Blog Post

A story from the New York Post features Case William Kelley, 42, who utilized a home printer to create a fraudulent check to successfully purchase a Porsche from an Oklahoma Dealer. This may sound like fake news…

Read MoreNigerian “419 scammer” goes big time “Hushpuppi” portrayed himself as successful and wealthy to recruit and fool victims It was a small error that eventually snared him By now, the phrase “Nigerian email scammer” has become a cliche to the extent that one wonders if they actually exist in the literal sense — a person…

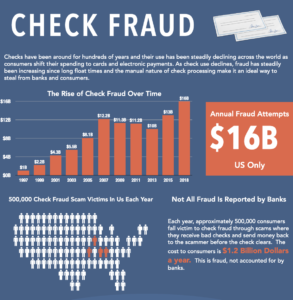

Read MoreAn article by Antoinette Burnside, assistant vice president and product manager for Kennewick-based Community First Bank and HFG Trust, appeared in the Tri-Cities Area Journal of Business, describing how pervasive check fraud is feeding financial fraud in general.

Read MoreAmong the myriad fraud schemes emerging during the COVID-19 crisis are “money mule schemes.” A money mule is “a person who transfers illegally acquired money on behalf of or at the direction of another.” These are scams that, frankly, take advantage of the desperation some persons and businesses feel due to to COVID-19 economic impacts. In this climate, actors are able to fairly easily deceive otherwise savvy victims by impersonating federal government agencies, international organizations, or charities.

Read MorePymnts.com looks at the startling emerging story of a Germany payments company called Wirecard, where as much as $2.1 billion may be unaccounted for.

The story notes that “even the largest companies with the most resources to digitize and combat fraud are not immune to the risk — from both within and outside of, the organization.”

Read MoreAs seen in the above video, scammers representing themselves as officials of government agencies is a common tactic. Victims are caught off-guard by the scammer’s aggressive tone and threats of legal repercussions, raising the victim’s anxiety and clouding their judgement to extract money from them. The scammers have adopted a new angle, utilizing the pandemic to their advantage.

Read MoreAs noted many times both here and in the general media, check fraud persistent and pervasive — and now compounded by fraudsters constructing corona virus-related scams.

Financial institutions should be on high alert for scams and fraud schemes that target the institution itself and/or its customers. It is equally important for financial institutions to evaluate their current check fraud processes and technologies and identify any possible gaps.

Read MoreThis is a fairly typical fraud scheme that many, if not all of us, have encountered within our email inboxes. While we would normally mark the email as “spam,” delete it from our inbox, and move on with our day, there is a reason fraudsters continue to utilize this scam. The emails are sent to a large number of email addresses in hopes to find a less technically savvy individuals.

Read MoreAccording to Frank on Fraud, there are 16 main types of check fraud On the surface, check fraud growth defies logic A huge amount of check fraud goes unreported – – up to $1.2 billion in losses per year, in fact FRANK ON FRAUD is a terrific (and entertaining) blog by Frank McKenna, the Co-Founder…

Read MoreJavelin Strategy & Research has made available their 2020 Identity Fraud Study (available for download here). The data presents a sobering outlook:

The results of Javelin’s 2020 Identity Fraud Survey serve as a wake-up call—one that will force financial institutions, businesses, and the payment industry to reevaluate how identity fraud is managed. Total identity fraud reached $16.9 billion (USD) in 2019, yet the dollar loss is only part of the story. To have a more fulsome understanding of identity fraud a comprehensive evaluation of the drop in number of victims lead to several unsettling findings. Criminals are targeting smaller numbers of victims, while inflicting damage that is more complex to prevent or remediate.

Read More