OrboNation Newsletter: Check Processing and Fraud – March 2023

Report: First-Party and Third-Party Check Fraud Increase 78% and 74% in 2022

Aite-Novarica Group’s expert, Trace Fooshée, shares their research to help fortify fraud platforms via Fraud Trends for 2023 and Beyond: Everything Old is New Again, ANG’s latest report on the future of fraud prevention.

Following expert research and reporting, the guide predicts which fraud trends will continue to rise, which can be quelled, and what fraud fighters need to add to their stack to stay ahead of threats, new and old.

Aite-Novarica Group surveyed 34 U.S. fraud executives who attended Aite-Novarica Group’s Financial Crime Forum in September 2022 in order to better understand the current and future environment for fraud trends.

The data show that check fraud continues to grow, with 74% of respondents seeing a rise in third-party check fraud with 0% seeing a decline and 78% of respondents seeing a rise in first-party check fraud with only 7% reporting a decline. While the sample size is on the smaller size, we are able to see that the respondents' views align with the industry reports...

Twitter Entering the Banking Arena — Banks Need to Take Notice

Since its acquisition by Elon Musk, Twitter has certainly not lacked interesting storylines and speculation in the media. While most news up to now has dealt with employee discontent or technology issues, Twitter has also made progress in deploying a payments option.

As noted by Financial Times, Twitter has begun the process of applying for regulatory licenses and development of the software...

