OrboNation Newsletter: Check Processing Edition – July 2022

Alogent: “Checks Are Not Going Away”…with Data to Back It Up!

A post at Alogent starts with a very clear -- and, by now, familiar -- proclamation: "Checks are not going away."

The stigma around the use of checks was even the focus of an SNL sketch, where they joked about the amount of data needed before it could be tendered. What those script writers didn’t realize was the value and richness of this data, making the check one of the most secure forms of payment for consumers and businesses, as well as its importance in the larger transactional ecosystem linked to big data.

Check Fraud Roundtable

In collaboration with dozens of financial institutions of all sizes, OrboGraph facilitated the first session of the Check Fraud Roundtable (6/28/2022) -- a series of organized meetings to share experiences, trends, and prevalent fraud use cases, while identifying key technological barriers within on-us and deposit check fraud.

If you would like to participate in future roundtable sessions,

please email marketing@orbograph.com.

Gartner Inc. Predicts $623B Tech Investments in 2022 by Banks and Financial Services Firms

In a press release by Gartner, Inc., the company boldly predicts that banks and financial firms will boost their technology products and services investments in 2022 to the tune of $623 billion. Gartner Inc. goes on to identify what they consider the top three tech trends emerging in banking and investment services...

The Metaverse: The Next Frontier for Banking?

Brace yourself: It's time for banks to begin planning their move to the Metaverse.

Or Web3. Or Web 3.0. Or whatever they're calling it today. If you're not exactly sure what the Metaverse is, rest assured that you are not alone...but that hasn't stopped banks from eagerly diving in...

ABA Banking Journal: Complementing Technologies to Combat Check Fraud in the Digital Age

As cited by an article at the ABA Banking Journal, the 2021 Association for Financial Professionals Payments Fraud and Control Survey indicates that checks remain the payment method most impacted by fraud activity at 66% -- even as banking moves toward digital...

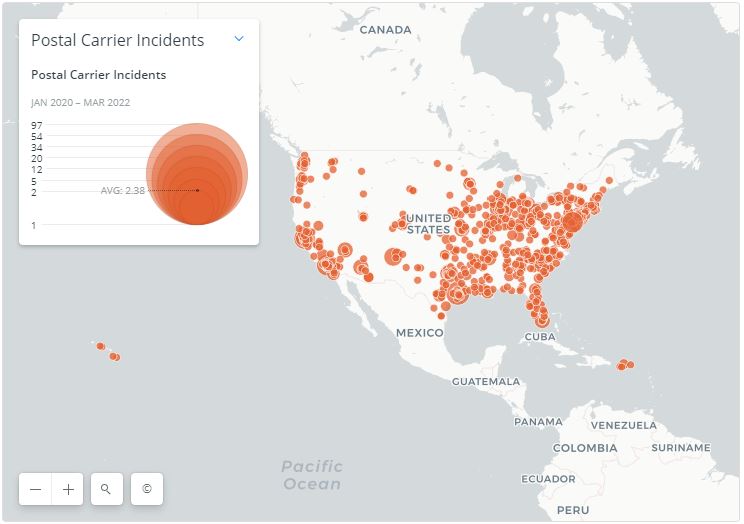

Mail Carrier Robberies on the Increase: Fueled by Check Fraud?

As if it weren't bad enough that fraudsters have made it a habit to steal from home mailboxes and even postal service mailboxes, there are now reports of mail carriers being physically assaulted in order to steal mail containing checks. Fraudsters, having gained access to online black market sales opportunities, have decided that it's worth the risk to actually steal from persons carrying the mail...

Forbes.com: Businesses Need to be Alert to Internal Check Fraud Schemes

Though digital payment options are popular (and there seems to be a new one every week), the fact is that checks remain a preferred payment method. As a result, check fraud by employees or third parties is something every company -- big and small -- must be aware of. Because every organization needs to put safeguards...

Frank on Fraud: 10 Fraud Worst Practices and How to Avoid Them

PYMNTS and Ingo Money have collaborated on The Money Mobility Playbook -- an exploration on how Fintechs and FIs can provide clients and customers with optimal money mobility regardless of the type of payment or disbursement they choose to make.

One of the many discoveries revealed within is that a considerable amount of payments made to small- to medium-sized businesses (SMBs) --29% -- are still via check...

Forbes.com: Businesses Need to be Alert to Internal Check Fraud Schemes

The always-informative Frank on Fraud blog discusses -- with accompanying highly entertaining imagery and GIFs -- the 10 Worst Fraud Practices and How to Avoid Them. Frank recognizes that the same mistakes seem to be made "year in and year out," so he put together a handy list to aid in addressing and tackling them...

Explainable AI (XAI): Challenges & How to Overcome Them

Artificial intelligence and machine learning technologies are making a big impact in the banking industry, as their ability to process millions and even billions of transactions in mere seconds is unparalleled. However, the astounding amount of data being processed means it's not without its pitfalls, particularly when it comes to decision making for complex tasks...

ACFE and SAS Release Anti-Fraud Technology Benchmarking Report 2022

The Association of Certified Fraud Examiners and SAS released their Anti-Fraud Technology Benchmarking Report 2022 -- a report exploring how organizations are using anti-fraud technologies and which ones they plan to adopt.

The fight against fraud can feel like a battle to stay one step ahead of the fraud perpetrators, especially as the fraud risks that organizations face today are more dynamic and persistent than ever. Thankfully, anti-fraud professionals have a full suite of technologies they can deploy to combat these threats...