OrboNation Newsletter: Check Processing and Fraud – January 2023

Fraud Expert: Check Fraud Predicted to Hit $24B+ in 2023

Suparna Goswami of the ISMG Network spoke to Frank McKenna, chief fraud strategist at Point Predictive and creator of the always informative frankonfraud website, about how banks can prep for the onslaught of check fraud, first-party fraud, and AI-related scams foreseen for the immediate future.

McKenna starts by observing that 2022 was "a year like no other," which made it very interesting, he explains, from an observational standpoint.

"We see a thing like check fraud - an "old technology" type of fraud - become the number one type of fraud. Who would have guessed that?"

Looking ahead, McKenna warns that there is no relief in sight from the fraud threat as he predicts check fraud to hit $24B or more in 2023.

OrboAnywhere Version 5.0 Released with OrbNet AI Free Read

Handwritten and printed payee recognition expands product capabilities, new GPUs also certified

Burlington, MA, January 26, 2023 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, announced the release of OrboAnywhere Version 5.0 to business partners in December 2022. Version 5.0 delivers major architectural modernization and is applicable to all OrboAnywhere Modules.

Fraud Scheme — Straight from the Movies?

The Washington Post tells the story of a movie-emulator who instigated a copy-cat crime inspired by the 1990 film Office Space. Ermenildo “Ernie” Castro, a 28 year-old software engineer, followed the diabolical example he saw in the film:

And so the software engineer, much like the disaffected tech workers in the 1999 cult classic, allegedly injected malicious computer code into his employer’s information-technology system. For months, that code rerouted a portion of the shipping charges on tens of thousands of customers’ purchases, sending money to an account controlled by Castro instead of the online retailer he worked for, Seattle police wrote in court documents.

Ringing in the New Year: Community Banking Trends for 2023

2022 has been an eventful year for the banking industry. Banks have embraced technology and the digitization of banking -- confirmed by Gartner Inc predicting that banks and financial firms boosted their technology products and services investments in 2022 to the tune of $623 billion.

As we look forward to 2023, our friends at Alogent have identified what they see as the six major community banking trends to expect in 2023.

Identifying the Top 5 Vulnerabilities and Trends in Check Fraud for 2023

While there are no specific data points to reference just yet, we can conclude from conversations with our partners and clients within the banking industry that check fraud saw another surge in 2022 -- and there are no signs of it slowing down.

From our newest eBook entitled Top 5 Vulnerabilities and Trends in Check Fraud for 2023:

Ask anyone in the banking space and they will tell you - check fraud is back and is surging. The last benchmark of 2018 showed estimates of $15B in fraud attempts, translating into $1.3B in losses. Most experts and financial institutions agree that attempts are up 300%+ from pre-pandemic levels.

New BAI Executive Report Highlights Fraud Prevention

This month’s BAI Executive Report examines in great detail the current state of fraud protection and what can be done to bring more efficiency and effectiveness to the effort.

As BAI explains, this includes a look at the role of both humans and technology in various fraud prevention strategies.

Community and Small Banks: How to Increase Business Banking Relationships in the Age of Fintechs

Turns out community banks and credit unions can be proud of themselves: According to a recent Javelin study as reported at Jack Henry Fintalk, businesses that identify a community bank or credit union as their primary financial institution report far greater satisfaction than those using a larger bank.

However, before smaller financial institutions break out the champagne, there are other factors to examine...

Current Landscape of Financial Fraud: Emerging Tools for Check Fraud Detection (Infographic)

According to an article at BANKING EXCHANGE by Farshid Sabet, Chief Business Officer of Katana Graph, fraud has ballooned into a $130 billion global financial problem.

