Uncategorized

Rachel Woolley, global director of Financial Crime at Fenergo, tells FinTech Futures that penalties against financial institutions have come “fast and furious” over the past few years.

Read MoreOnPay Solutions President and CEO Neal Anderson minced no words in a recent interview with Pymnts.com wherein he discussed B2B payments fraud trends, including the growing threat of internal fraud. He went on to explain that organizations need to prepare themselves to address and mitigate the fraud threat, even as employees work from home.

Read MoreBG Motor Cars owner Noman Beg was on vacation when he took a look at his bank account — and noted, with considerable alarm, that a check had been written against his account for $33,525. Problem was, he had not written that check, nor did he foresee being able to cover it alongside normal expenses in the near future.

Read MoreIn a summary of Mercator Advisory Group’s new Insight Summary Report, 2020 Small Business PaymentsInsights, COVID-19 and B2B Payments & Cards – The Result of the Pandemic, PaymentsJournal.com summarizes their findings.

Read MoreThe “Check Clearing for the 21st Century Act,” also known as “Check 21” or “Check 21 Act,” launched on Oct. 28, 2004. Many are unaware that the terrorist attacks of Sept. 11, 2001—which grounded planes and caused major delays in check processing (preventing the transport of canceled checks to Federal Reserve banks)—was actually the event that spurred passage of Check 21.

Read MoreBy now, many of you have heard of the arguments between utilize GPU vs CPU. towardsdatascience.com provides a simple explanation on the reasoning behind the need for GPUs for machine learning:

GPUs are optimized for training artificial intelligence and deep learning models as they can process multiple computations simultaneously.

They have a large number of cores, which allows for better computation of multiple parallel processes. Additionally, computations in deep learning need to handle huge amounts of data — this makes a GPU’s memory bandwidth most suitable.

Read MoreWhile we mainly explore fraud and counterfeit scams from the payment side of things, it should be noted that the popularity of online shopping — particularly during the COVID-19 pandemic — has created a new breed of fraudster that creates and sells fake products. Meanwhile, Amazon is not immune from fraudsters, as reported in WIRED Magazine:

Read MoreCheck writers and depositors have become accustomed to a next day or two day check clearing process for the majority of items. But when an extended clearing process does happen, i.e. 2-3 days, it becomes a real inconvenience, especially for millennials accustomed to instant digital payments, or for those folks who still get payroll checks. There are many other examples.

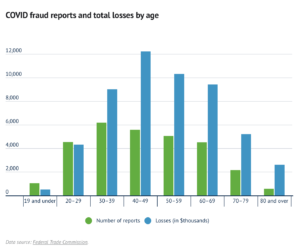

Read MoreMotley Fool’s The Ascent recently took look at FTC statistics in order to get a handle on mounting COVID-19 fraud losses losses to persons and businesses. COVID-19 fraud is defined in this case as any type of scam, fraud, or identity theft related to the novel coronavirus. Key findings from the report include: As of August 10, 2020, Americans have reported over 160,000 cases of fraud and losses of over $106 million.

Read MorePymnts.com explores the various hurdles banks face when taking that big — and increasingly necessary — step. They note that migrating to the cloud is a vital tool traditional financial institutions (FIs’) will need in order to compete with digital-native FinTechs.

Read More