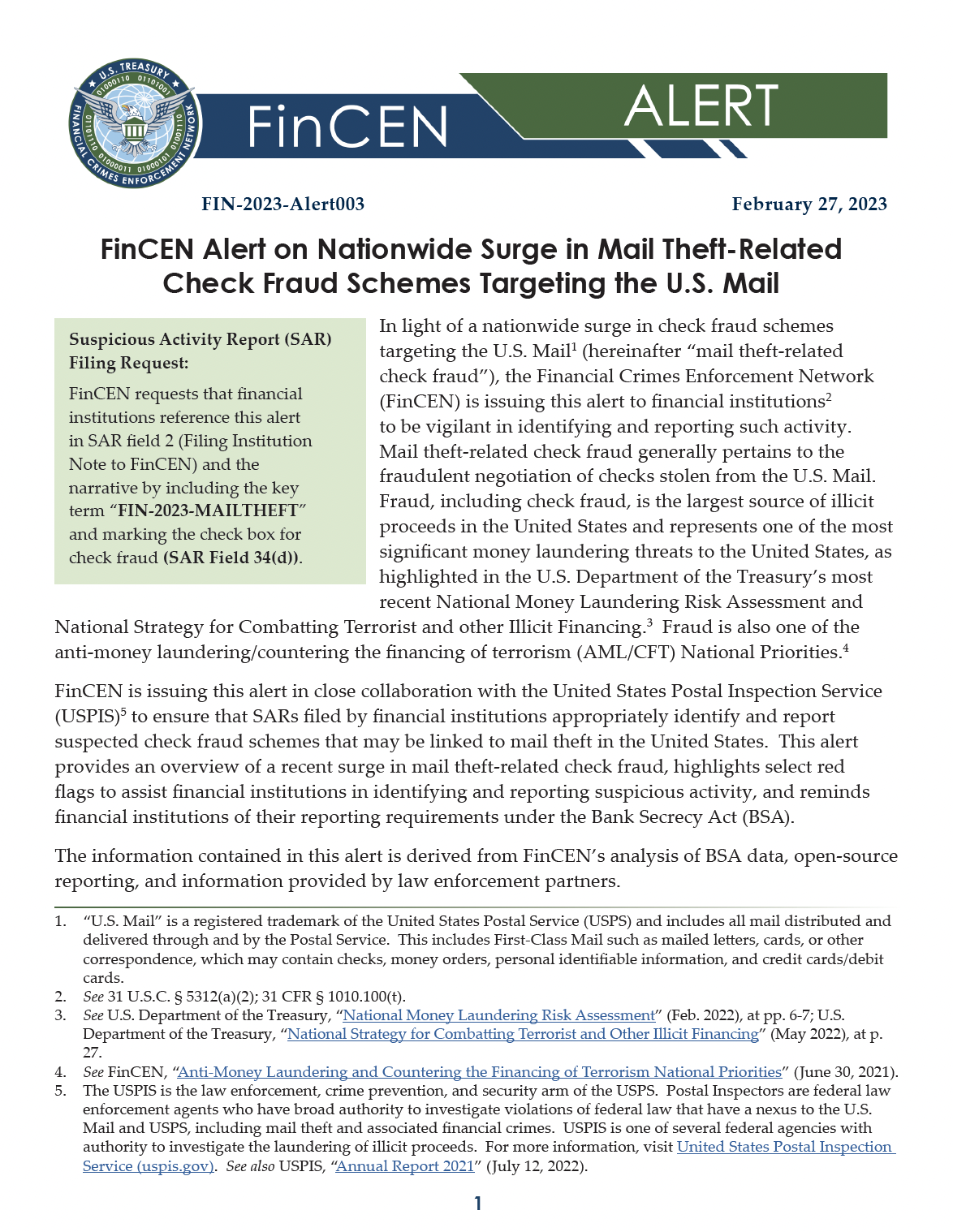

FinCEN Warning: Check Fraud Related SARs Nearly Double in 2022

The Financial Crimes Enforcement Network (FinCEN) has made it clear: There is a nationwide surge in check fraud, and it is targeting the US mail.

“Criminals have been increasingly targeting the U.S. Mail and United States Postal Service mail carriers since the COVID-19 pandemic to commit check fraud,” the agency said in a Monday (Feb. 27) news release.

FinCEN reveals that Bank Secrecy Act reporting for check fraud has risen to a large extent in the last three years...

Artificial Intelligence in Banking: Possible Impact of OpenAI’s ChatGPT

Open AI's ChatGPT has seen tremendous growth since its release to the public in December 2022 and the potential capabilities of ChatGPT are impressive, to say the least. As described by Entrepreneur.com:

ChatGPT can have entire conversations, admit mistakes, challenge incorrect premises and write essays, scripts, articles and headlines. Because of its intelligence and massive database, ChatGPT can serve many industries — even banking.

