OrboNation Newsletter: Check Processing and Fraud – July 2023

Former Fraudster Shares His Go-To Check Fraud Scams

Perhaps one of the best ways to learn about fraud methodologies might be to "look over the shoulder" of a person who actually perpetrated check fraud -- which is exactly what is presented in Part 10 of "Zack's Life Story" on YouTube.

"Black Zack" provides some information about his past, including several stints in prison. Since being released, he's decided to share with the world "entertaining crime stories" in the form of episodic examinations of his life in and out of jail and some of the scam activity with which he was involved. His ultimate goal is to put his criminal past behind him.

OrboGraph Writer Verification Technology Wins Business Intelligence Group’s 2023 AI Excellence Award for Detecting Altered and Fictitious Checks

Company wins award back-to-back years for Hybrid Intelligent Systems category

Burlington, MA, April 4, 2023 - OrboGraph, a premier supplier of check processing automation and fraud detection software and services, announced today that the company was selected as winner of the prestigious 2023 AI Excellence Award in the Hybrid Intelligent Systems category for its latest AI innovation in detecting altered and counterfeit checks with its new Writer Verification™ technology.

Artificial Intelligence for Fraud: Fighting Fire with Fire

As reported at The Banker, fraud prevention software company SEON recently published their 2023 Global Banking Fraud Index, wherein they report that the costliest fraud variety recorded last year -- check, card, and bank account fraud -- was more than three times as common as the type that came in second place: online shopping and auctions fraud (the third costliest was application fraud, excluding mortgages).

Jack Henry & Associates: Improving Operations and CX Through Automation & Digital Banking

Rob Loethen takes a walk down nostalgia lane on the Jack Henry Fintalk web page, remembering how a calculator became a life-changing tool introduced when he was in grade school.

Now, the financial services industry is going through a similar situation, where automation and technology are becoming life-changing tools.

Fraud/ol/ogy Podcast: Updates on 2023 Fraud Industry Predictions

The Fraud/ol/ogy Podcast, hosted by long-time online fraud expert Karisse Hendrick, dives into all areas of "Fraudology" from the perspective of a fraud-fighter. With guests ranging from former cybercriminals to fraud-fighters at Fortune 500 companies to law enforcement and others, you will no doubt be entertained, while learning a lot about fraud & other forms of abuse prevention!

In the July 11th episode, Ms. Hendrik welcomes Frank McKenna (author of the Frank On Fraud Blog and co-founder of Point Predictive) and Mary Ann Miller (VP of Customer Experience at Prove) to the podcast to update on predictions they'd made in 2022 for the new year now that we've reached the mid-point (yes, we are indeed already half-way through 2023).

Jack Henry & Associates: Fraudsters Benefit from Technology Too

A post at Jack Henry FinTalk notes that the growth and accessibility of technology has made banking easier for consumers, financial institutions, and businesses. Unfortunately, fraudsters are embracing the same technology.

Even though fraud has been an ever-present battle for financial institutions, the playing field has changed. Fraudsters are now utilizing real-time push payments, AI-programs, and doubling down on social engineering endeavors which have been proven to be grossly profitable in their illicit endeavors.

Fintech Core Providers: Plug-and-Play Key for Bank & Credit Union Transformation

Core processing platforms are the lifeblood of the banking system. Without these systems, banks would be operating in the "stone age," manually processing and tracking transactions.

Over the past few decades, these platforms have been able to handle all types of transactions and payments, from credit cards to checks. However, with technology evolving, new payments channels arising, and customer expectations changing, core platforms are hard-pressed to keep up.

Reality TV Meets Check Fraud: Judge Judy is on the Case

The Honorable Judith Susan Sheindlin, most recognizably known as "Judge Judy," is a former prosecutor and Manhattan family court judge turned TV personality. Many people know her from the daytime TV show aptly named "Judge Judy," where she takes on a variety of cases. It is no surprise that she is taking on one of the most common cases of fraud these days: Check Fraud.

Real-Time Payments = Real-Time Fraud

As we've discussed in previous posts, consumers now have the expectation of near-instantaneous payments solutions. With the popularity of payments like Paypal and, most recently, apps like Venmo, Zelle, and CashApp, consumers are able to pay for items they need/desire and move money at a touch of a button.

For financial institutions, real-time payments have seen slow adoption. However, the Federal Reserve is looking to change that with the recently confirmed FedNow -- the government’s version of real-time payments (RTP) -- which will be deployed in phases, with the first component already available.

While the idea of instantaneous payments is great, there are major fraud implications.

Short and Long Term Perspective of AI and ML in Financial Service

Artificial Intelligence (AI) and Machine Learning (ML) are all over the news lately -- and for good reason. Almost every industry and endeavor can be touched by the existent and emergent tools that AI and ML make possible.

And, as Finextra reports, the UK banking world is in step with the latest developments:

The latest research from The Bank of England and Financial Conduct Authority, for example, suggests that 72% of UK firms in the sector are developing or deploying ML, a branch of AI that gives machines the ability to "learn" from data to improve computer performance.

Google Makes Another Big Splash; Introduces Anti-Money Laundering AI Tool

Over the past month, we've covered numerous topics related to artificial intelligence and its importance to the banking industry, specifically in the fight against fraud. We've talked about generative AI vs. traditional AI, and how Apple's Vision Pro could usher in a new immersive environment for fraud analysts in the near future.

However, Google is emerging as perhaps the biggest player in the banking industry. After a successful trial launch with HSBC, Google Cloud has announced AML AI, an AI-powered product designed to help global financial institutions detect and target instances of money laundering.

