Blog Post

Having already announced our client and partner virtual technology conference in late September, OrboGraph has completed it’s speaker line-up for the ORBOIMPACT conference for the afternoons of October 29th and 30th (see agenda here). Day 1 (Thursday, Oct. 29): Healthcare Payments Sessions Day #1 is highlighted by Keynote speaker Mr. Michael Manna at 12:15 PM ET. During the…

Read MoreAs we continue to explore the check fraud trends in 2020, an OrboGraph/Alogent collaboration brings this exciting webinar: The Future is Now: Industry Insights and the Role of Data to Mitigate Check Fraud and Modernize Deposits. In this unique webinar/streaming session, hosted on Thursday, October 22, 2020 from 2:00 – 3:00 PM EST, we will discuss…

Read MoreThe ABA Deposit Fraud Account Fraud Survey is the “official” industry benchmark when it comes to fraud trends and losses for banks and financial institutions. The latest version, released on January 1, 2020, is labeled as the 2019 report. The survey provided great depth and illustrated that fraudsters “went a little crazy” from 2016 to…

Read MoreResearch by TransUnion, whose flagship fraud prevention solution IDVision® with iovation® gives them intelligence from billions of transactions and more than 40,000 websites and apps, recently released their quarterly analysis of global online fraud trends found that fraudsters are decreasing their schemes against businesses, but increasing COVID-19 focused scams against consumers online.

Read MoreIt’s a story becoming more and more common, unfortunately: On May 19, Stephen Holder of Franklin, WI lost his job because of COVID-19. Not to worry. Four days later Stephen got an alert for for a remote position via CareerBuilder. Things were looking up! Or were they?

Read MoreOnPay Solutions President and CEO Neal Anderson minced no words in a recent interview with Pymnts.com wherein he discussed B2B payments fraud trends, including the growing threat of internal fraud. He went on to explain that organizations need to prepare themselves to address and mitigate the fraud threat, even as employees work from home.

Read MoreBG Motor Cars owner Noman Beg was on vacation when he took a look at his bank account — and noted, with considerable alarm, that a check had been written against his account for $33,525. Problem was, he had not written that check, nor did he foresee being able to cover it alongside normal expenses in the near future.

Read MoreThe “Check Clearing for the 21st Century Act,” also known as “Check 21” or “Check 21 Act,” launched on Oct. 28, 2004. Many are unaware that the terrorist attacks of Sept. 11, 2001—which grounded planes and caused major delays in check processing (preventing the transport of canceled checks to Federal Reserve banks)—was actually the event that spurred passage of Check 21.

Read MoreWhile we mainly explore fraud and counterfeit scams from the payment side of things, it should be noted that the popularity of online shopping — particularly during the COVID-19 pandemic — has created a new breed of fraudster that creates and sells fake products. Meanwhile, Amazon is not immune from fraudsters, as reported in WIRED Magazine:

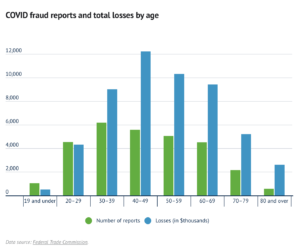

Read MoreMotley Fool’s The Ascent recently took look at FTC statistics in order to get a handle on mounting COVID-19 fraud losses losses to persons and businesses. COVID-19 fraud is defined in this case as any type of scam, fraud, or identity theft related to the novel coronavirus. Key findings from the report include: As of August 10, 2020, Americans have reported over 160,000 cases of fraud and losses of over $106 million.

Read More