OrboNation Newsletter: Check Processing and Fraud – January 2024

Exploring the Strengths and Weaknesses of Positive Pay Systems for Check Fraud Detection

Recently, OrboGraph's Marketing Manager and Check Fraud Detection Specialist James Bi had a conversation with a mid-sized bank about check fraud detection solutions. Specifically, this bank was interested in positive pay systems; they desired to be better educated to sell to their corporate customers.

As many of our readers know, a typical positive pay solution extracts the MICR, serial number, and amounts from a newly deposited check and compares this data to an issuer file that is provided by the corporate customer. While a powerful tool, it's important to understand that this is just one piece of technology that should be part of an overall, multilayered check fraud detection strategy.

Over the past few years, however, positive pay systems have received technology enhancements that make them are a stronger tool for check fraud detection.

OrboGraph Partners with Dr. David Maimon, Expert in Proactive Fraud Intelligence

Relationship will drive new innovation and collaboration around dark web check fraud prevention

Burlington, MA, November 13, 2023 – OrboGraph, a global leader in the fields of check fraud detection and image recognition solutions, is excited to announce a strategic partnership with Dr. David Maimon, Professor at Georgia State University, and a recognized authority in Proactive Fraud Intelligence. This collaboration underscores OrboGraph's commitment to remaining at the forefront of fraud detection and prevention in the financial industry.

As part of this partnership, Dr. Maimon will be a featured presenter at the upcoming OrboGraph Virtual Check Fraud Roundtable on November 14th. The roundtable will provide a platform for industry leaders and experts to discuss the latest advancements in fraud detection, focusing on emerging trends in dark web activity...

How and Why mRDC is Exploited by Fraudsters

Having read an article published by ABA on their Risk and Compliance portal titled “The Dangers of Mobile Remote Deposit Fraud," David Peterson, Chief Innovation Officer, Speaker, Facilitator and Advocate for Metacognition!, purports to discuss the dangers of labeling mobile remote deposit capture (mRDC) as the source of check fraud.

He presents a scenario and makes a very interesting point...

Millennials and GenZ: The Newest Check Writers?

In the newest segment of their “I’ve Always Wondered” series, which addresses questions many of us have about the economy and spending habits, Marketplace tackles the question: "Why do we still use paper checks?"

For insight, they consulted experts:

There are a slew of reasons explaining our continued check use. Many check writers have had lots of positive experiences with them, and it can be difficult for people, in general, to change their behavior, explained Cynthia Cryder, an associate professor of marketing at Washington University in St. Louis.

