Uncategorized

If you’ve been following the news, you’ve heard warnings about COVID-19 infection spikes as a result of seasonal and behavioral factors. Another unfortunate spike related to the pandemic is check fraud.

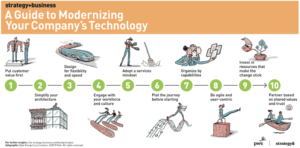

Read MoreEven as we see our industry create and adopt newer and better, more precise tools for improving check processing and preventing fraud (we proclaimed 2019, remember, the Year of AI and Modernization), it’s important to be aware of how to most effectively integrate new technology the current ecosystem in a manner that maximizes return on investment.

Read MoreWe’ve discussed at length the ways in which Image Analysis is a crucial tool in preventing and detecting check fraud. For instance, image analysis is deployed to “see the attributes of an image” and compare that to previously cleared checks for match purposes.

Read MoreMore than ever before, the healthcare industry is forced to maintain spartan budgets — even as an unprecedented pandemic puts stress on all aspects of the industry. In a HIMSS20 digital presentation, Mark Morsch, vice president of technology at Optum360, cited data indicating a huge hole in efficiency — as much as $200 billion in administrative waste due to inefficient revenue cycle practices.

Read MoreAs we continue to explore the check fraud trends in 2020, an OrboGraph/Alogent collaboration brings this exciting webinar: The Future is Now: Industry Insights and the Role of Data to Mitigate Check Fraud and Modernize Deposits. In this unique webinar/streaming session, hosted on Thursday, October 22, 2020 from 2:00 – 3:00 PM EST, we will discuss…

Read MoreThe “death knell” for checks has been sending false alarms for a decade; year after year we are told it’s time for checks to fade away, and 2020 is no different. However, the paper check hangs on and remains undeniably popular in spite of the frequency with which it is derided.

Read MoreThe ABA Deposit Fraud Account Fraud Survey is the “official” industry benchmark when it comes to fraud trends and losses for banks and financial institutions. The latest version, released on January 1, 2020, is labeled as the 2019 report. The survey provided great depth and illustrated that fraudsters “went a little crazy” from 2016 to…

Read MoreIt’s a safe bet to say that making a … safe bet during an unprecedented pandemic is not the easiest thing in the world. All the same, Becker’s Health IT got 20 healthcare executives and leaders to commit to posterity one health IT industry prediction for the next five years, and the answers are interesting,…

Read MorePredicting an economic recovery in today’s COVID-19 environment is far more complex than reading traditional individual economic indicators. As seen by the recent run in the stock market, there are certain market components somewhat disassociated from traditional indicators, i.e. unemployment rate, GDP growth, etc.

Read MoreResearch by TransUnion, whose flagship fraud prevention solution IDVision® with iovation® gives them intelligence from billions of transactions and more than 40,000 websites and apps, recently released their quarterly analysis of global online fraud trends found that fraudsters are decreasing their schemes against businesses, but increasing COVID-19 focused scams against consumers online.

Read More