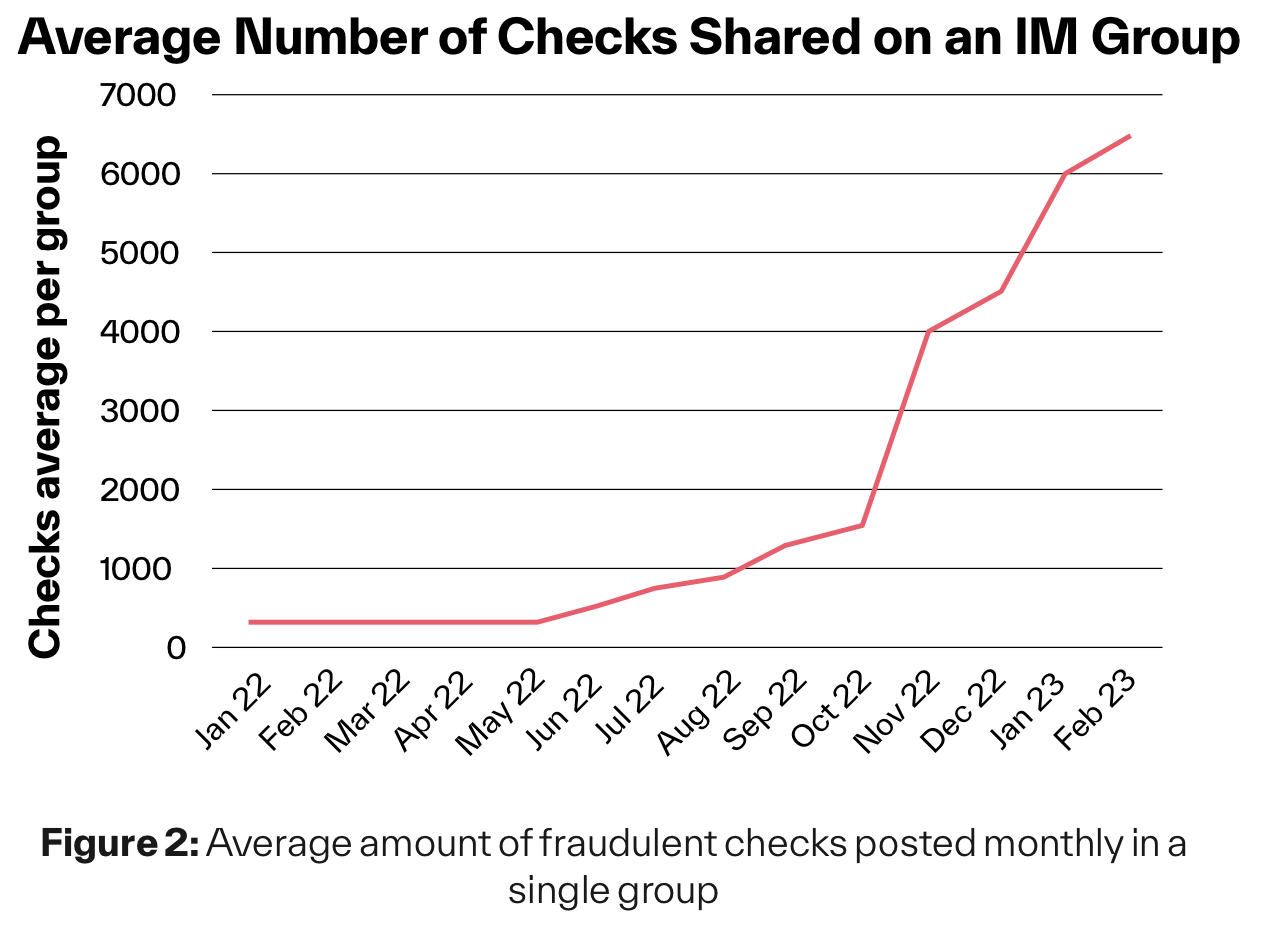

Dark Web Fraud “Groups” Listing Over 6K Stolen Checks Per Month

BlueVoyant Cyber Threat Intelligence Analyst Nissan Kedar takes a look at the emergence of check fraud as the "go-to" scam for bad actors. She notes that, over the past decade, the digital economy has done much to transition people from in-person banking to online transactions, emphasizing mobile banking as opposed to visits to an actual bank branch.

She observes that bad actors, perhaps frustrated with attempts to break through sophisticated cyber security, have moved their efforts to physical checks.

The Digital Pound: The Future of Payments in the UK?

Digital currency has been a topic of discussion for many years now. Most have heard of Bitcoin and other cryptocurrencies; yet no digital currency or cryptocurrency has made a strong enough case as a viable replacement for current payments.

One major drawback -- or advantage, depending on who you ask -- is that cryptocurrencies are unregulated. However, The Bank of England is doing its best to create interest for their new virtual currency, called the Digital Pound.

Reuters: Over 185K Check Fraud Related SARs Reported in 2023

According to the Thomson Reuters Regulatory Intelligence special report based on analysis of public data released by the U.S. Treasury Department’s anti-money laundering (AML) unit, FinCEN, there has been a significant increase in SARs (Suspicious Activity Reports) recorded in 2022.

As noted on page 23 of the report:

"Check fraud, was by far the most prevalent fraud type reported in 2022, with over 680,000 SAR filings. It was the second largest of all SAR categories that year. While firms have responded by reinforcing their anti-fraud organizations overall, they have focused particular attention on check fraud. While firms have responded by reinforcing their anti-fraud organizations overall, they have focused particular attention on check fraud."