OrboNation Newsletter: Check Processing and Fraud – November 2023

A Deeper Dive into the Reported $155M in Check Fraud Losses

It's widely accepted that industry check fraud attempts and losses have grown 200% to as high as 400% since pre-pandemic levels. However, as all are well aware, each bank is different; attempts and losses can be mitigated by improving processes and selecting the right tools, technologies, and vendors to combat check fraud.

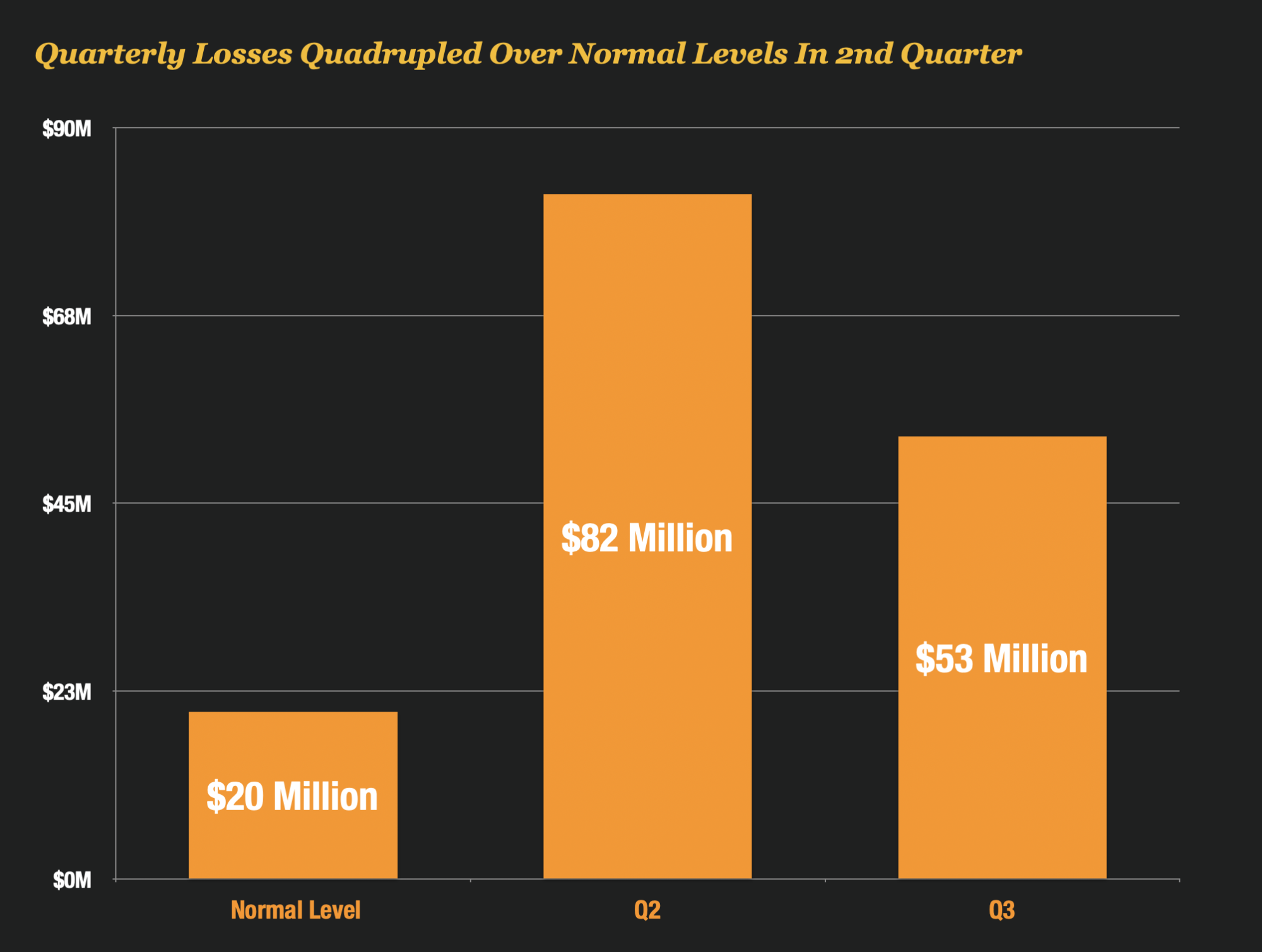

Such is the case for one large financial institution: Regions Bank. In its third quarter earnings call held on October 20, 2023, executives from Regions Bank reported some shocking numbers on check fraud losses:

- Q1 2023: $20M in check fraud losses (“Normal level”)

- Q2 2023: $82M in check fraud losses

- Q3 2023: $53M in check fraud losses

- Q4 2023: Estimated $25M in check fraud losses

Chief Financial Officer David Turner revealed to analysts a major issue of concern -- it generally takes Regions Bank about "50 to 60 days" to learn that it has accepted a bad check.

While details are limited, we can deduce that their check fraud detection processes and tools, combined with the delays discussed, are NOT spotting the fraudulent checks during the initial depositing process -- aka Day 1 or Day 2 processing.

OrboGraph Partners with Dr. David Maimon, Expert in Proactive Fraud Intelligence

Relationship will drive new innovation and collaboration around dark web check fraud prevention

Burlington, MA, November 13, 2023 – OrboGraph, a global leader in the fields of check fraud detection and image recognition solutions, is excited to announce a strategic partnership with Dr. David Maimon, Professor at Georgia State University, and a recognized authority in Proactive Fraud Intelligence. This collaboration underscores OrboGraph's commitment to remaining at the forefront of fraud detection and prevention in the financial industry.