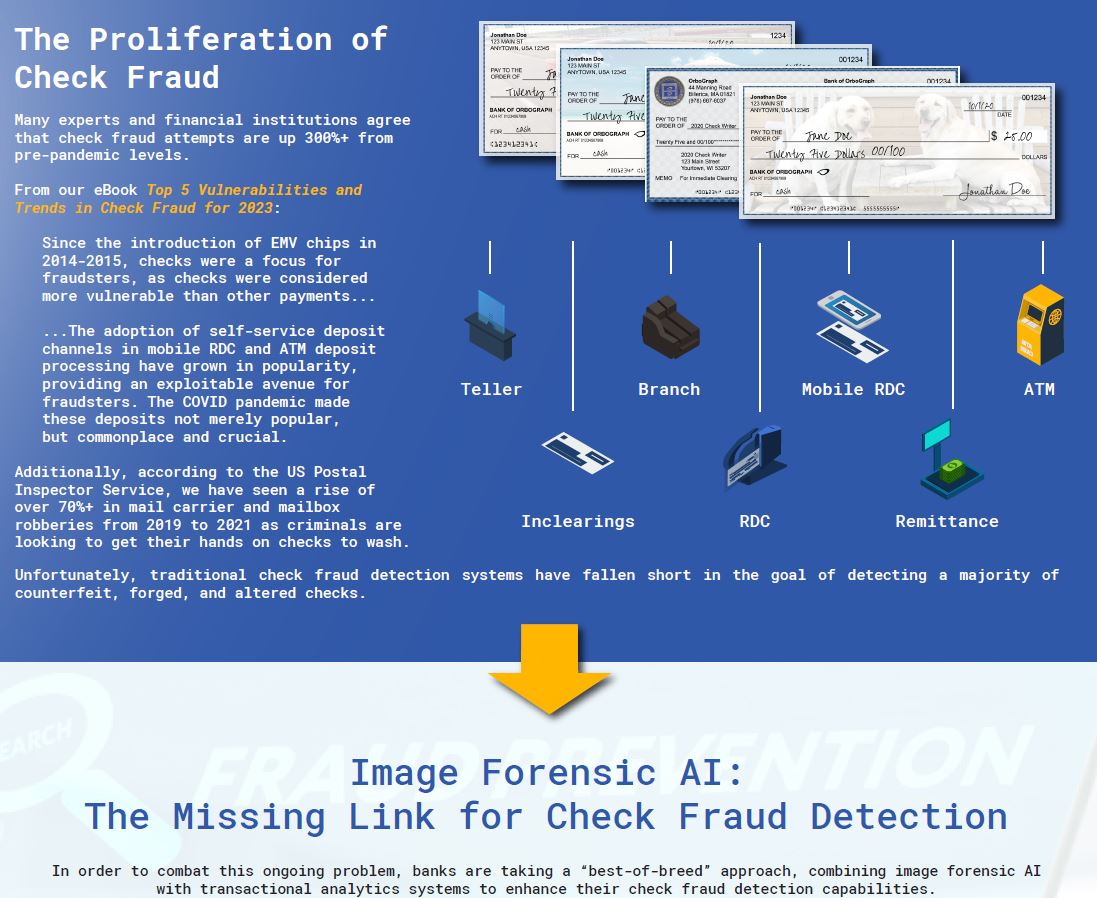

As noted in our new infographic entitled The Proliferation of Check Fraud:

Traditional check fraud detection systems have fallen short in the goal of detecting a majority of counterfeit, forged, and altered checks.

OrbNet AI: Applying Technology to International Markets

Artificial Intelligence has been making waves over the past decade, establishing itself as a technology that will revolutionize nearly all industries in some capacity.

For those in the banking industry, the application of AI has spread across a wide variety of utilities. which includes everything from AI chat assistants to automating back-end functions. This includes check processing and stemming check fraud, where OrboGraph's OrbNet AI and OrbNet Forensic AI have made major impacts in automation and fraud detection.

Challenger Banks Feeling the Pressure of Fraud

Challenger banks -- aka neobanks in the USA -- distinguish themselves from the historic banks by featuring modern financial technology practices, such as online-only operations, that avoid the costs and complexities of traditional banking.

While different than traditional banks, they are not immune to the challenges of check fraud...

The Check is in the Mail: 2023 Tax Filing Season is Upon Us

Tax filing season is upon us, and that means -- after a bit of frustration and receipt-hunting -- millions of Americans will be filing to receive refunds. In 2021 (the latest data available from IRS), 600.1 million refunds were issued at a total of $1.1 trillion value.

That's "trillion" with a "t." And, while many file their taxes electronically and receive refunds by direct deposit, two out of ten taxpayers still get their refunds in the form of paper checks via mail. The math is staggering: 20% of 600 million = 120M in checks.