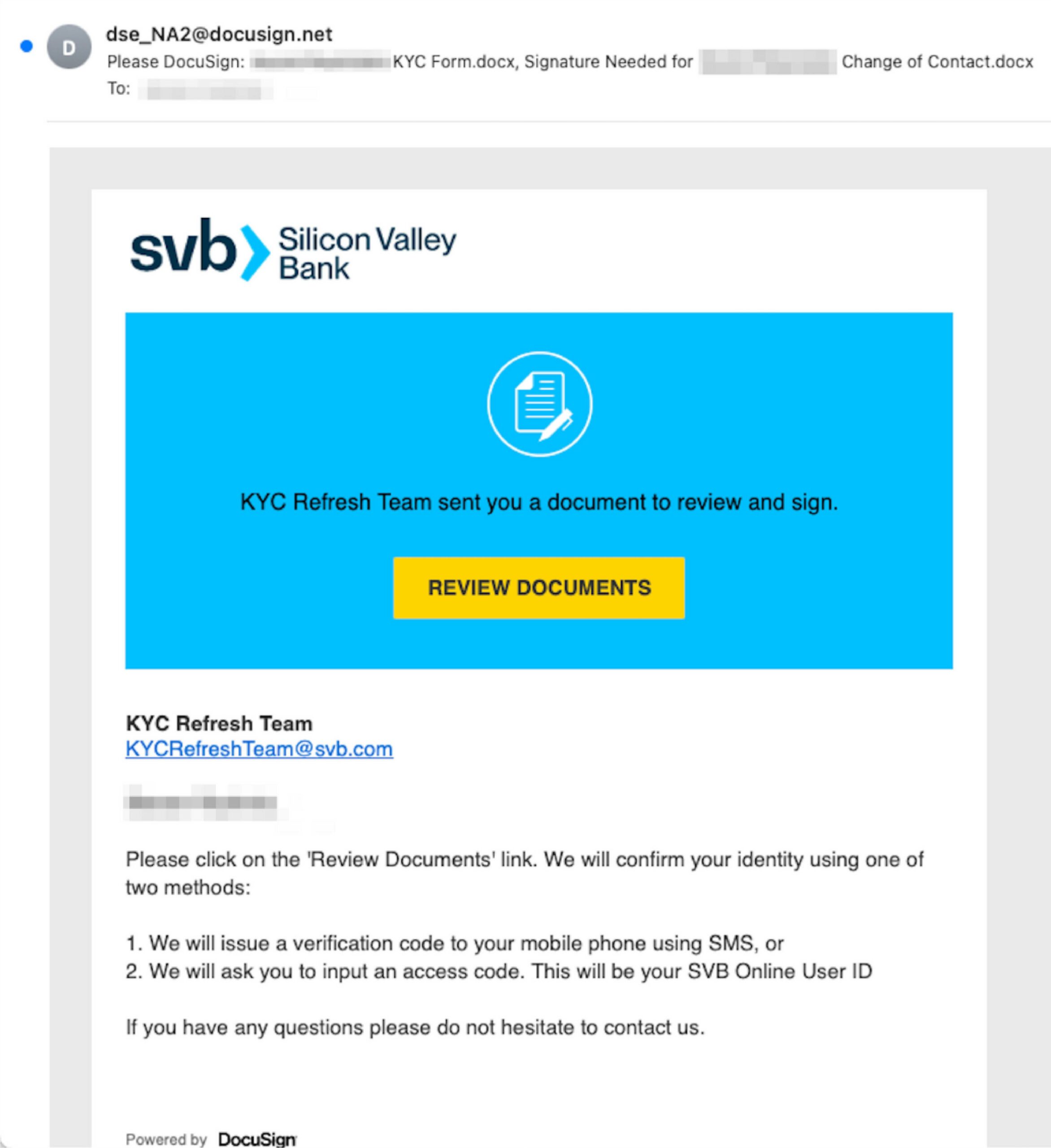

How Threat Actors Are Preying on Silicon Valley Bank Collapse

The Cloudflare Blog takes a look at the activities of a specific category of fraudster, the Threat Actor, in relationship to news events like the collapse and takeover by the US Federal Government of Silicon Valley Bank (SVB):

Unfortunately, where everyone sees a tragic situation, threat actors see opportunity. We have seen this time and again - in order to breach trust and trick unsuspecting victims, threat actors overwhelmingly use topical events as lures. These follow the news cycle or known high profile events (The Super Bowl, March Madness, Tax Day, Black Friday sales, COVID-19, and on and on), since there is a greater likelihood of users falling for messages referencing what’s top of mind at any given moment.

Fintech Stripe Introducing ChatGPT to Payments

According to Digital Transactions, Open AI, the San Francisco-based creator of the ChatGPT artificial-intelligence chatbot, announced Wednesday it is partnering with Stripe Inc. to enable payments for its ChatGPT Plus and DALL·E applications. In addition, Stripe announced it is incorporating OpenAI’s new natural-language technology, GPT-4, into its products and services...

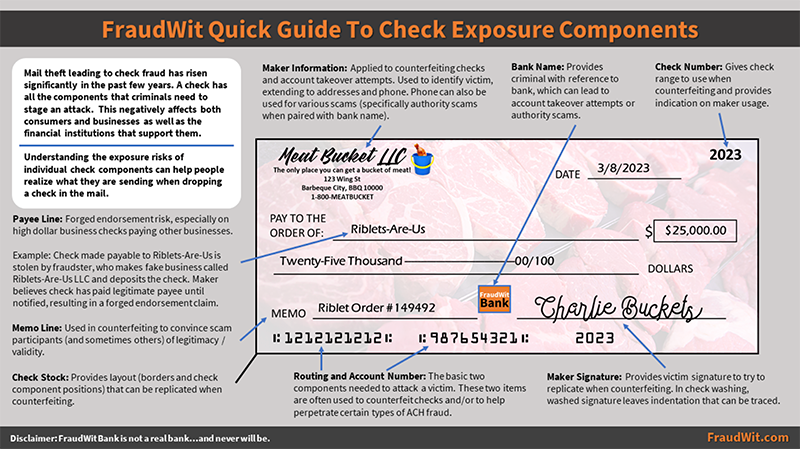

Stolen Checks: What Information is Exposed for Fraud?

