OrboNation Newsletter: The Best Articles from 2022

BAI: Majority of Banks See Checks as Biggest 1st & 3rd Party Fraud Concern

The latest BAI Deep Dive takes on "The fraud prevention balancing act: protection vs friction." Much of the discussion involves changes seen in fraud prevention techniques as consumer attitudes and expectations have evolved and changed in the face of new technology and the pandemic.

Guests for the discussion are:

- Jen Martin, Head of Enterprise Fraud Services at KeyBank

- Kevin Sanchez, Senior Vice President of Digital Financial Crimes at US Bank

- Karl Dahlgren, Managing Director of Research at BAI

- Holly Hughes, Chief Marketing Officer at BAI

OrboGraph Launches #OrboIntelligence Check Fraud Hub

Microsite highlights primary and secondary research in check and payments fraud

Billerica, MA, November 17, 2022 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, announced today the launch of the #OrboIntelligence Check Fraud Hub – a dedicated microsite resource centralizing primary and secondary research, industry trends, and 3rd party reports in the field of check and payments fraud.

PYMNTS.com: 81% of Businesses Still Pay Other Firms Via Paper Checks

While many industry experts have predicted the demise of checks and subsequent move towards fully digital payments, the reality is that checks are NOT going away anytime soon. In fact, a new PYMNTS report, THE TREASURER'S GUIDE TO AR PAYMENT OPTIMIZATION, reveals that 81% of businesses still pay other firms via paper checks, making it the most common B2B payment method, even amid companies’ digitization efforts.

mRDC: Tempting Fraud Target for the “Casual Fraudster”

In a recent interview with PYMNTS.com, Rusty Pickering, President and Chief Operating Officer, and Bill Roese, Chief Risk Officer of Ingo Money spoke about how check fraud continues to thrive alongside of digital banking tools -- and how digital banking tools may be assisting check fraud.

NICE Actimize 2022 Fraud Insights Report: 41% Increase in Attempted Fraud

NICE Actimize recently released "The 2022 NICE Actimize Fraud Insights Report," which identifies and analyzes the leading fraud threats and patterns that impacted leading global financial institutions in 2021.

The report makes clear that banking fraud continues to rise: the data-driven research study found a 41% increase in attempted fraud over a similar evaluation conducted the year before.

Did EMV Start the Check Fraud Pandemic?

EMV cards have much to tout when it comes to security and fraud prevention. EMV fraud prevention technology is a fraud detection tool which uses tokenization technology to transmit one-time-use encrypted information in place of cardholder data. The cardholder’s data is never transmitted, so it is much harder for hackers to intercept and steal it.

However, when examining the introduction of the EMV chip to credit and debit cards, we can see a direct correlation where in just a few years, fraudsters shifted towards the check...

Checks Are Still Relevant: A Bank’s Perspective

As we continue to explore the relevancy of checks as a payment avenue, it's important that we keep in mind some data previously noted in our blog:

- Checks still account for nearly 23% of the total value of payments in 2020

- 81% of businesses still pay other firms via paper checks

- 78% of renters are paying by check

- 60% of the freight and logistics Industry still pay carriers and shippers with paper checks

PaymentsJournal: Checks Are the Top Vehicle for Commercial Payments Fraud

The new episode of Truth In Data from PaymentsJournal features information on the types of commercial payments fraud that are afflicting organizations -- and they find that, while declining, checks are the leading tool used for fraud.

According to Data provided by Mercator Advisory Group’s Report entitled The Cost of Fraud: B2B Payments Experience 10% Increase During the Pandemic, of the organizations surveyed...

78% of Renters Still Pay by Check — And It’s Not Only Renters Writing Checks

As we noted in a previous blog, checks are NOT going away. In fact, our friends at Alogent reported that of non-cash payment methods, checks accounted for nearly 23% of the total value of payments in 2020, according to the December 2021 Federal Reserve report.

This may lead you to ask the question: Who still uses checks?

Fiserv Survey: 64% Would Increase Check Usage if Funds Were Immediately Available

Victoria Dougherty, Fiserv's Director of Product Management, Financial and Risk Management Solutions, notes that "reports of the paper check's death have been greatly exaggerated."

Most people still write and cash checks, even if they do it less frequently. Plus, with fewer checks in circulation, the checks people write and receive – and the funds tied to them – may be more relevant to how people live and work.

