions to enhancing check fraud detection capabilities through its integrations to leverage consortium data.

OrboGraph has been at the forefront of combating the surge in check fraud, which has seen a 3-4X increase from pre-pandemic levels. Leveraging OrbNet Forensic AI technology, the OrboGraph OrboAnywhere suite has achieved remarkable success, boasting detection rates as high as 95%+ on counterfeits, forgeries, and alterations.

Predictive Intelligence: “Game-Changer” for Preventing Payments Fraud Attacks?

Payments Journal reports that Predictive Intelligence has emerged as a valuable tool for financial institutions in their efforts to mitigate fraud attacks on payments.

Unfortunately, faster payment systems have increased fraud by giving criminals many more opportunities and a much wider pool of potential victims.

New Cooperative Effort to Fight Mail Fraud

The American Bankers Association and the U.S. Postal Inspection Service have announced a cooperative effort to combat check fraud, kicking off the partnership with a rather extraordinary new infographic designed to educate consumers regarding what they can do to protect their mail and their checks.

With mail theft on the rise, it's indeed a very good idea for the Post Office to leverage as many effective alliances as possible -- including the US Congress -- in their ongoing defense of parcels as well as increasing safety for their personnel, who have been assaulted by persons looking to procure checks and parcels.

OrboGraph Hosted Events:

OrboGraph Innovation Conference

May 15-16, 2024

Access the Detailed Agenda →

OrboGraph Check Fraud Roundtable

May 14-15, 2024

Access the Detailed Agenda →

Location: Hilton Tampa Downtown

211 N Tampa St, Tampa, FL 33602

Writing Checks: Good for the Brain

Writing checks may seem antiquated. However, there are many advantages, including having a paper trail for your payment and the "buffer" time from sending to depositing.

Here's another advantage that comes from making sure people are comfortable using checks that you may not have considered:

Checks can actually make you .... smarter.

Dressed to Steal: Fake Letter Carriers Commit Postal Theft

A CBS News report from Chicago describes postal theft carried out by an individual wearing a completely authentic postal uniform. Surveillance photos provided by the USPS show him wearing what looks to be a baseball cap and sweater with the U.S. Postal Service logo on them.

While this apparel is indeed convincing to the layman, the Postal Police can spot the fakers.

In Challenging Times, Banks Cannot Afford to Defer Tech Investment

While current conditions may make banks conservative with tech investments, AI is emerging as a vital tool. Banks will need to stay up to date with AI in order to remain competitive.

The Financial Brand asked Pal Krogdahl, director of technology strategy and advisory services at digital banking platform provider Samlink, to share his valuable advice regarding banking technology.

Mail Theft Continues to be Priority for the Government — Is Privatizing Mail the Solution?

Since the pandemic, the post office has garnered much attention from the government -- both positive and negative.

As we've noted previously, the government is pushing several different bi-partisan legislative measures to protect mail and mail carriers. And, as Postmaster General DeJoy continues a slow-moving push to deploy counter measures against criminals, new avenues are making waves.

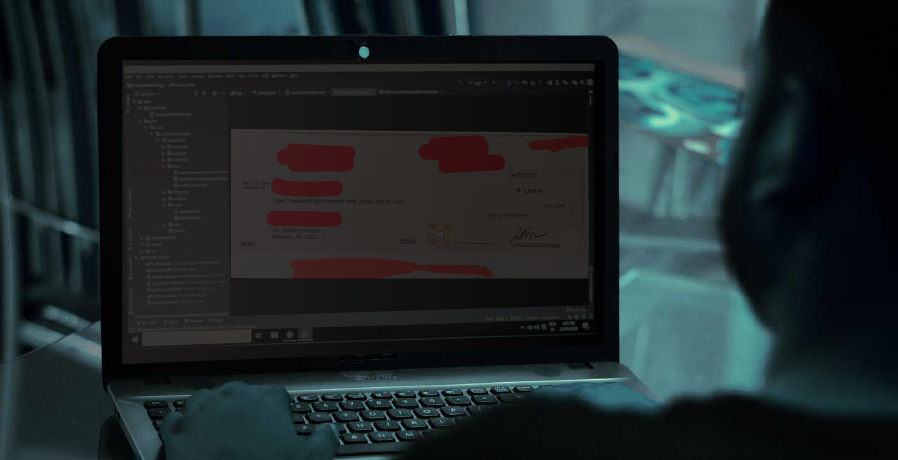

Check Cooking Lab: Low Investment, High Return

Florida's Attorney General, Ashley Moody, recently issued a warning about a digital check manipulation or "check cooking" scheme where fraudsters alter stolen checks to change the payee and payment amount. The warning comes in the wake of an investigation in which the Cyber Fraud...

US-Based Oracle Making Waves in the Banking Industry

Not long after we heard news that Apple has taken advantage of "open banking" in the UK to introduce a new feature allowing customers to connect eligible debit and credit cards in their Apple Wallet, Fintech Futures reports that US-based software provider Oracle has made two significant deals in 2024.

The first major deal is signing the first taker for its Flexcube core banking solution in Slovenia:

US Treasury Leverages AI to Recover $375M…A Small Drop in the Fraud Bucket?

CNN reports that the US Treasury Department has begun using artificial intelligence -- or AI -- to detect fraud and recover funds, adopting techniques already widely used in the private sector.

Starting around late 2022, the Treasury Department began using enhanced fraud-detection methods powered by AI to spot fraud, CNN has learned.