Uncategorized

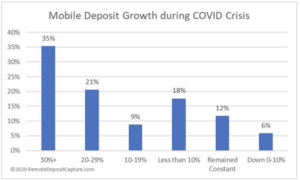

RemoteDepositCapture.com had a hunch that the Covid-19 pandemic would lead to an increase in RDC deposits (Mobile Deposit, Desktop, ATM, etc.). So, in late February, they started polling the industry, asking the following question: For Financial Institutions: What has been the rate of growth or decline in your mobile deposit volume over the past year?…

Read MoreAs noted many times both here and in the general media, check fraud persistent and pervasive — and now compounded by fraudsters constructing corona virus-related scams.

Financial institutions should be on high alert for scams and fraud schemes that target the institution itself and/or its customers. It is equally important for financial institutions to evaluate their current check fraud processes and technologies and identify any possible gaps.

Read MoreMoving from “big data” to “wide data” Visualization of data through DataOps and technology Data Visualization benefits for the Revenue Cycle Management In the digital world, we are seeing tremendous growth and robustness of data being collected through various systems, particularly in healthcare. According to a recent press release from Gartner: By 2020, most data and…

Read MoreOrboGraph will soon be launching a website refresh with the official market announcements around OrbNet AI and OrboAnywhere 4.0. Check recognition is a process which is not perfect, but the gap of unread items is closing. As technology approaches reading all legible items, it is important to look closely at “defect” items which did not…

Read MoreThis is a fairly typical fraud scheme that many, if not all of us, have encountered within our email inboxes. While we would normally mark the email as “spam,” delete it from our inbox, and move on with our day, there is a reason fraudsters continue to utilize this scam. The emails are sent to a large number of email addresses in hopes to find a less technically savvy individuals.

Read MoreAs the COVID-19 pandemic hopefully continues to subside — and the general population becomes more and more used to social distancing and appropriate use of facemasks — companies that had sent their employees home to work are beginning cautious steps toward bringing a portion of them back to the office. Cerner, for example, has begun…

Read MoreAccording to Frank on Fraud, there are 16 main types of check fraud On the surface, check fraud growth defies logic A huge amount of check fraud goes unreported – – up to $1.2 billion in losses per year, in fact FRANK ON FRAUD is a terrific (and entertaining) blog by Frank McKenna, the Co-Founder…

Read MoreA new podcast at PYMNTS.com features a conversation with Michael Reed, division president of payments at Deluxe. The podcast covers a wide range of timely payments topics, including: Checks still widely used with Reed reporting $7 trillion total transactional amounts with $2 trillion from lockbox. How work-from-home mandates have forced businesses to rethink how they…

Read MoreJavelin Strategy & Research has made available their 2020 Identity Fraud Study (available for download here). The data presents a sobering outlook:

The results of Javelin’s 2020 Identity Fraud Survey serve as a wake-up call—one that will force financial institutions, businesses, and the payment industry to reevaluate how identity fraud is managed. Total identity fraud reached $16.9 billion (USD) in 2019, yet the dollar loss is only part of the story. To have a more fulsome understanding of identity fraud a comprehensive evaluation of the drop in number of victims lead to several unsettling findings. Criminals are targeting smaller numbers of victims, while inflicting damage that is more complex to prevent or remediate.

Read MoreLast month, FT Partners hosted a VIP Video Conference to review their new industry research report, Understanding the Impact of COVID-19 on FinTech, which is available HERE. They were joined by three leading FinTech CEOs and discussed their approaches to the COVID-19 era. Video Conference Panelists: Steve McLaughlin, Founder and CEO of FT Partners Greg…

Read More