OrboNation Newsletter: Check Processing Edition – August 2021

Is Vigilance Enough to Prevent Your Customers from Deposit Fraud?

In the fight against deposit fraud, vigilance is a key component. But we need to ask ourselves as fraud prevention professionals: Is that enough?

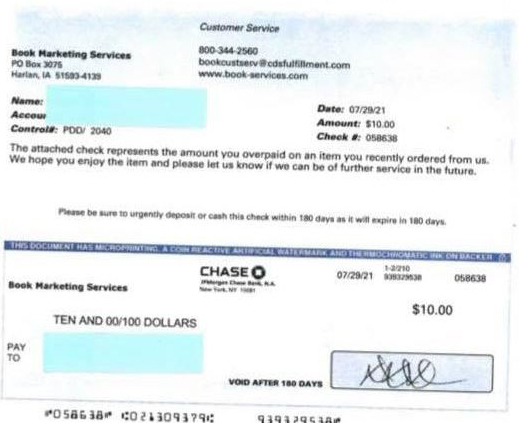

We review two examples in which people avoided becoming a victim of deposit fraud, including a video from Action 10 News detailing a "car wrap" scheme and a CBS 17 story detailing a "Book Marketing Services" scheme with the potential victim sharing the picture of the check mailed to them.

In these two situations, vigilance prevented fraud losses. But what else can be done by banks to prevent deposit fraud?

83% of Financial Pros Feel that AI is Important to Company’s Success

Kevin Levitt, Global Business Development, Financial Services, NVIDIA, has an excellent post at Finextra.com examining the prevalence -- and importance -- of Artificial Intelligence adoption in fintechs, investment firms, and consumer banks. Financial institutions are using...

PaymentsJournal Podcast: Machine Learning Leading Fraud Detection

PaymentsJournal offers a podcast wherein Patricia Rojas, Senior Manager Data Scientist at ACI Worldwide, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group, discuss the ways Machine Learning (ML) has become a vital component in the...

Happy Silver Anniversary, Symcor!

Congratulations go out to Symcor Inc. on their 25th anniversary in business! Symcor got its start as a joint venture between three of Canada’s largest financial institutions (the Toronto Dominion Bank, Royal Bank of Canada, and Bank of Montreal), and evolved...

Millennials Want Cryptocurrency to be Their Digital Payment

A commentary at Digitaltransactions.net by Peter Jensen, chief executive of RocketFuel Blockchain Inc., explores the reasons the Millennial generation are not only unintimidated by cryptocurrency, but also prefer it as the digital payment of choice: As the generation...

The Alcohol Industry Brews Efficiency from the Chaos of Regulation-Influenced B2B Payments

In any industry, dealing effectively and efficiently with suppliers is a challenge. This challenge is enormously compounded in the world of liquor sales, a maze of regulations and restrictions that change from region to region and bedevil even the...

Stimulus Check Scam Evolution – Prevention Tips

It is no surprise to note that scammers are, first and foremost, opportunists. When the United States government began issuing several rounds of stimulus checks, they were right there with complicated -- and not-so-complicated -- schemes in place...

Walmart: Taking On Banks for Consumer Business

Wal-Mart -- already equipped with its own credit and debit/prepaid cards -- has in recent months partnered with Ribbit Capital to start a fintech. Payments Journal reports that they are also looking at more financial services offerings via a branded all-purpose mobile app...

August is “Fraud Month” and the Fraudsters Are Targeting Back-to-School Shoppers

We've always known that "back to school" makes August a big month for retailers, but here's a little-known fact: August, as it turns out, is also the most popular month for fraud. It's back-to-school time, after all, and that means a lot of purchasing! The Berkshire Eagle reports...