Examining the Deposit Fraud Trends in 2024

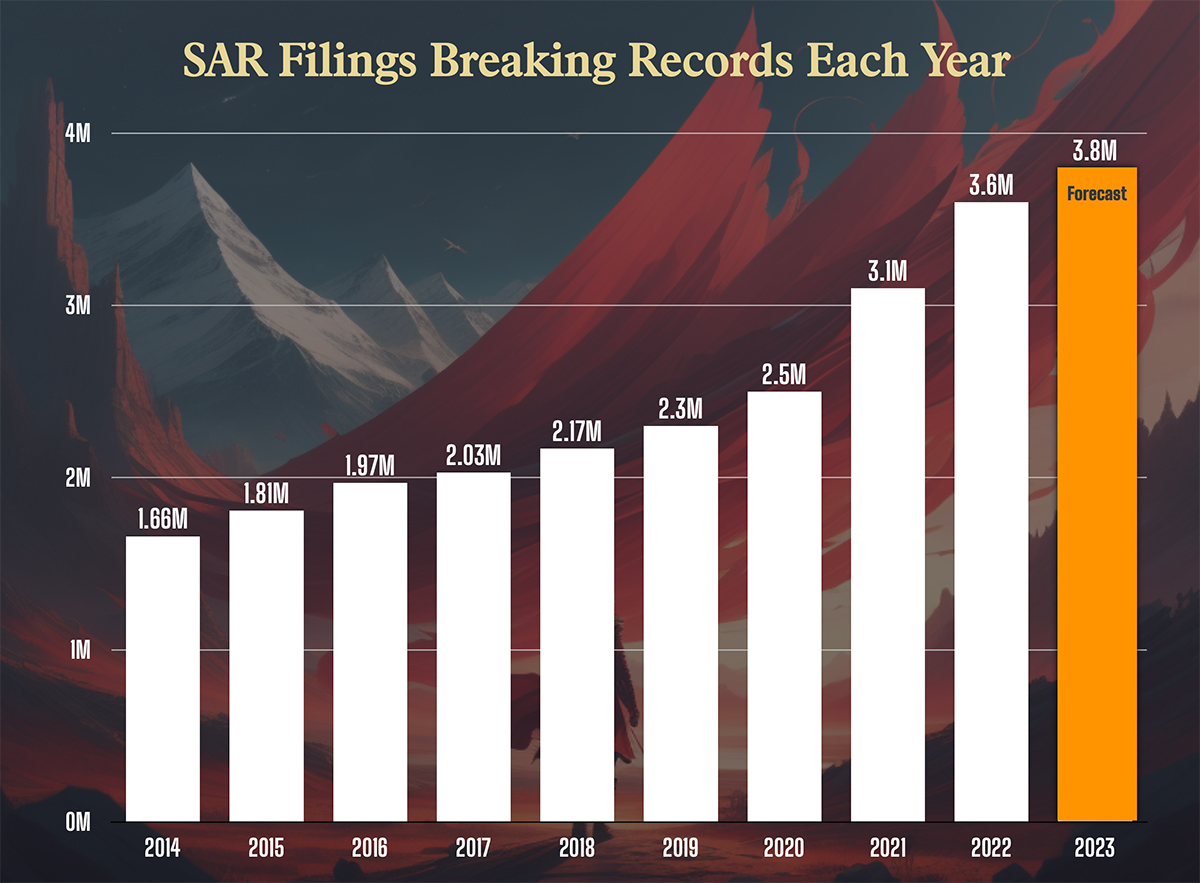

Advanced Fraud Solutions has released their 2024 Deposit Fraud Trends Report -- describing the complexity with deposit fraud, particularly as "new scams emerge every week, technologies evolve at lightning speed, and unforeseen events like pandemics add to the challenge."

The report notes that there were 1 million cases of deposit related fraud in first half of 2023. It's crucial for financial institutions to be aware of the scams to better protect themselves and their customers.

With the staggering number of deposit-related fraud cases in 2023, what can we expect for 2024?

FrankonFraud: Ten – No, Eleven – Fraud Predictions for 2024

Fraud in 2023 saw an increase in almost every possible channel. And, while we are able to look at past historical data for each payment channel, it's difficult for anyone to predict the future. However, Frank McKenna, author of the always informative FrankonFraud blog, has taken on the challenge with the help of fellow #FraudFighters Mary Ann Miller and Karrisse Hendrik and published their fraud predictions for 2024.

My fraud-fighting friends, Mary Ann Miller and Karrisse Hendrik, and I mind-meld each year to imagine the year ahead.

A flurry of text and Zoom calls goes on for weeks. Out of that process, we create ten predictions we think will come true in the next 12 months (or perhaps beyond).

X Marks a Spot in Payments — Maybe

Back in April of 2023, we noted Elon Musk's aspirations to turn his newly named "X" in the everything app, including payments. This share parallels with other big name fintechs like Apple who want a share of the banking pie.

Well, Banking Dive reports that Elon Musk has made public his plans to launch peer-to-peer payments on the platform in 2024. This would allow users to transact directly on X, expanding its utility and commerce opportunities...

ABA Journal: Integrated Anti-Fraud Approach Critical for 2024 Success

The article highlights the three primary fraud techniques at work today: Counterfeits, Forgeries, and Alterations.

ABA Risk and Compliance takes a look at check fraud, a persistent challenge for banks with reported cases doubling in 2022.

But, none of this is really a problem because checks are going away, right? The answer is a resounding no:

Technology and Collaboration: The Foundation of a Strong Check Fraud Strategy

Sherah S., Head of Legal, Risk, and Compliance at CheckAlt, recognizes that check fraud is growing more and more common and accessible to fraudsters. That doesn't mean financial institutions and businesses are helpless against the threat, however. In a recent LinkedIn post, she discusses five strategies and insights for organizations to that are crucial to deploy in their battle against check fraud:

- Embrace cutting-edge fraud detection software to analyze patterns and identify potential fraud.

- Foster collaborative partnerships with other financial institutions to share information and adopt best practices.

- Provide comprehensive training for employees to educate them on fraud techniques and how to identify and report suspicious activity.

- Implement robust authentication methods like multi-factor authentication to verify identities and access.

- Adopt continuous monitoring through advanced analytics to detect suspicious transactions or unauthorized access in real time.

Alogent’s 2024 New Years Resolutions for Mobile Banking

Wendi Klein, VP of Marketing at Alogent, asks if 2024 just might be the time to take an even more serious look at mobile banking and suggests the best ways to take advantage of what has by now become an expected banking feature:

With the kick-off to 2024, it’s an opportune time for financial institutions to set resolutions that align with today's dynamic banking landscape. Although mobile banking has become commonplace, this is still an area for banks and credit unions to differentiate themselves. Given the market's ever-growing demand for convenience, security, and innovation, it's critical to continue to adapt within the mobile banking arena to remain competitive and meet account holder expectations.

NY Times Investigative Reporting: Reaching Out to Unknowing Stolen Check Victims

On the heels of NY Times reporter Tara Siegel Bernard covering the rise of check fraud, colleague Rob Lieber has taken it a step further to investigate the epidemic. In his related article on NY Times, Lieber gains access to these check fraud groups to take a look at how stolen checks on being sold on Telegram.

Lieber notes that the Telegram app is easily downloadable on any smartphone -- making the platform easily accessible to fraudsters. Remember, Telegram is an encrypted messaging platform, making it difficult for law enforcement to gather evidence of crimes. He utilizes his investigative reporting skills to gain access to a group, where he finds a plethora of stolen checks for sale.