The FraudWit website, home to "short and quirky articles, educational presentations, and other content" created with consumers and fraud professionals in mind, offers a useful guide to the exposure components that can be found on a check -- in other words, the elements of a check that can be used for fraud...

mRDC: “Double Presentment” Check Fraud

Mobile remote deposit capture, or mRDC, is wildly popular among banking consumers - and why not? Upon receipt of a paper check, rather than having to travel to a local bank branch to deposit the money into an account, today's bank consumer has only to sign the check and use their smartphone to photograph it front and back.

Once the amount specified is in the recipient's account, the paper check is destroyed -- at least, in theory...

Business Payments: Leveraging AI for Speed and Security

PYMNTS talked to Manish Jaiswal, chief product and technology officer at Corcentric, about the ways AI technology can and will improve business payments by making them faster and -- most importantly -- safer.

“Real-time payments processing is becoming a reality in B2B,” Mr. Jaiswal noted. Still, there are challenges to address...

USPS Outlines 10-Year Reform Plan — Are Stolen Checks Addressed?

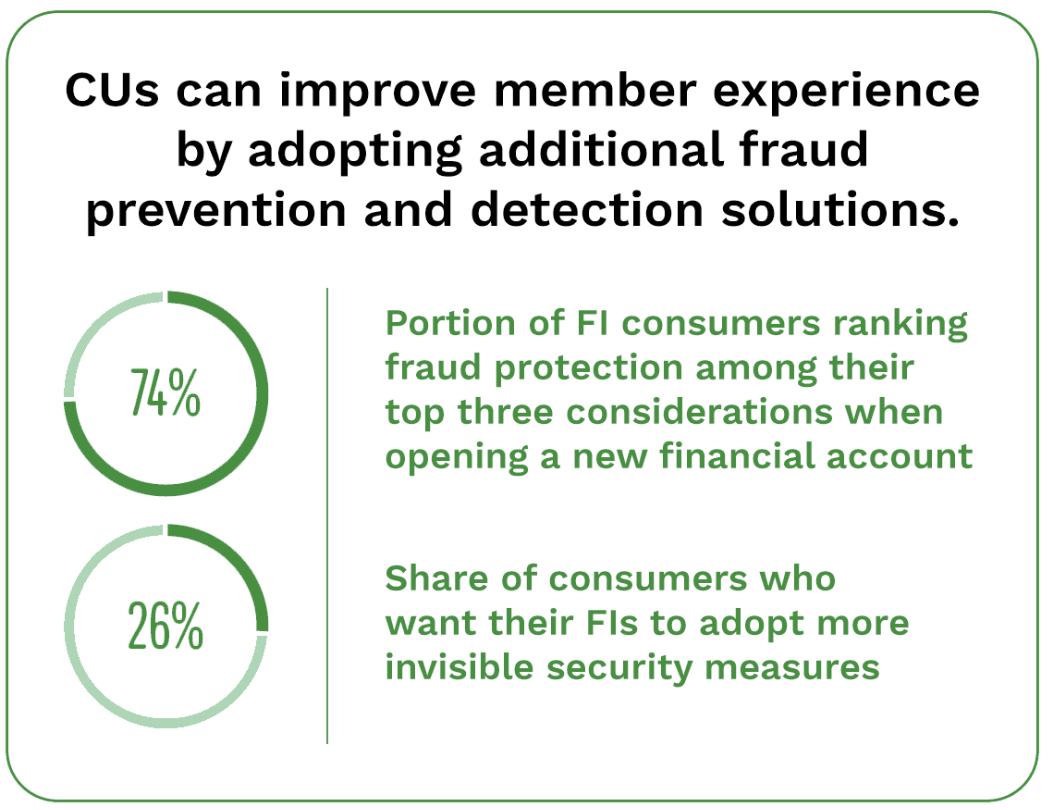

PYMNTS.com reports that there is a fairly glaring disconnect between credit unions and their members when it comes to fraud concerns. While members see a real threat, CUs do not seem to be responding in kind:

Despite the growing fraud risk and subsequent member concern, many credit unions (CUs) do not appear to be actively innovating in response. A 2022 PYMNTS report found that less than 27% of CU executives said they were investing in fraud management and anti-money laundering (AML) solutions, down from more than 57% in 2021. A similarly small share of CUs — less than 26% — were investing in security, authentication or digital identity innovations. These numbers indicate there is much room for improvement.