As part of this partnership, Dr. Maimon will be a featured presenter at the upcoming OrboGraph Virtual Check Fraud Roundtable on November 14th. The roundtable will provide a platform for industry leaders and experts to discuss the latest advancements in fraud detection, focusing on emerging trends in dark web activity...

Artificial Intelligence: Futuristic Dream or Realizable Present?

Artificial intelligence has been one of the hottest topics within the banking industry over the past few years. Every day, banking professionals are bombarded with emails from publications and vendors relating how AI is the greatest thing to happen to the banking industry; yet, according the American Banker, the excitement isn't leading to implementation. In fact, a recent survey from Arizent -- parent company of American Banker -- notes that "20% of banks named AI or machine learning as the technology they are most excited about."

Strategic Tech Decisioning Key for Future Success of Financial Institutions

A new article by Bain & Company shares what they've learned after analyzing the performance of 42 of the world's largest banks based on total shareholder return, cost-to-income ratio, and net promoter score over the past few years.

Its findings? No surprise here: Banks leading in technology delivered higher returns, lower costs, and greater customer satisfaction compared to their peers. However, there are many banks frustrated by shallow results after vast investments.

What's the secret to success?

Preventative Measures to Mitigate Check Fraud for Suppliers

Business checks are a prized commodity when it comes to check fraud, as 81% of businesses still pay other firms with checks. This presents a major opportunity for fraudsters -- made clear as business checks are sold for $250+ on the dark web vs. $175 for personal checks.

The reasons are simple:

- Business checking accounts typically hold more funds

- Businesses write more checks, making it more difficult to identify a fraudulent check payment

- Altering a business check only requires minor modifications like adding "& NAME" on the payee vs. washing the entire payee and amounts

One industry that handles more check payments than most is suppliers. The payment process between suppliers and their customers has seen little change over the past few decades, and the old adage "if it ain't broke, don't fix it" applies directly here.

UK Finance Reports Cases of Check Fraud Increased +35% in H1 2023

While we typically focus on fraud as it occurs here in the USA, many financial institutions operate in multiple countries. This includes our friends "from across the pond": the United Kingdom.

Recently, UK Finance released their 2023 Half Year Fraud Update, a report on fraud statistics for the first half of this year.

Apple: New Open Banking Feature Launched for UK Customers

It is no secret that the banking industry is a ripe target for big tech. Recently, we've seen Elon Musk's "X" make it known they are entering the payments realm, having begun the process of applying for regulatory licenses and development of the software needed. Additionally, we saw Apple launch its new savings accounts to complement Apple Cards, which saw $10B in deposits as of August 2023, according to Goldman Sachs.

Apple has made another move, taking advantage of "open banking" in the UK to bring a new feature to its payments platform. According to Fintech Futures, Apple has launched a new feature in the UK, allowing customers to connect eligible debit and credit cards in their Apple Wallet to view account balances and transaction histories from supported banks like Barclays, HSBC, and NatWest.

Check Fraud Can Cost Businesses Up to 1.5% of Their Revenue

Industry Analysts, Inc. reminds us that, in spite of the growth and popularity of digital payment systems, checks are still a force to be reckoned with.

Indeed, the article goes on to acknowledge that digital contactless payments get plenty of attention and press warnings of possible digital breaches -- overshadowing a real and pervasive threat that continues to grow:

But here’s the kicker: while most execs are sweating over digital breaches, a significant risk is being swept under the rug — check fraud. It’s alarming to think that this blind spot can cost businesses up to 1.5% of their revenue, not to mention the hit their reputation could take.

Understanding Reg CC “Exceptions” for Fighting Check Fraud

Mary Ellen Biery, a Senior Strategist & Content Manager at Abrigo offers a look at the challenges facing financial institutions as they work to comply with Reg CC while protecting themselves from the rapidly growing threat of check fraud.

The first thing to point out:

Nothing in Reg CC affects a financial institution’s right to accept or reject a check for deposit, regulators have noted...

...Reg CC also doesn’t affect the right to revoke settlement, charge back accounts for returned or unpaid checks, or charge back electronic payments if the institution doesn’t receive “actually and finally collected funds.”

Diversity of Deposits Key for Digital Banking Success

As we've noted in previous blog posts, digital banking is growing by leaps and bounds - good news for financial institutions, as digital banking availability and usage have been shown to boost customer loyalty and provide a host of other upsides.

However, as explained via a post at BAI.org by Danielle Kane, Director of Small Business Banking at Grasshopper Bank, the ongoing success of digital banks will rely on some basic goals that should be kept in mind...

Mail Theft & Check Fraud Victims: Individuals, Businesses, and now Congress?

Rep. Ken Calvert, a Republican congressman from California, spotlighted the increase in mail theft/check fraud. He put his money where his mouth is and introduced legislation that would double the penalties for those convicted of stealing from the U.S. Postal Service.

Now, in an ironic twist, an article from Raw Story reports that Rep. Calvert's very own leadership political action committee — Eureka Political Action Committee — experienced an "unauthorized expense" worth $9,900 in late August, according to a filing with the Federal Election Commission.