OrboNation Newsletter: Check Processing and Fraud – September 2024

Check Fraud Scenario Highlights Issues with “Breach of Warranty”

This past week OrboGraph’s own James Bi, Marketing Manager and Check Fraud Detection Specialist, was in attendance at the Wespay 2024 Payments Symposium. In addition to his presentation, Check Fraud in 2024: Are We Catching Up to the Fraudsters?, the conference held three distinct sessions on check fraud -- the banking industry continues to struggle with this specific challenge.

At the conference, Steven S. Cree, Vice President of ECCHO / The Clearing House, hosted an informative and interactive session entitled: Do You Have a Clue? Let’s Walk-Through Check Scenarios, where attendees were presented real-life check fraud scenarios and discussed the warranties and liabilities for each bank.

"This session was truly eye opening for all the attendees." said James Bi. "Different attendees had different perspectives, referencing regulations from UCC and Reg CC that they believed applied. Mr. Cree did an excellent job in explaining the answers so that attendees were able to take this information and apply it to scenarios at their FIs."

Banks Shifting From Competition to Collaborations to Fight Check Fraud?

Brian Keefe, Senior Pre-Sales Consultant at NICE Actimize, shares some advice for combating check fraud in the financial industry. Via "Q&A" format, Keefe highlights the ongoing threat posed by fraudsters to the traditional paper check system, despite a significant decline in check usage over the years...

75% of Organizations Still Use Paper Checks According to New PYMNTS Report

The industry narrative that "the check is dead" has lost a lot of steam. While checks have seen slight declines year-over-year, the US has not experienced the mass adoption of digital payments that were supposed to deliver the "knock-out blow" to check payments.

In fact, OrboGraph has seen financial institutions (FIs) change their tune, investing heavily in the payment channel. FIs are updating their legacy systems to deploy AI and machine learning technologies that automate the process.

There are various very good reasons for businesses to continue the use of checks...

How Financial Institutions Can Detect TikTok’s “Infinite Money Glitch”

TikTok trends are all the rage now. While YouTube remains the leader for content created by individuals, many are addicted to the short-form videos provided by TikTok. However, whatever the platform, this has contributed to poor advice or "tips" going viral -- particularly when it comes to the financial realm.

This has culminated in a viral trend where individuals unwittingly commit check fraud -- dubbed the Infinite Money Glitch.

According to NBC's Today, the origin of the trend can be traced back to a Tweet or "X" on August 29, 2024, where a user posted an image of their bank receipt from the ATM after depositing a fake $80,000.00 check...

OrboGraph Featured Speaker at Various Industry Events

Conference season is upon us, and here at OrboGraph, we are traveling all across the country to speak at various industry events on check fraud!

Past events:

- September 12-13, 2024: Wespay Payment Symposium

- September 20, 2024: Scientific Association of Forensic Examiners International Conference

- September 24-25, 2024: UMACHA Navigating Payments

Upcoming Events:

- September 29 - October 1, 2024: Fiserv Client Conference 2024

- October 7-10, 2024: 2024 Jack Henry Connect

- October 15-16, 2024: NEACH/PaymentsFirst 2024 End-User Payments Fraud Symposium

- October 16, 2024: Southern Financial Exchange Virtual Payments Fraud Symposium

- October 22-25, 2024: FIS Image Solutions User Group Meeting 2024

We look forward to seeing you at one of these events!

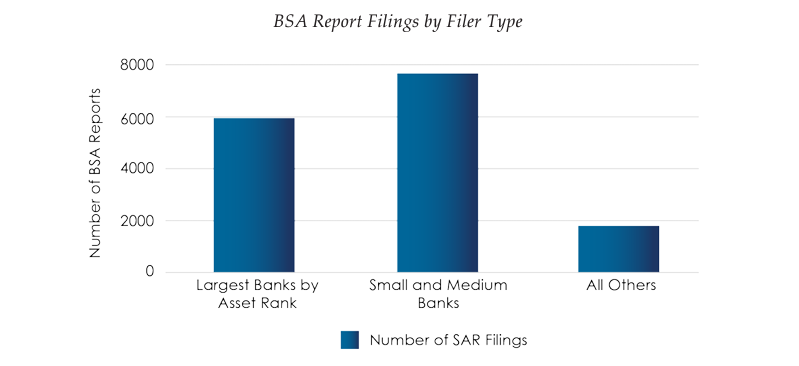

FinCEN Reports $688M in Check Fraud Linked to Mail Theft – What Financial Institutions Need to Know

The correlation between the increase in mail theft and rising check fraud is undeniable. Check fraud has been trending upwards since the EMV chip appeared; mail-theft and stolen checks have helped push check fraud attempts and losses to new levels. While many were surprised by the trend, OrboGraph -- a leader in check fraud detection -- saw preliminary indicators and was an early adopter of AI and machine learning technologies to help financial institutions in the fight against fraud.

Recently, FinCEN published its analysis of check fraud-related mail theft via press release. However, the numbers reported are deceiving.

According to the FinCEN Press Release, financial institutions reported over $688 million in suspicious activity related to mail theft-based check fraud in the six months following FinCEN's 2023 alert on the issue.

What needs to be understood is that $688 million is just a portion of the problem...

Core Modernization as Path to Banking Success: Four Approaches

We noted earlier this month that progressive modernization of technology is key for banking success. As stated by the post's author, Forbes Councils Member Rodrigo Silva:

With the right approach to technology, regional banks have the potential to innovate their way to competitiveness and higher profits.