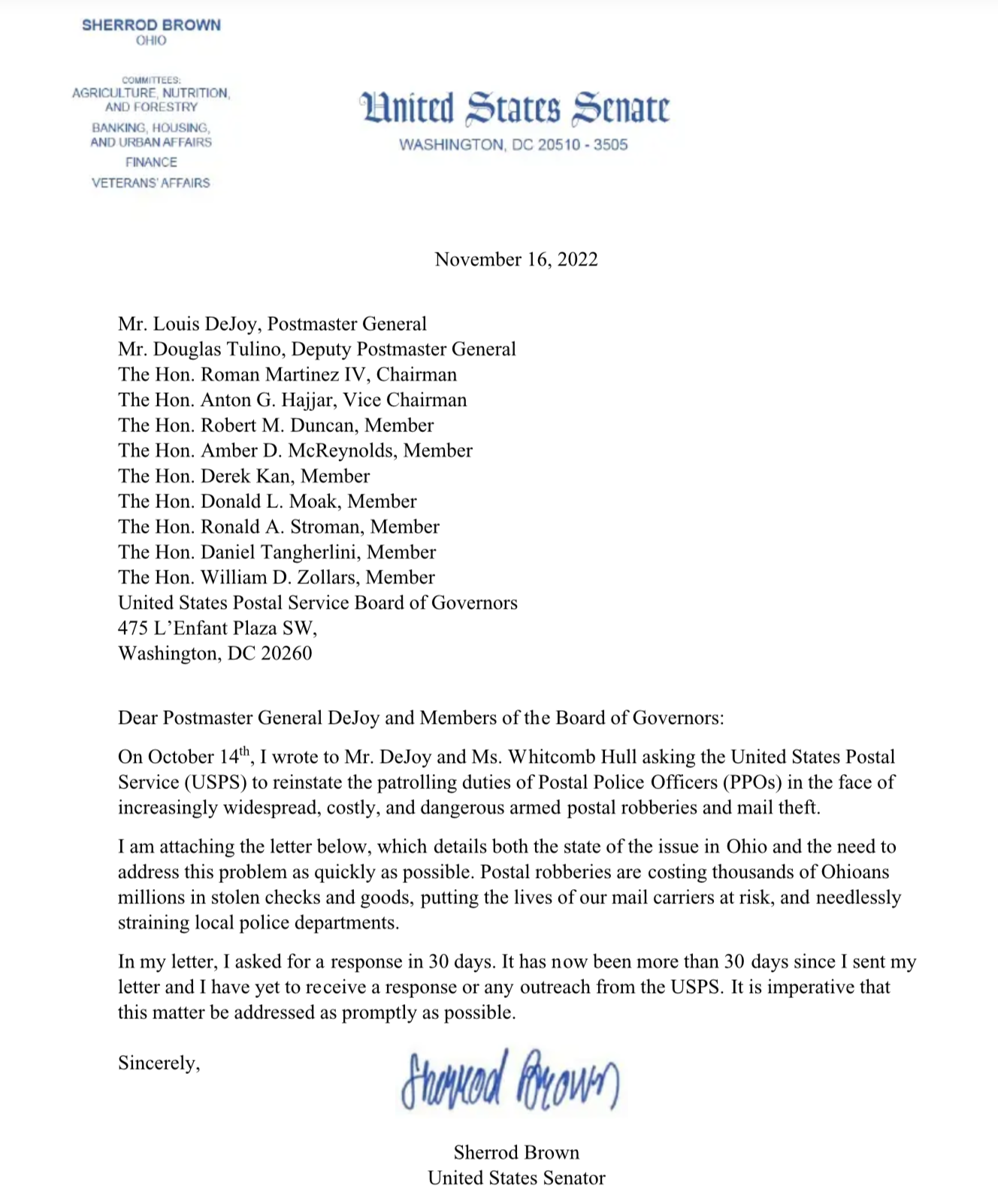

Government Increasing Pressure on Post Office to Curb Mail Theft & Check Fraud

American news website Axios takes a look at the huge uptick in check fraud crime, particularly check washing and what is being called "mailbox fishing."

Thieves are stealing paper checks from mailboxes, "washing" them with nail polish remover, and filling in new amounts and payees — causing endless grief for victims and their banks, which typically foot the bill.

Axios also notes the increase in fraudsters committing violent crimes, robbing postal workers for their mail and "arrow keys," the topics of banks and the postal office pointing fingers at who is to blame, and the attention check fraud is garnering from elected government officials...