OrboNation Newsletter: Check Processing Edition – October 2021

Google Abandons Plans to Offer Plex Checking Accounts — While Post Office Looks to Cash Checks

About two years ago, Google shook the financial world a bit when it announced its intention to offer checking accounts to its users in partnership with banks and credit unions. Google was initially planning to work with Citigroup and Stanford Federal Credit Union.

That is no longer the case, as Banking Dive reports...

BBB Study: Job Scams Jumped During Pandemic

The Better Business Bureau has released a study that shows an increase in job scams during the COVID-19 pandemic.

As reported in The Augusta Chronicle:

Job scams have been a problem for years. In 2020, the BBB estimated 14 million victims with $2 billion in direct losses related to job scams.

BAI Research: 84% of Digital Banking Customers Experienced First/Third Party Fraud Since March

Mastercard Inc. solidifies its participation in cryptocurrency Crypto fraud has steadily increased Banks will need to be aware of inevitable crossover fraud Digital Transactions, true to its name, reported a literal digital transaction as Mastercard Inc. announced last week its acquisition of CipherTrace...

ABA Looks at a Cloud Computing Success Story at JPMorgan Chase

JPMorgan Chase is known as an early adopter of cutting-edge tech, and, true to form, they are deploying a new, cloud-based core system for their retail bank using software developed by Thought Machine. Cloud computing in the fintech world is certainly not new at this stage...

Avoiding Investment in Fraud Tools — Save Now, Pay Later

In his always-entertaining Frank On Fraud blog, Frank McKenna takes a look at businesses that are struggling to get the fraud tools and technology they know they need in the current business environment. Unfortunately, many are getting hung up on immediate return on investment rather than proactive, preventive steps...

Disaster-Proof: FDITECH Launches Tech Sprint to Measure & Test Bank Operational Resiliency

A couple of days ago, Facebook went offline for approximately six hours and it made international headlines. Afterwards, it was revealed that a relatively minor internal error caused the outage, which reportedly cost Mark Zuckerberg seven billion dollars (with a "b"). However...

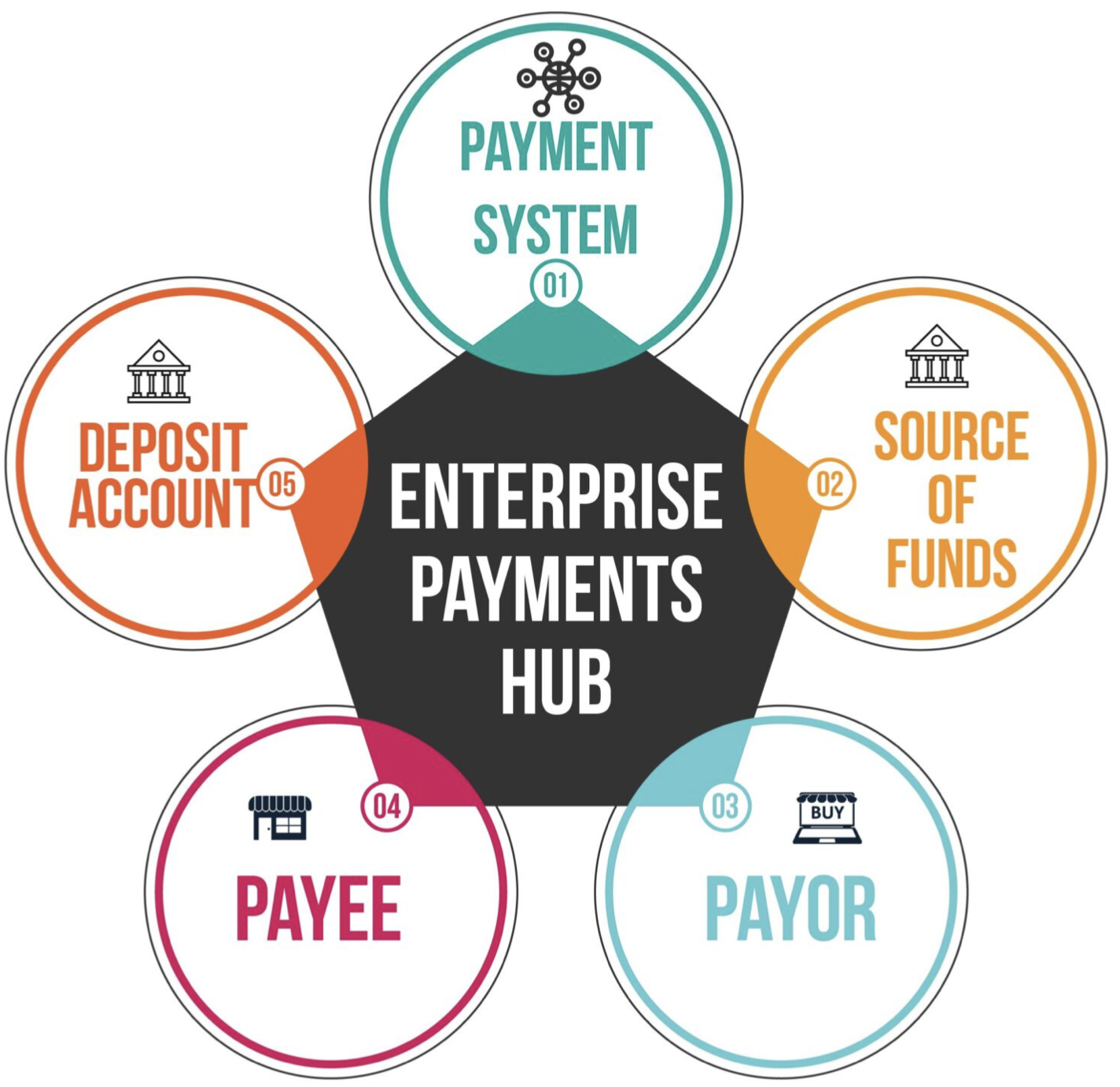

How Did Enterprise Payments and Payment Hubs Change the Industry?

Many of us who have been working in the bank and financial industry for more than a few years can remember when the concepts of cloud services, enterprise payments, and payment hubs were speculative and almost "science fiction." However, one day you wake up and what used to be "Star...

To Catch a Criminal, Train AI to Think Like One

Business Innovation Brief offers some streetwise advice: If you want to stop fraud activity, you have to think like a criminal.

They also go one step further to suggest that, perhaps, in some strange way we admire and "root for" the criminal mind: Have you seen the...

AFP: 66% of All Fraud Originates from Paper Checks

Joshua Riggins, president of Farmers and Mechanics Federal Savings Bank, makes no bones about it in an article for the Greene County Daily World: Even in the rapidly expanding world of digital finances, check fraud is still threat to be taken seriously. In a digital age concerned with technology and cybersecurity, there is no more prevalent fraud than that of paper checks...