This is a strategy we've seen in check processing, where financial institutions are investing in technologies like AI and machine learning from vendors like OrboGraph to automate the process -- creating new efficiencies...

Fidelity In Danger of Their Own Fraud “Glitch?”

Over the past few weeks, fraud professionals have closely followed the "Infinite Money Glitch" -- a viral trend that brought check kiting back into the spotlight. And, as an industry leader in check fraud detection, OrboGraph was no different and quickly did an analysis of the scam -- it was even noted during James Bi's presentation at the recent Wespay Payment Symposium.

Since their meteoric rise in 2015/2016, check fraud schemes have popped up across the globe. What is interesting to see if that many of these schemes are not new, just different twists or spins. For example, one common scam is the overpayment scam, where a check is delivered with a larger amount than expected. The scammer will then request the excess amount be sent back to them. But, did you know that overpayment scam has been around since 2004?

Who Thought Check Kiting Would Make a Comeback?

If you ask anyone in the banking industry if they thought check fraud would be running rampant in 2024, the majority would respond with a simple "no." However, OrboGraph saw signs back in 2015 that check fraud was starting to make a comeback with the introduction of EMV chips to credit/debit cards and was on the forefront of investing its research and development into artificial intelligence and machine learning for check fraud detection.

We noted recently that most check fraud schemes still utilize many of the same methods from decades ago, just with a little twist.

Well, it looks like Check Kiting is making a comeback -- with the "Infinite Money Glitch" as a prime example...

Why Investing in Banking Tech is Critical

The banking industry can learn from recent history; it can look back at the past few decades of "the check is dead" being stated as truth. At the recent Wespay Payment Symposium, Steve Cree, Vice President, ECCHO Rules and Member Governance - The Clearing House, reminded us that the notion of "check death" has been around since he started in banking back in 1983.

This sentiment is a major factor as to why checks have become a major target for fraudsters. Many financial institutions bought into the "check is dead" notion and chose not to invest in the payment channel. This left the channel not only inefficient, but also vulnerable to fraud. However, many FIs have made the move to deploy AI and machine learning for both check processing and check fraud detection, automating the payment channel while securing their customer accounts.

Will US banks learn from the lessons of the recent past? Can they glean insights from other banking markets across the globe?

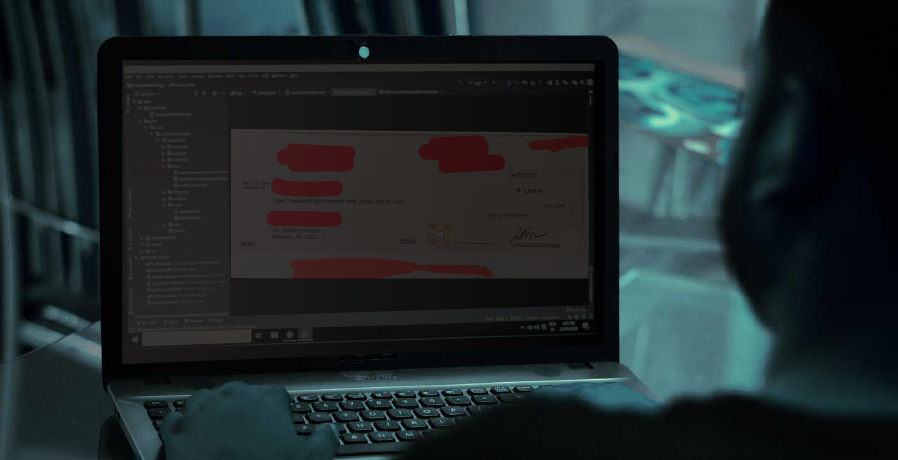

How Public Service Officers Can Spot Signs of Check Fraud

In the fight against check fraud, public service officers are often overlooked -- even as they play a crucial role to stopping fraudsters.

Financial institutions are seen as the last defense between fraudsters and their customers' funds. They are tasked with putting in place strong policies and procedures to fight fraud, while also working with companies like OrboGraph, who provide technology solutions including image forensic AI to identify when check payments are fraudulent...

LittleBricks Charity Almost Fall Victim to Overpayment Check Fraud Scam

What hurts more than stepping on a bunch of LEGO blocks while barefoot? Hearing that a charitable organization has fallen victim to a scammer.

Unfortunately, no one is off limits to fraudsters -- not even charities. While many would think that the fraudsters would imitate a charity to steal funds for donators, there are fraudsters who will target charities themselves via "contributions." While banks can protect their customers by utilizing technologies from vendors like OrboGraph to detect check fraud, they are also expected to help educate their customer base to be more aware of the scams...

Progressive Modernization of Technology Key for Regional Bank Success

A post at Forbes describes an environment where regional banks in the US face growing digital disruption and "macro headwinds" -- and describes how embracing technological change is crucial for their revival. The author, Forbes Councils Member Rodrigo Silva, goes on to note that this transformation must prioritize fraud prevention to protect both the banks and their customers.

Digital disruption has made it easy for customers to switch banks and unbundle their banking relationships, creating competition for each product in a customer's wallet...

A Complete Guide on How to Report Check Fraud

Check fraud poses a substantial risk to the banking industry, impacting both reputation and financial stability. At OrboGraph, we understand the importance of confronting this challenge head-on and how to report check fraud. The ingenuity of fraudsters has evolved, with various types of fraud – such as counterfeit checks, forged endorsements, and altered payee and amounts – becoming increasingly prevalent. We must stay proactive in identifying these deceptive practices and reporting them efficiently to mitigate risks and limit losses...